As a member of the military, you're entitled to certain protections under the Servicemembers Civil Relief Act (SCRA). One of the key benefits of SCRA is the ability to request reduced interest rates on certain loans, including those from Navy Federal Credit Union. But navigating the process of requesting SCRA benefits can be daunting, especially when it comes to filling out the Navy Federal SCRA request form. In this article, we'll break down the process and provide you with the information you need to make it as smooth as possible.

The importance of SCRA benefits cannot be overstated. By reducing interest rates on loans, SCRA can help alleviate financial burdens on military members and their families. But to take advantage of these benefits, you need to submit a request to your lender, in this case, Navy Federal Credit Union. That's where the Navy Federal SCRA request form comes in.

Understanding the Navy Federal SCRA Request Form

Before we dive into the details of the form, it's essential to understand the basics of SCRA benefits and how they apply to Navy Federal Credit Union loans. SCRA benefits are available to eligible military members, including those on active duty, in the reserves, or in the National Guard. These benefits can include reduced interest rates on loans, as well as protection from foreclosure and repossession.

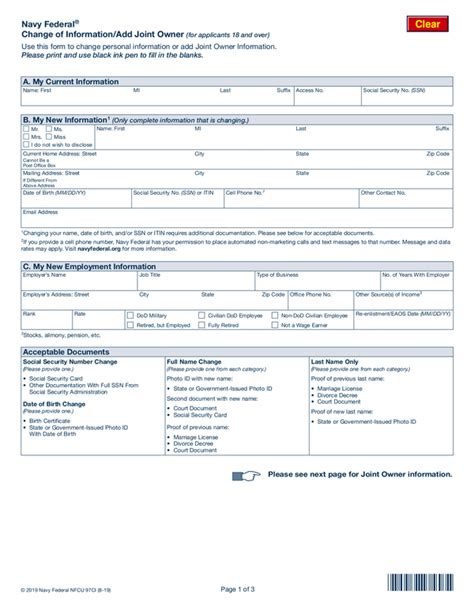

The Navy Federal SCRA request form is used to request these benefits on eligible loans. The form requires you to provide information about your military service, including your branch of service, rank, and dates of active duty. You'll also need to provide information about the loans you're requesting benefits for, including the loan number, account type, and current interest rate.

Required Documents for the Navy Federal SCRA Request Form

To complete the Navy Federal SCRA request form, you'll need to provide certain documents to support your request. These documents may include:

- A copy of your military orders, including your deployment or activation orders

- A copy of your DD Form 214 (discharge paperwork)

- A copy of your Leave and Earnings Statement (LES)

- A copy of your military ID card

You may also need to provide additional documentation, such as proof of income or residency, depending on the specific requirements of your loan.

Filling Out the Navy Federal SCRA Request Form

Now that we've covered the basics of the Navy Federal SCRA request form, let's walk through the process of filling it out.

- Section 1: Military Service Information

- Provide your branch of service, rank, and dates of active duty

- Include your military ID number and unit information

- Section 2: Loan Information

- List the loans you're requesting benefits for, including the loan number and account type

- Provide the current interest rate and balance for each loan

- Section 3: Supporting Documentation

- Attach the required documents, including military orders, DD Form 214, LES, and military ID card

Tips for Completing the Navy Federal SCRA Request Form

To ensure your request is processed smoothly, here are a few tips to keep in mind:

- Make sure to fill out the form completely and accurately

- Include all required documents to support your request

- Submit the form and supporting documents via certified mail or fax to ensure receipt

- Keep a copy of the form and supporting documents for your records

What to Expect After Submitting the Navy Federal SCRA Request Form

Once you've submitted the Navy Federal SCRA request form, you can expect to receive a response from Navy Federal Credit Union within a few weeks. If your request is approved, you'll receive a notification letter outlining the terms of your SCRA benefits, including the reduced interest rate and any other benefits you're eligible for.

If your request is denied, you'll receive a notification letter explaining the reason for the denial. You may be able to appeal the decision by providing additional documentation or information.

FAQs About the Navy Federal SCRA Request Form

Here are a few frequently asked questions about the Navy Federal SCRA request form:

- Q: Who is eligible for SCRA benefits? A: Eligible military members, including those on active duty, in the reserves, or in the National Guard.

- Q: What types of loans are eligible for SCRA benefits? A: Eligible loans include mortgages, auto loans, credit cards, and other types of debt.

- Q: How long does it take to process the Navy Federal SCRA request form? A: Processing times may vary, but you can expect to receive a response within a few weeks.

What is the interest rate reduction under SCRA?

+The interest rate reduction under SCRA is typically 6% per annum.

How long do SCRA benefits last?

+SCRA benefits typically last for the duration of your military service, plus a certain period after your service ends.

Can I request SCRA benefits on multiple loans?

+Yes, you can request SCRA benefits on multiple loans, but you'll need to submit a separate request form for each loan.

By following these steps and providing the required documentation, you can ensure a smooth and successful process for requesting SCRA benefits on your Navy Federal Credit Union loans. Remember to stay informed and take advantage of the resources available to you as a military member.