Navigating Tax Season: Understanding the Importance of Printable Tax Forms

As tax season approaches, individuals and businesses in Colorado are preparing to file their state income tax returns. The Colorado Department of Revenue provides various tax forms, including the Form 104, which is used for personal income tax returns. In this article, we will guide you through the process of downloading and using the printable Colorado Tax Form 104, as well as provide valuable information on the form's purpose, benefits, and requirements.

The Purpose of Colorado Tax Form 104

The Colorado Tax Form 104 is a critical document used by the state's residents to report their income, claim deductions and credits, and calculate their tax liability. The form is designed to simplify the tax filing process, allowing individuals to accurately report their financial information and meet their tax obligations.

Benefits of Using Printable Tax Forms

In today's digital age, printable tax forms offer several benefits, including:

- Convenience: Printable tax forms can be easily downloaded and completed from the comfort of your own home.

- Accuracy: Using a printable form helps reduce errors, as you can review and revise your information before submitting it.

- Cost-effective: Printable tax forms eliminate the need for expensive tax preparation software or professional assistance.

- Environmentally friendly: By using digital forms, you can reduce paper waste and minimize your environmental footprint.

How to Download and Use Printable Colorado Tax Form 104

To access the printable Colorado Tax Form 104, follow these steps:

- Visit the Colorado Department of Revenue website ().

- Click on the "Forms" tab and select "Individual Income Tax" from the drop-down menu.

- Choose the correct tax year and form type (Form 104).

- Download the printable PDF form to your computer or mobile device.

- Complete the form accurately, using the provided instructions and guidelines.

Key Information and Requirements

Before completing the printable Colorado Tax Form 104, ensure you have the following information and meet the necessary requirements:

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Employer identification number (if self-employed)

- W-2 forms from all employers

- 1099 forms for freelance work or other income

- Receipts for deductions and credits

- Any other relevant tax documents

Step-by-Step Guide to Completing Form 104

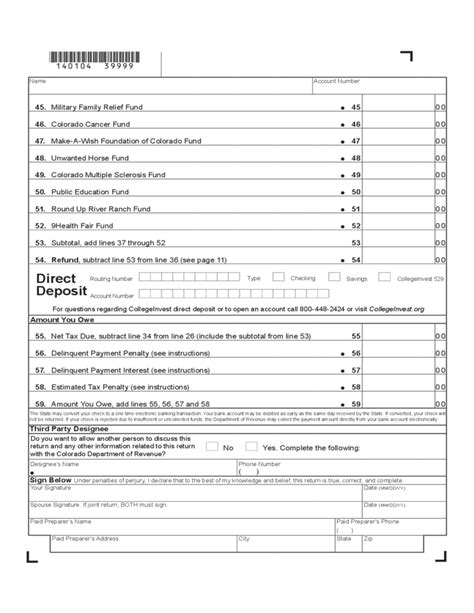

To complete the printable Colorado Tax Form 104, follow these steps:

- Identification: Enter your name, address, Social Security number, and date of birth.

- Income: Report all income from W-2 forms, 1099 forms, and other sources.

- Deductions and Credits: Claim deductions and credits, such as the standard deduction, itemized deductions, and earned income tax credit.

- Tax Liability: Calculate your tax liability using the provided tax tables or schedules.

- Sign and Date: Sign and date the form, indicating your certification of accuracy.

Tips and Reminders

- Ensure accuracy: Double-check your information and calculations to avoid errors.

- Meet deadlines: File your tax return by the specified deadline to avoid penalties and interest.

- Seek assistance: If needed, consult the Colorado Department of Revenue website or contact a tax professional for guidance.

Conclusion and Next Steps

In conclusion, the printable Colorado Tax Form 104 is a valuable resource for individuals and businesses in the state. By following the guidelines and instructions outlined in this article, you can accurately complete and submit your tax return. Remember to take advantage of the benefits offered by printable tax forms, including convenience, accuracy, and cost-effectiveness.

What's Next?

- Share your experience: Comment below and share your thoughts on using printable tax forms.

- Spread the word: Share this article with friends and family to help them navigate tax season.

- Stay informed: Visit the Colorado Department of Revenue website for updates and news on tax laws and regulations.

What is the deadline for filing Colorado Tax Form 104?

+The deadline for filing Colorado Tax Form 104 is typically April 15th of each year.

Can I e-file my Colorado tax return?

+Yes, you can e-file your Colorado tax return using the Colorado Department of Revenue's online filing system.

What if I need help completing my tax return?

+You can contact the Colorado Department of Revenue or consult a tax professional for assistance.