As a resident of Illinois, understanding the state's tax laws and regulations is crucial to ensure you file your taxes correctly and take advantage of all the credits and deductions available to you. In this comprehensive guide, we will walk you through the process of filing your Illinois state tax form 1040, highlighting key aspects to consider, benefits to claim, and potential pitfalls to avoid.

Filing Requirements for Illinois State Tax Form 1040

Before we dive into the details of filing your Illinois state tax form 1040, it's essential to understand who is required to file. If you are a resident of Illinois and have a federal adjusted gross income (AGI) above a certain threshold, you are required to file a state tax return. For the 2022 tax year, the thresholds are as follows:

- Single filers: $12,000 or more

- Joint filers: $24,000 or more

- Head of household: $18,000 or more

- Qualifying widow(er): $24,000 or more

Even if you don't meet these thresholds, you may still need to file a state tax return if you have other income, such as self-employment income, or if you want to claim a refund.

Who Can File for Free?

If you are a low-income taxpayer, you may be eligible to file your Illinois state tax return for free. The Illinois Department of Revenue (IDOR) offers free filing options for individuals with an AGI of $30,000 or less. Additionally, if you are 65 or older, or if you have a disability, you may also be eligible for free filing.

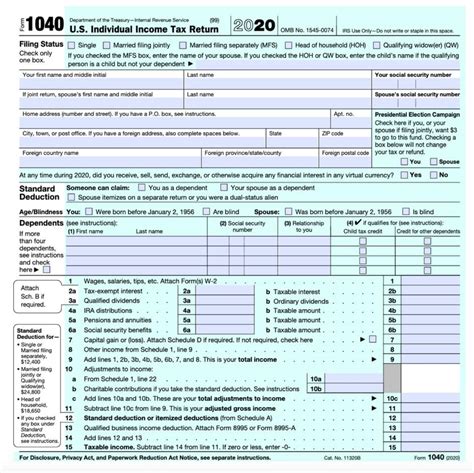

Forms and Schedules Required for Illinois State Tax Form 1040

To file your Illinois state tax form 1040, you will need to complete the following forms and schedules:

- IL-1040: Illinois Individual Income Tax Return

- Schedule I: Income

- Schedule M: Modifications to Federal Adjusted Gross Income

- Schedule IL-E/EIC: Illinois Earned Income Credit

- Schedule IL-CR: Illinois Credits

You may also need to complete additional schedules or forms, depending on your specific tax situation. For example, if you have self-employment income, you will need to complete Schedule C (Form 1040).

Illinois Tax Credits and Deductions

Illinois offers a range of tax credits and deductions that can help reduce your state tax liability. Some of the most common credits and deductions include:

- Illinois Earned Income Credit (EIC): a credit of up to $550 for low-income working individuals and families

- Education Expenses Credit: a credit of up to $500 for education expenses

- Property Tax Credit: a credit of up to $500 for property taxes paid

- Charitable Contributions Deduction: a deduction for charitable contributions made during the tax year

Filing Options for Illinois State Tax Form 1040

You have several options for filing your Illinois state tax form 1040:

- E-file: file electronically through the IDOR website or through a tax software provider

- Mail: mail your paper return to the IDOR

- Tax Professional: hire a tax professional to prepare and file your return

E-filing is the fastest and most convenient way to file your return, and it's also the most secure. If you e-file, you can expect your refund to be processed within 2-3 weeks.

Common Errors to Avoid When Filing Illinois State Tax Form 1040

When filing your Illinois state tax form 1040, there are several common errors to avoid:

- Inaccurate or missing Social Security numbers

- Incorrect or missing income information

- Failure to claim all eligible credits and deductions

- Incorrect or missing signatures

To avoid these errors, make sure to carefully review your return before submitting it, and consider hiring a tax professional if you are unsure about any aspect of the filing process.

Illinois State Tax Form 1040 Filing Deadlines and Penalties

The deadline for filing your Illinois state tax form 1040 is typically April 15th of each year. However, if you need more time to file, you can request an automatic six-month extension by filing Form IL-556.

If you fail to file your return on time, you may be subject to penalties and interest on any taxes owed. The penalty for late filing is 5% of the unpaid taxes per month, up to a maximum of 25%.

Amending Your Illinois State Tax Return

If you need to make changes to your original return, you can file an amended return using Form IL-1040-X. You can file an amended return for up to three years after the original filing deadline.

To amend your return, you will need to:

- Complete Form IL-1040-X

- Attach a copy of your original return

- Explain the changes you are making

Amending your return can help you claim additional credits or deductions, or correct errors that may have been made on your original return.

What is the deadline for filing my Illinois state tax form 1040?

+The deadline for filing your Illinois state tax form 1040 is typically April 15th of each year.

Can I e-file my Illinois state tax form 1040?

+Yes, you can e-file your Illinois state tax form 1040 through the IDOR website or through a tax software provider.

What is the Illinois Earned Income Credit (EIC)?

+The Illinois Earned Income Credit (EIC) is a credit of up to $550 for low-income working individuals and families.

By following the guidelines outlined in this comprehensive guide, you can ensure that you file your Illinois state tax form 1040 accurately and on time, and take advantage of all the credits and deductions available to you. Remember to e-file, claim all eligible credits and deductions, and avoid common errors to make the filing process as smooth and stress-free as possible.