Tax season is upon us, and with it comes the daunting task of filing our taxes. One of the most important forms you'll need to file your Missouri state taxes is the MO-1040A. But where can you get your hands on this elusive form? In this article, we'll explore five ways to obtain a printable MO-1040A form, making it easier for you to file your taxes on time.

What is the MO-1040A Form?

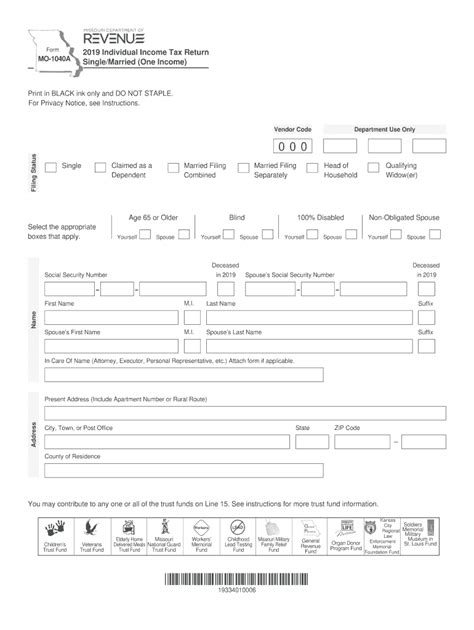

Before we dive into the ways to obtain the MO-1040A form, let's quickly cover what it is. The MO-1040A is the short form for Missouri individual income tax returns. It's a simplified version of the standard MO-1040 form, designed for individuals with straightforward tax situations. The MO-1040A form is ideal for those who don't have dependents, itemize deductions, or claim certain credits.

1. Download from the Missouri Department of Revenue Website

The most straightforward way to get a printable MO-1040A form is to download it directly from the Missouri Department of Revenue website. Simply visit the website, navigate to the "Forms" section, and search for the MO-1040A form. You can download the form in PDF format, which you can then print and fill out.

Benefits of Downloading from the Missouri Department of Revenue Website

- Convenient and easily accessible

- Always up-to-date with the latest tax year information

- Free to download and print

2. Order by Phone or Mail from the Missouri Department of Revenue

If you prefer a physical copy of the MO-1040A form or don't have access to a printer, you can order one by phone or mail from the Missouri Department of Revenue. Simply call the department's customer service number or mail a request to their office, and they'll send you a copy of the form.

Benefits of Ordering by Phone or Mail

- Convenient for those without internet access or a printer

- Physical copy of the form can be easier to work with

- No need to worry about downloading and printing

3. Pick Up a Copy at a Local Library or Public Office

Many local libraries and public offices, such as county clerks' offices or community centers, carry a supply of MO-1040A forms. You can visit one of these locations and pick up a copy of the form, which you can then fill out and submit.

Benefits of Picking Up a Copy at a Local Library or Public Office

- Convenient for those who prefer a physical copy of the form

- No need to worry about downloading or printing

- Opportunity to ask questions or seek assistance from staff

4. Use Tax Preparation Software

If you're using tax preparation software, such as TurboTax or H&R Block, you may be able to access and print a MO-1040A form directly from the software. This can be a convenient option, especially if you're already using the software to prepare your taxes.

Benefits of Using Tax Preparation Software

- Convenient and integrated with your tax preparation process

- Often includes guidance and support to help with form completion

- May offer e-filing options for faster processing

5. Contact a Tax Professional or Accountant

Finally, if you're working with a tax professional or accountant, they may be able to provide you with a MO-1040A form or assist you with completing and filing it. This can be a good option if you have complex tax situations or need personalized guidance.

Benefits of Contacting a Tax Professional or Accountant

- Personalized guidance and support

- Expert knowledge of tax laws and regulations

- Often includes review and audit protection

If you're struggling to find a printable MO-1040A form, don't worry! There are plenty of options available to you. Whether you download from the Missouri Department of Revenue website, order by phone or mail, pick up a copy at a local library or public office, use tax preparation software, or contact a tax professional or accountant, you'll be able to get the form you need to file your taxes on time.

Now that you've learned about the different ways to obtain a printable MO-1040A form, it's time to take action. Which method will you choose? Share your experiences and tips in the comments below!

What is the MO-1040A form used for?

+The MO-1040A form is used for Missouri individual income tax returns. It's a simplified version of the standard MO-1040 form, designed for individuals with straightforward tax situations.

Can I e-file my MO-1040A form?

+Yes, you can e-file your MO-1040A form using tax preparation software or through the Missouri Department of Revenue's website.

What if I need help completing my MO-1040A form?

+If you need help completing your MO-1040A form, you can contact a tax professional or accountant for personalized guidance and support.