As an employer, managing employee taxes and benefits can be a daunting task. One crucial aspect of this is understanding the Missouri Withholding Form, also known as the MO W-4. This form plays a vital role in ensuring that employees' state income taxes are withheld correctly. In this article, we will delve into the world of MO Withholding Form, exploring its importance, benefits, and steps for both employers and employees to navigate this process efficiently.

What is the Missouri Withholding Form?

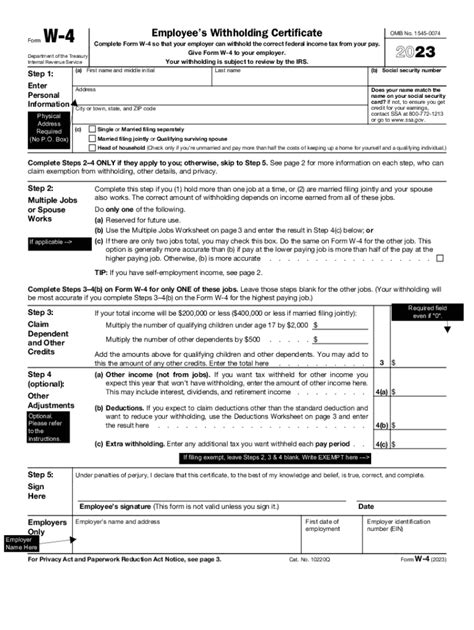

The Missouri Withholding Form, also known as the MO W-4, is a document used by employers to determine the correct amount of state income taxes to withhold from an employee's wages. This form is similar to the federal W-4 form but is specific to the state of Missouri. The MO W-4 form is used to calculate the amount of state taxes that should be withheld from an employee's paycheck, based on their filing status, number of dependents, and other factors.

Why is the Missouri Withholding Form Important?

The Missouri Withholding Form is essential for both employers and employees. For employers, accurately completing the MO W-4 form ensures that they are withholding the correct amount of state taxes from their employees' wages, avoiding any potential penalties or fines. For employees, the MO W-4 form helps ensure that they are not overpaying or underpaying their state taxes, which can impact their take-home pay.

Benefits of the Missouri Withholding Form

The Missouri Withholding Form provides several benefits for both employers and employees. Some of these benefits include:

- Accurate Tax Withholding: The MO W-4 form helps ensure that the correct amount of state taxes is withheld from an employee's wages, reducing the risk of overpayment or underpayment.

- Reduced Tax Liability: By accurately completing the MO W-4 form, employees can reduce their tax liability and avoid owing money to the state when filing their tax returns.

- Increased Take-Home Pay: By withholding the correct amount of state taxes, employees can increase their take-home pay and avoid having to pay too much in taxes throughout the year.

Steps for Employers to Complete the Missouri Withholding Form

To complete the Missouri Withholding Form, employers should follow these steps:

- Obtain the MO W-4 Form: Employers can obtain the MO W-4 form from the Missouri Department of Revenue website or by contacting their local tax office.

- Gather Employee Information: Employers should gather information from their employees, including their filing status, number of dependents, and other relevant details.

- Complete the MO W-4 Form: Employers should complete the MO W-4 form using the employee's information, making sure to accurately calculate the correct amount of state taxes to withhold.

- Submit the MO W-4 Form: Employers should submit the completed MO W-4 form to the Missouri Department of Revenue, either electronically or by mail.

Steps for Employees to Complete the Missouri Withholding Form

Employees can also take steps to ensure that their state taxes are withheld correctly. Here are some steps employees can follow:

- Review the MO W-4 Form: Employees should review the MO W-4 form to ensure that their employer is withholding the correct amount of state taxes.

- Update Employee Information: Employees should update their information with their employer, including any changes to their filing status or number of dependents.

- Check Tax Withholding: Employees should check their pay stubs to ensure that the correct amount of state taxes is being withheld.

Common Mistakes to Avoid When Completing the Missouri Withholding Form

When completing the Missouri Withholding Form, both employers and employees should avoid common mistakes that can lead to inaccurate tax withholding. Some common mistakes to avoid include:

- Inaccurate Employee Information: Employers should ensure that they have accurate information from their employees, including their filing status and number of dependents.

- Incorrect Tax Withholding: Employers should accurately calculate the correct amount of state taxes to withhold, based on the employee's information.

- Failure to Update Information: Employees should update their information with their employer, including any changes to their filing status or number of dependents.

Penalties for Inaccurate Tax Withholding

Failure to accurately complete the Missouri Withholding Form can result in penalties for both employers and employees. Some penalties for inaccurate tax withholding include:

- Fines and Penalties: Employers may face fines and penalties for failing to accurately withhold state taxes from their employees' wages.

- Interest on Underpaid Taxes: Employees may be required to pay interest on underpaid taxes, if they do not have enough taxes withheld from their wages.

Conclusion

The Missouri Withholding Form is an essential document for both employers and employees in Missouri. By accurately completing the MO W-4 form, employers can ensure that they are withholding the correct amount of state taxes from their employees' wages, while employees can reduce their tax liability and increase their take-home pay. By following the steps outlined in this article, both employers and employees can navigate the process of completing the Missouri Withholding Form efficiently and effectively.

What is the purpose of the Missouri Withholding Form?

+The Missouri Withholding Form is used to determine the correct amount of state income taxes to withhold from an employee's wages.

Who is required to complete the Missouri Withholding Form?

+Both employers and employees in Missouri are required to complete the Missouri Withholding Form.

What are the penalties for inaccurate tax withholding?

+Failure to accurately complete the Missouri Withholding Form can result in fines and penalties for employers, and interest on underpaid taxes for employees.