Tax season can be a daunting time for many individuals, especially when it comes to navigating the complexities of state tax forms. With numerous forms to fill out, deadlines to meet, and rules to follow, it's easy to get overwhelmed. However, with TurboTax state forms, filing your state taxes just got a whole lot easier.

Understanding TurboTax State Forms

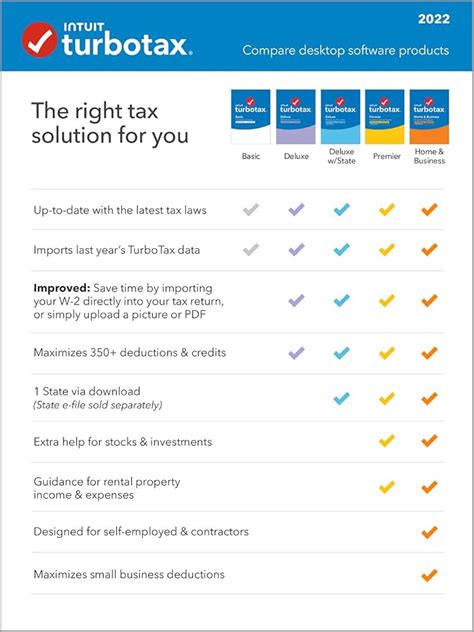

TurboTax is a popular tax preparation software that helps individuals prepare and file their federal and state taxes. One of the key features of TurboTax is its extensive library of state tax forms, which are available for all 50 states. Whether you're a resident of California, New York, or Texas, TurboTax has got you covered.

What State Forms Are Available on TurboTax?

TurboTax offers a wide range of state tax forms, including:

- State income tax returns (e.g., 540, 540A, 540B)

- State amended returns (e.g., 540X, 540A-X)

- State extension forms (e.g., 540-ES, 540A-ES)

- State tax credits and deductions (e.g., Earned Income Tax Credit, Child Tax Credit)

How to Access TurboTax State Forms

Accessing TurboTax state forms is a breeze. Here's how:

- Log in to your TurboTax account or sign up for a new account if you're a first-time user.

- Click on the "State" tab on the top navigation bar.

- Select your state from the drop-down menu.

- Choose the type of form you need to file (e.g., income tax return, amended return, etc.).

- Follow the on-screen instructions to fill out and submit your form.

Tips for Filing TurboTax State Forms

To ensure a smooth filing experience, keep the following tips in mind:

- Make sure you have all the necessary documents and information before starting the filing process.

- Double-check your form for errors and accuracy before submitting.

- Take advantage of TurboTax's built-in audit detection and support features to minimize the risk of errors.

- File electronically to receive your refund faster.

TurboTax State Forms Filing Fees

The cost of filing TurboTax state forms varies depending on the type of form and the state you're filing in. Here's a breakdown of the typical fees:

- State income tax returns: $29.99 - $49.99

- State amended returns: $19.99 - $39.99

- State extension forms: $9.99 - $29.99

Keep in mind that these fees are subject to change, and you may be eligible for discounts or promotions.

Benefits of Using TurboTax State Forms

By using TurboTax state forms, you can enjoy numerous benefits, including:

- Convenience: File your state taxes from the comfort of your own home, 24/7.

- Accuracy: TurboTax's software ensures accuracy and minimizes the risk of errors.

- Speed: Get your refund faster with electronic filing.

- Support: Receive expert support and guidance throughout the filing process.

TurboTax State Forms vs. Other Tax Preparation Software

While there are other tax preparation software options available, TurboTax stands out for its user-friendly interface, comprehensive library of state forms, and expert support. Here's how TurboTax compares to other popular tax preparation software:

- H&R Block: Offers a range of state forms, but may require more manual entry and calculations.

- TaxAct: Provides state forms, but may have limited support and guidance.

- Credit Karma Tax: Offers free state and federal tax filing, but may have limited form availability and support.

Conclusion: Simplify Your State Tax Filing with TurboTax

Filing your state taxes doesn't have to be a daunting task. With TurboTax state forms, you can enjoy a hassle-free filing experience, complete with accuracy, convenience, and expert support. Whether you're a seasoned tax filer or a first-time user, TurboTax has got you covered. So why wait? Get started with TurboTax today and simplify your state tax filing process.

What is the deadline for filing TurboTax state forms?

+The deadline for filing TurboTax state forms varies depending on the state and type of form. Generally, the deadline for state income tax returns is April 15th, but this may vary.

Can I file TurboTax state forms electronically?

+Yes, TurboTax allows you to file state forms electronically. This is the fastest and most convenient way to file your state taxes.

What happens if I make a mistake on my TurboTax state form?

+If you make a mistake on your TurboTax state form, you can easily correct it and resubmit. TurboTax's software also includes built-in audit detection and support features to minimize the risk of errors.