Tax season can be a daunting time for individuals and businesses alike, and understanding the various tax forms and requirements can be overwhelming. In the state of Missouri, taxpayers are required to file a variety of tax forms, including the Missouri Form Mo A. In this article, we will delve into the details of Missouri Form Mo A, exploring what it is, who needs to file it, and how to complete it.

What is Missouri Form Mo A?

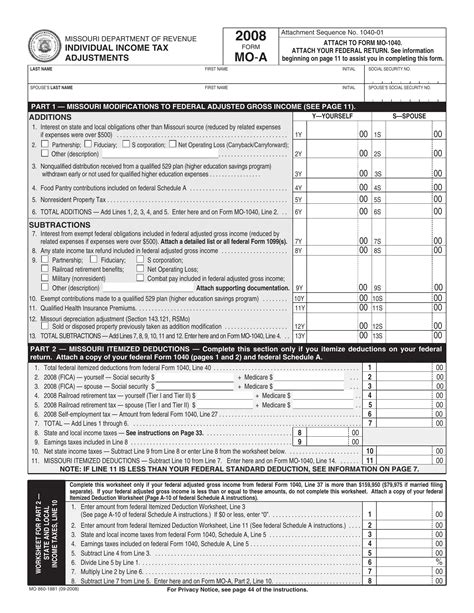

Missouri Form Mo A is the state's annual income tax return form for individuals. It is used to report an individual's income, deductions, and credits for the tax year. The form is used by the Missouri Department of Revenue to determine the taxpayer's state income tax liability. Form Mo A is similar to the federal income tax return form, Form 1040, but is specific to the state of Missouri.

Who Needs to File Missouri Form Mo A?

Not all individuals are required to file Missouri Form Mo A. The requirement to file depends on the individual's income and filing status. Generally, individuals who meet the following criteria must file Form Mo A:

- Single individuals with a gross income of $9,000 or more

- Married individuals filing jointly with a gross income of $18,000 or more

- Married individuals filing separately with a gross income of $9,000 or more

- Head of household with a gross income of $12,000 or more

- Qualifying widow(er) with a gross income of $18,000 or more

Additionally, individuals who have self-employment income, receive tips, or have other income that is not subject to withholding may also need to file Form Mo A.

How to Complete Missouri Form Mo A

Completing Missouri Form Mo A requires gathering various documents and information. Here are the steps to follow:

- Gather necessary documents:

- Federal income tax return (Form 1040)

- W-2 forms from employers

- 1099 forms for self-employment income, interest, and dividends

- Other income statements

- Determine filing status:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

- Calculate income:

- Report all income from W-2 and 1099 forms

- Include self-employment income

- Report interest and dividends

- Claim deductions and credits:

- Standard deduction or itemized deductions

- Personal exemption

- Dependent exemption

- Child tax credit

- Earned income tax credit (EITC)

- Calculate tax liability:

- Use the Missouri tax tables or tax calculator to determine tax liability

- Complete the form:

- Fill out the form accurately and completely

- Sign and date the form

Missouri Form Mo A Schedules and Attachments

Missouri Form Mo A requires several schedules and attachments to be completed and submitted. These include:

- Schedule A: Itemized deductions

- Schedule B: Interest and dividends

- Schedule C: Self-employment income

- Schedule D: Capital gains and losses

- Schedule EIC: Earned income tax credit

- Attachment 1: Dependent exemption

- Attachment 2: Child tax credit

Missouri Form Mo A Filing Options

Taxpayers have several options for filing Missouri Form Mo A:

- E-file: File electronically through the Missouri Department of Revenue's website or through a tax software provider.

- Mail: Mail the completed form to the Missouri Department of Revenue.

- In-person: File in-person at a Missouri Department of Revenue office.

Missouri Form Mo A Deadline

The deadline for filing Missouri Form Mo A is typically April 15th of each year. However, if the 15th falls on a weekend or holiday, the deadline is extended to the next business day.

Missouri Form Mo A Penalties and Interest

Taxpayers who fail to file or pay their Missouri state income tax on time may be subject to penalties and interest. The penalty for late filing is 5% of the unpaid tax liability, and the penalty for late payment is 1/2% of the unpaid tax liability per month.

Conclusion

Understanding Missouri Form Mo A is crucial for taxpayers who need to file their state income tax return. By following the steps outlined in this article, taxpayers can ensure they complete the form accurately and avoid any potential penalties or interest. Remember to gather all necessary documents, determine filing status, calculate income, claim deductions and credits, and complete the form carefully. If you have any questions or concerns, consult the Missouri Department of Revenue's website or seek the advice of a tax professional.

What is the deadline for filing Missouri Form Mo A?

+The deadline for filing Missouri Form Mo A is typically April 15th of each year. However, if the 15th falls on a weekend or holiday, the deadline is extended to the next business day.

Who needs to file Missouri Form Mo A?

+Individuals who meet certain income and filing status criteria must file Missouri Form Mo A. This includes single individuals with a gross income of $9,000 or more, married individuals filing jointly with a gross income of $18,000 or more, and others.

What is the penalty for late filing of Missouri Form Mo A?

+The penalty for late filing of Missouri Form Mo A is 5% of the unpaid tax liability.