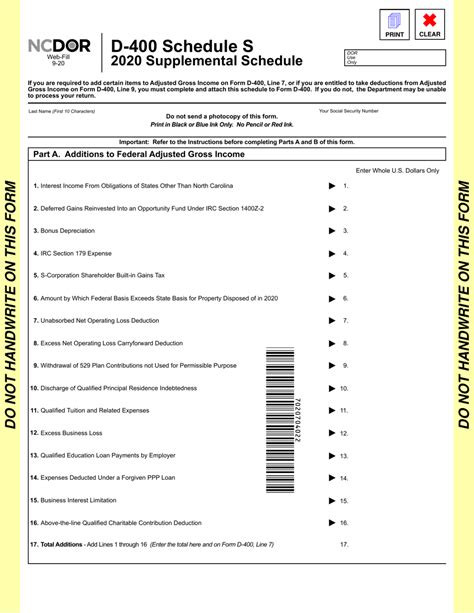

Filling out tax forms can be a daunting task, especially for those who are new to the process. The NC Form D-400 Schedule S is a crucial part of the North Carolina state tax return, and it's essential to complete it accurately to avoid any errors or delays in processing your tax refund. In this article, we will guide you through the process of filling out the NC Form D-400 Schedule S, highlighting five key steps to help you navigate this complex form.

What is the NC Form D-400 Schedule S?

The NC Form D-400 Schedule S is a supplemental schedule to the North Carolina Individual Income Tax Return (Form D-400). It is used to report income from self-employment, such as income from a sole proprietorship, single-member limited liability company (LLC), or partnership. This schedule is also used to report deductions related to self-employment income, such as business expenses and depreciation.

Step 1: Gather Required Information

Before you start filling out the NC Form D-400 Schedule S, make sure you have all the necessary information and documents. You will need:

- Your business financial records, including income statements and balance sheets

- Your business expense records, including receipts and invoices

- Your depreciation schedule, if applicable

- Your self-employment tax records, if applicable

- Your social security number or employer identification number (EIN)

Step 2: Complete Part 1 - Self-Employment Income

In Part 1 of the NC Form D-400 Schedule S, you will report your self-employment income. This includes income from a sole proprietorship, single-member LLC, or partnership. You will need to complete the following lines:

- Line 1: Net profit or loss from self-employment

- Line 2: Self-employment tax deduction

- Line 3: Net earnings from self-employment

Make sure to follow the instructions carefully and report your self-employment income accurately.

Step 3: Complete Part 2 - Business Expenses

In Part 2 of the NC Form D-400 Schedule S, you will report your business expenses. This includes expenses related to your self-employment income, such as:

- Line 4: Business use percentage

- Line 5: Total business expenses

- Line 6: Depreciation and amortization

You will need to calculate your business expenses and report them accurately on this part of the form.

Step 4: Complete Part 3 - Depreciation and Amortization

In Part 3 of the NC Form D-400 Schedule S, you will report your depreciation and amortization expenses. This includes expenses related to property, equipment, and other assets used in your business.

- Line 7: Depreciation expense

- Line 8: Amortization expense

- Line 9: Total depreciation and amortization

Make sure to follow the instructions carefully and report your depreciation and amortization expenses accurately.

Step 5: Complete Part 4 - Self-Employment Tax

In Part 4 of the NC Form D-400 Schedule S, you will report your self-employment tax. This includes tax on your net earnings from self-employment.

- Line 10: Self-employment tax

- Line 11: Total self-employment tax

Make sure to follow the instructions carefully and report your self-employment tax accurately.

Tips and Reminders

- Make sure to sign and date the form

- Keep a copy of the form for your records

- File the form with your North Carolina state tax return

- Consult a tax professional if you are unsure about any part of the form

By following these five steps, you can accurately fill out the NC Form D-400 Schedule S and ensure that your North Carolina state tax return is processed correctly.

Encouragement to Engage

We hope this article has been helpful in guiding you through the process of filling out the NC Form D-400 Schedule S. If you have any questions or comments, please feel free to share them below. Additionally, if you found this article helpful, please share it with others who may be struggling with this form.

FAQ Section

What is the deadline for filing the NC Form D-400 Schedule S?

+The deadline for filing the NC Form D-400 Schedule S is April 15th of each year.

Do I need to file the NC Form D-400 Schedule S if I am not self-employed?

+No, you do not need to file the NC Form D-400 Schedule S if you are not self-employed.