Understanding the Truist Bank Beneficiary Form: A Comprehensive Guide

When it comes to managing your finances, having a clear plan in place is essential. One crucial aspect of this plan is designating beneficiaries for your bank accounts. If you're a Truist Bank customer, you'll need to complete a beneficiary form to ensure that your assets are distributed according to your wishes in the event of your passing. In this article, we'll delve into the details of the Truist Bank beneficiary form, its importance, and provide a step-by-step guide on how to fill it out.

What is a Beneficiary Form?

A beneficiary form is a document that allows you to name individuals or organizations that will receive the funds in your bank account upon your death. This form is typically used for payable-on-death (POD) accounts, which are designed to transfer assets directly to the named beneficiaries without the need for probate.

Why is the Truist Bank Beneficiary Form Important?

The Truist Bank beneficiary form is a vital component of your estate planning strategy. By completing this form, you can ensure that your assets are distributed according to your wishes, rather than being determined by state laws. This can help to avoid potential disputes and delays in the distribution of your assets.

Benefits of Designating Beneficiaries

Designating beneficiaries for your Truist Bank accounts offers several benefits, including:

- Avoiding probate: By naming beneficiaries, you can avoid the need for probate, which can be a time-consuming and costly process.

- Ensuring asset distribution: By designating beneficiaries, you can ensure that your assets are distributed according to your wishes, rather than being determined by state laws.

- Reducing taxes: In some cases, designating beneficiaries can help to reduce taxes on your estate.

How to Fill Out the Truist Bank Beneficiary Form

Filling out the Truist Bank beneficiary form is a straightforward process. Here's a step-by-step guide to help you get started:

- Gather required information: Before you begin, make sure you have the following information:

- Your account number

- The names and addresses of your beneficiaries

- The social security numbers or tax identification numbers of your beneficiaries

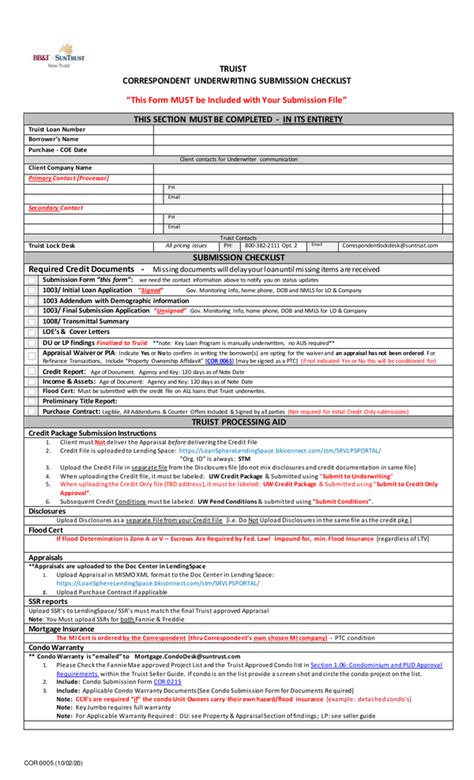

- Download the form: You can download the Truist Bank beneficiary form from the bank's website or obtain a copy from your local branch.

- Fill out the form: Complete the form by providing the required information, including your account number, the names and addresses of your beneficiaries, and their social security numbers or tax identification numbers.

- Sign the form: Once you've completed the form, sign it in the presence of a notary public.

- Return the form: Return the completed form to your local Truist Bank branch or mail it to the address specified on the form.

Truist Bank Beneficiary Form Download

If you're looking for a downloadable version of the Truist Bank beneficiary form, you can find it on the bank's website. Simply follow these steps:

- Visit the Truist Bank website: Go to the Truist Bank website and navigate to the "Forms" or "Resources" section.

- Search for the beneficiary form: Use the search function to find the beneficiary form.

- Download the form: Click on the form to download it to your computer.

FAQs

Here are some frequently asked questions about the Truist Bank beneficiary form:

Q: Who can be a beneficiary? A: Anyone can be a beneficiary, including individuals, organizations, and charities.

Q: Can I change my beneficiaries? A: Yes, you can change your beneficiaries at any time by completing a new beneficiary form.

Q: Is the beneficiary form required for all accounts? A: No, the beneficiary form is only required for POD accounts.

Q: Can I name multiple beneficiaries? A: Yes, you can name multiple beneficiaries for a single account.

Q: Is the beneficiary form confidential? A: Yes, the beneficiary form is confidential and will only be used to determine the distribution of your assets upon your death.

What happens if I don't complete a beneficiary form?

+If you don't complete a beneficiary form, your assets will be distributed according to state laws. This can lead to delays and disputes in the distribution of your assets.

Can I name a minor as a beneficiary?

+Yes, you can name a minor as a beneficiary, but you'll need to appoint a guardian to manage the assets on their behalf until they reach the age of majority.

How do I know if I need to complete a beneficiary form?

+If you have a POD account, you'll need to complete a beneficiary form. You can contact your local Truist Bank branch to determine if you need to complete a beneficiary form.

We hope this comprehensive guide has provided you with the information you need to understand the importance of the Truist Bank beneficiary form and how to fill it out. By taking the time to complete this form, you can ensure that your assets are distributed according to your wishes and avoid potential disputes and delays.

Don't hesitate to reach out to your local Truist Bank branch if you have any questions or concerns about the beneficiary form. Remember to review and update your beneficiary designations regularly to ensure that they reflect your current wishes.

Share your thoughts and experiences with beneficiary forms in the comments section below.