Understanding the Importance of Filing Kennesaw State Tax Form

As a resident of Kennesaw, Georgia, it's essential to understand the significance of filing your state tax form. The state tax form is used to report your income, claim deductions and credits, and calculate your tax liability. Filing your state tax form accurately and on time can help you avoid penalties, interest, and even audit issues. In this article, we'll explore five ways to fill out your Kennesaw state tax form, ensuring you comply with the state's tax laws and regulations.

Why Filing Kennesaw State Tax Form is Crucial

Filing your Kennesaw state tax form is crucial for several reasons:

- It helps you report your income accurately, ensuring you pay the correct amount of taxes.

- You can claim deductions and credits, reducing your tax liability.

- Filing your state tax form on time helps you avoid penalties and interest.

- It enables the state to allocate funds for public services, such as education, healthcare, and infrastructure.

5 Ways to Fill Kennesaw State Tax Form

Here are five ways to fill out your Kennesaw state tax form:

1. E-File Using Tax Software

You can use tax software like TurboTax, H&R Block, or TaxAct to e-file your Kennesaw state tax form. These software programs guide you through the filing process, ensuring you report your income accurately and claim deductions and credits.

- Pros: Convenient, accurate, and fast.

- Cons: May require technical expertise, and software costs can add up.

2. Hire a Tax Professional

You can hire a tax professional or accountant to fill out your Kennesaw state tax form. They'll ensure you comply with state tax laws and regulations.

- Pros: Expertise, accuracy, and personalized service.

- Cons: May be expensive, and you'll need to provide financial information.

3. Use the Georgia Tax Center

The Georgia Tax Center is a free online service that allows you to file your state tax form electronically. You can access the service through the Georgia Department of Revenue's website.

- Pros: Free, convenient, and accurate.

- Cons: May require technical expertise, and support may be limited.

4. Mail a Paper Return

You can fill out a paper copy of the Kennesaw state tax form and mail it to the Georgia Department of Revenue.

- Pros: No technical expertise required, and you can keep a paper record.

- Cons: May be time-consuming, and you'll need to ensure accurate completion.

5. Visit a Local Tax Office

You can visit a local tax office or IRS office to fill out your Kennesaw state tax form. Tax professionals will guide you through the process.

- Pros: Personalized service, accuracy, and support.

- Cons: May require travel, and wait times can be long.

Additional Tips for Filling Kennesaw State Tax Form

Here are some additional tips to keep in mind when filling out your Kennesaw state tax form:

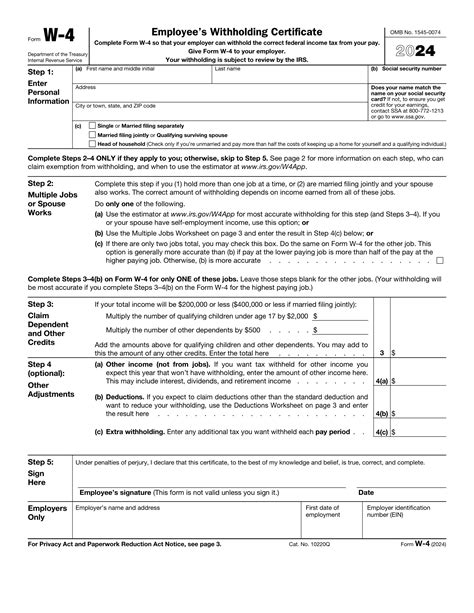

- Ensure you have all necessary documents, such as your W-2 forms and 1099 forms.

- Report all income, including self-employment income and investments.

- Claim deductions and credits accurately, as these can reduce your tax liability.

- Double-check your math and ensure accurate completion.

- File your state tax form on time to avoid penalties and interest.

Final Thoughts

Filing your Kennesaw state tax form is a crucial part of being a responsible citizen. By following the five ways outlined in this article, you can ensure accurate completion and compliance with state tax laws and regulations. Don't hesitate to seek help if you need it, and remember to file your state tax form on time to avoid penalties and interest.

Share Your Thoughts

We'd love to hear from you! Share your experiences with filling out the Kennesaw state tax form in the comments below. Do you have any tips or advice to share with others? Let us know!

Related Articles

What is the deadline for filing the Kennesaw state tax form?

+The deadline for filing the Kennesaw state tax form is typically April 15th of each year.

Can I e-file my Kennesaw state tax form?

+Yes, you can e-file your Kennesaw state tax form using tax software or the Georgia Tax Center.

What documents do I need to fill out the Kennesaw state tax form?

+You'll need your W-2 forms, 1099 forms, and other income documentation to fill out the Kennesaw state tax form.