If you're a Massachusetts taxpayer who has fallen behind on your tax payments, you may be eligible for tax amnesty through the Massachusetts Department of Revenue (DOR). The MA Form 355-7004 is a vital document that helps you navigate this process. In this article, we'll delve into the world of Massachusetts tax amnesty, exploring the benefits, eligibility criteria, and the step-by-step process of applying for amnesty using the MA Form 355-7004.

Understanding Massachusetts Tax Amnesty

Massachusetts tax amnesty is a program designed to encourage taxpayers to settle their outstanding tax liabilities. By participating in the program, eligible taxpayers can avoid penalties and interest on their tax debt. The amnesty program is usually announced by the Massachusetts DOR, and taxpayers have a limited time to apply.

The benefits of tax amnesty include:

- Waiver of penalties and interest on tax debt

- Opportunity to settle tax liabilities without fear of prosecution

- Chance to start fresh and become compliant with tax laws

However, not all taxpayers are eligible for tax amnesty. To qualify, you must meet specific criteria, which we'll discuss in the next section.

Eligibility Criteria for Massachusetts Tax Amnesty

To be eligible for Massachusetts tax amnesty, you must meet the following conditions:

- You must have an outstanding tax liability with the Massachusetts DOR.

- You must not have been contacted by the DOR or the Massachusetts Attorney General's Office regarding your tax liability.

- You must not have been assessed any penalties or interest on your tax debt.

- You must agree to pay your tax liability in full within the specified timeframe.

If you meet these criteria, you can proceed with applying for tax amnesty using the MA Form 355-7004.

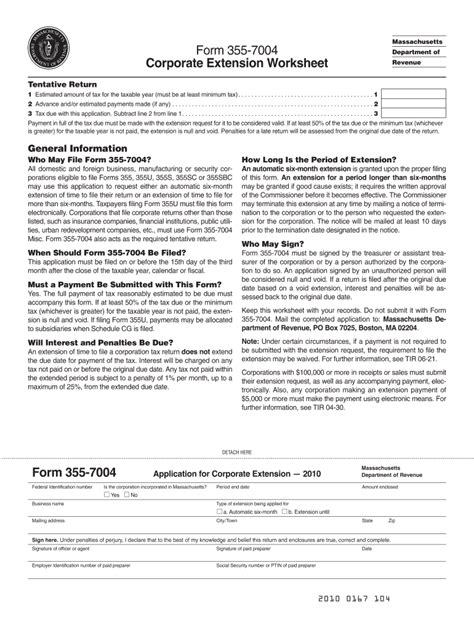

Completing the MA Form 355-7004

The MA Form 355-7004 is a crucial document that helps you apply for Massachusetts tax amnesty. The form is divided into several sections, which we'll outline below:

- Section 1: Taxpayer Information

- Provide your name, address, and taxpayer identification number (TIN).

- Section 2: Tax Liability Information

- List the tax periods and amounts you owe for each tax type (e.g., income tax, sales tax).

- Section 3: Payment Information

- Specify how you intend to pay your tax liability (e.g., lump sum, installment agreement).

- Section 4: Certification

- Sign and date the form, certifying that the information provided is accurate and true.

When completing the form, make sure to follow these tips:

- Use black ink and print clearly.

- Ensure all information is accurate and complete.

- Attach supporting documentation, such as tax returns and payment records, as required.

Submitting the MA Form 355-7004

Once you've completed the MA Form 355-7004, you'll need to submit it to the Massachusetts DOR. You can do this by:

- Mailing the form to the address listed on the form.

- Faxing the form to the number listed on the form.

- Submitting the form electronically through the Massachusetts DOR's online portal.

What to Expect After Submitting the MA Form 355-7004

After submitting the MA Form 355-7004, you can expect the following:

- The Massachusetts DOR will review your application and verify the information provided.

- If your application is approved, you'll receive a letter outlining the terms of your tax amnesty agreement.

- You'll need to make the required payments and comply with the terms of the agreement to avoid any further action.

Frequently Asked Questions

Here are some frequently asked questions about Massachusetts tax amnesty and the MA Form 355-7004:

What is the deadline for applying for Massachusetts tax amnesty?

+The deadline for applying for Massachusetts tax amnesty varies depending on the program. Check the Massachusetts DOR's website for the latest information.

Can I apply for tax amnesty if I have an open audit or appeal?

+No, you cannot apply for tax amnesty if you have an open audit or appeal. You must resolve these issues before applying for amnesty.

What happens if I don't comply with the terms of my tax amnesty agreement?

+If you don't comply with the terms of your tax amnesty agreement, you may be subject to penalties and interest on your tax debt. You may also be prosecuted for tax evasion.

By following the guidelines outlined in this article, you can successfully apply for Massachusetts tax amnesty using the MA Form 355-7004. Remember to carefully review the eligibility criteria and complete the form accurately to avoid any issues. If you have any questions or concerns, don't hesitate to reach out to the Massachusetts DOR or a qualified tax professional.

We hope this article has provided you with a comprehensive understanding of Massachusetts tax amnesty and the MA Form 355-7004. If you have any further questions or would like to share your experiences with tax amnesty, please leave a comment below.