Managing your finances effectively is crucial for achieving stability and peace of mind. One key aspect of financial management is understanding and properly handling your tax obligations. For many, dealing with taxes can seem daunting, especially when it comes to obtaining the necessary forms. If you're among those who need to access the MOHELA tax form, this article is designed to guide you through the process.

Whether you're a seasoned taxpayer or just starting out, navigating the world of tax forms can be overwhelming. MOHELA, or the Missouri Higher Education Loan Authority, plays a significant role in the lives of many students and borrowers by managing and servicing their loans. For those who have interacted with MOHELA, obtaining the MOHELA tax form is an essential part of tax preparation.

In this comprehensive guide, we'll explore three ways to obtain the MOHELA tax form, ensuring you have all the information you need to complete your taxes accurately and on time.

Understanding the MOHELA Tax Form

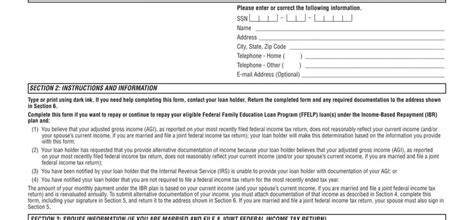

Before diving into how to obtain the MOHELA tax form, it's essential to understand its purpose. This form typically reports the interest paid on your MOHELA-managed loans, which you may be able to claim as a deduction on your tax return. The form will usually be a 1098-E, Student Loan Interest Statement, and is mailed to eligible borrowers by January 31st of each year.

Why You Need the MOHELA Tax Form

The MOHELA tax form is crucial for anyone looking to deduct the interest paid on their student loans from their taxable income. This deduction can provide significant savings on your tax bill, making it a vital component of your tax preparation.

Method 1: Online Access Through MOHELA's Website

One of the most convenient ways to obtain the MOHELA tax form is through their official website. MOHELA provides online access to your tax documents for your convenience. Here's how you can access your form:

- Visit the MOHELA Website: Start by navigating to MOHELA's official website.

- Log In to Your Account: Use your credentials to log in to your MOHELA account. If you're having trouble, you can follow the prompts to recover your login information.

- Navigate to the Tax Documents Section: Once logged in, look for a section related to tax documents or statements. This section may be under your account details or in a dedicated tax information area.

- Download Your MOHELA Tax Form: Click on the option to view or download your 1098-E form. Make sure to save a copy to your computer for easy access during tax preparation.

Method 2: Contact MOHELA Customer Service

If you're unable to access your MOHELA tax form online, another option is to contact MOHELA's customer service directly. They can assist you in obtaining the form or provide guidance on how to access it. Here’s how:

- Call MOHELA: Reach out to MOHELA’s customer service phone number, which can be found on their website.

- Request Your Tax Form: Explain to the representative that you need a copy of your 1098-E form for tax purposes. They may ask for your account information to verify your identity.

- Wait for the Form to Be Sent: MOHELA will either email you the form, mail it to your registered address, or guide you on how to access it through their website.

Method 3: Through the IRS or Your Tax Professional

In some cases, you might not need to obtain the MOHELA tax form directly from MOHELA. The IRS or your tax professional can sometimes assist in accessing the necessary information.

- Contact the IRS: If you’re unable to get the form from MOHELA, you can try contacting the IRS for assistance. They might be able to provide guidance or an alternative solution.

- Consult Your Tax Professional: Your tax preparer or accountant may also be able to help you obtain the necessary information from MOHELA or guide you on how to proceed without the form.

Tips for Working with MOHELA Tax Forms

- Keep Records: Always keep a copy of your MOHELA tax form and any correspondence with MOHELA for your records.

- Check for Errors: Verify the information on your 1098-E form for accuracy to avoid any issues during tax filing.

- Seek Professional Help: If you’re unsure about how to handle your MOHELA tax form or have complex tax situations, consider consulting a tax professional.

How do I know if I qualify for the student loan interest deduction?

+You may qualify for the student loan interest deduction if you paid interest on a qualified student loan during the tax year and meet certain income and other requirements as outlined by the IRS.

Can I claim the student loan interest deduction if I'm not the borrower?

+Typically, you can only claim the deduction if you're the borrower. However, there are exceptions, such as when you're claiming a dependent exemption for someone who is borrowing. Consult the IRS guidelines or a tax professional for specific advice.

What if I lost my MOHELA tax form?

+If you've lost your MOHELA tax form, you can try the methods outlined in this article to obtain a replacement or seek assistance from MOHELA’s customer service or the IRS.

Now that you've learned how to obtain your MOHELA tax form and understand its importance, you're well on your way to navigating the complexities of tax preparation. Remember, staying informed and organized is key to managing your finances effectively. Take the time to explore these methods and ensure you have all the necessary documents for a smooth tax filing experience.

We hope this guide has been helpful in your journey to understanding and obtaining the MOHELA tax form. If you have any questions or need further clarification, feel free to ask in the comments below. Don't forget to share this article with anyone who might benefit from this information.