For many Minnesota homeowners, receiving the annual property tax statement can be a daunting experience. The complex form, known as the Mn M1 Form, contains a wealth of information that can be overwhelming to decipher. However, understanding the components of this form is crucial for property owners to ensure they are meeting their tax obligations and taking advantage of available deductions and exemptions.

In this article, we will break down the Mn M1 Form, section by section, to provide a comprehensive guide for Minnesota property owners. We will cover the various components of the form, including the types of taxes and assessments, deductions and exemptions, and payment options. By the end of this article, readers will have a clear understanding of the Mn M1 Form and be able to confidently navigate the complexities of their property tax statement.

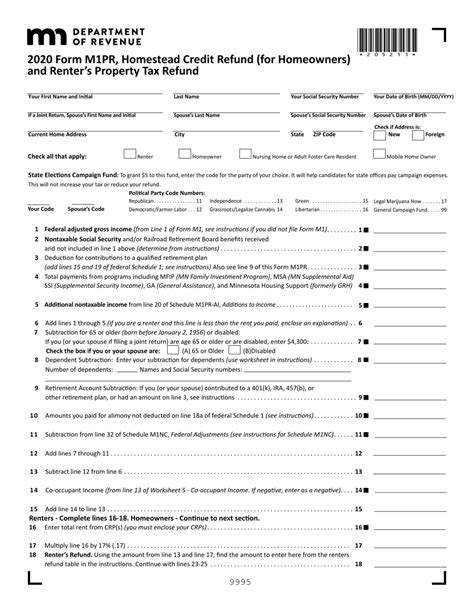

Understanding the Mn M1 Form

The Mn M1 Form is a standardized document used by the State of Minnesota to report property tax information to homeowners. The form is typically mailed to property owners in March or April of each year and includes information on the current year's taxes, as well as any past-due taxes or special assessments.

Section 1: Property Information

The first section of the Mn M1 Form contains basic information about the property, including the property identification number, parcel number, and address. This section also includes the property owner's name and mailing address.

Taxes and Assessments

The Mn M1 Form reports various types of taxes and assessments, including:

- Ad Valorem Taxes: These are the primary property taxes levied by the county, city, or township.

- Special Assessments: These are taxes levied by special districts, such as sewer or water districts.

- Net Tax Capacity: This is the taxable value of the property, which is used to calculate the ad valorem taxes.

Section 2: Taxes and Assessments

This section of the Mn M1 Form provides a detailed breakdown of the taxes and assessments levied on the property. The section includes the tax rate, tax amount, and any special assessments or fees.

Deductions and Exemptions

The Mn M1 Form also reports any deductions or exemptions applied to the property taxes. These may include:

- Homestead Exemption: A reduction in taxes for owner-occupied properties.

- Senior Citizen Exemption: A reduction in taxes for senior citizens.

- Blind or Disabled Exemption: A reduction in taxes for blind or disabled individuals.

Section 3: Deductions and Exemptions

This section of the Mn M1 Form lists any deductions or exemptions applied to the property taxes. The section includes the type of exemption, the exemption amount, and the resulting tax reduction.

Payment Options

The Mn M1 Form provides information on payment options for property owners, including:

- Due Dates: The deadlines for paying property taxes.

- Payment Methods: The available methods for paying property taxes, such as online payment or mail.

Section 4: Payment Information

This section of the Mn M1 Form provides detailed information on payment options and due dates. The section includes the payment amount, due date, and any late payment fees.

By understanding the components of the Mn M1 Form, Minnesota property owners can ensure they are meeting their tax obligations and taking advantage of available deductions and exemptions. We hope this guide has provided a clear and comprehensive overview of the Mn M1 Form.

If you have any questions or concerns about your property tax statement, we encourage you to reach out to your local county assessor's office or a qualified tax professional. Additionally, please share this article with others who may find it helpful, and don't hesitate to comment below with any questions or feedback.

What is the Mn M1 Form?

+The Mn M1 Form is a standardized document used by the State of Minnesota to report property tax information to homeowners.

What is the purpose of the Mn M1 Form?

+The purpose of the Mn M1 Form is to provide property owners with a detailed breakdown of their property taxes, including any deductions or exemptions.

How do I understand the Mn M1 Form?

+This article provides a comprehensive guide to understanding the Mn M1 Form, including explanations of the various sections and components.