The 1040A form - a crucial part of the tax filing process for many Missourians. While it may seem daunting, understanding the ins and outs of this form can make a world of difference in ensuring you receive the refund you're entitled to. In this comprehensive guide, we'll break down the 1040A form into manageable sections, providing you with the knowledge and confidence to tackle your taxes with ease.

What is the 1040A Form?

The 1040A form, also known as the "Short Form," is a simplified version of the standard 1040 form. It's designed for individuals with straightforward tax situations, such as those who only have income from wages, salaries, tips, and interest. If you're a Missourian with a relatively simple tax situation, the 1040A form might be the perfect fit for you.

Who Can Use the 1040A Form?

To qualify for the 1040A form, you must meet certain criteria:

- Your income is only from wages, salaries, tips, and interest.

- Your income is below $100,000.

- You're filing as single or married filing jointly.

- You don't have any dependents.

- You're not claiming any itemized deductions.

- You're not claiming any tax credits, except for the earned income tax credit (EITC).

If you meet these requirements, you can use the 1040A form to simplify your tax filing process.

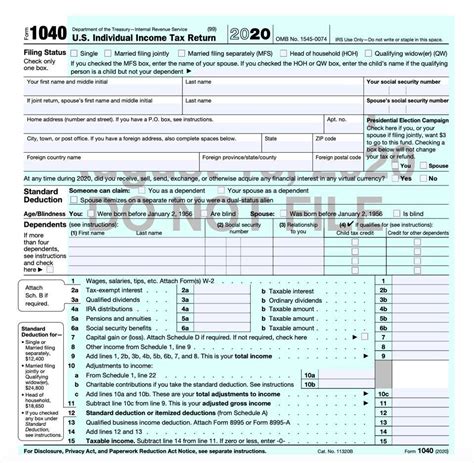

Breaking Down the 1040A Form

The 1040A form consists of two pages, with various sections and lines that require your attention. Let's break down each section to ensure you understand what's required:

- Name, Address, and Social Security Number: This section is straightforward. Enter your name, address, and Social Security number as it appears on your Social Security card.

- Filing Status: Choose your filing status from the options provided: single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Income: Report your income from wages, salaries, tips, and interest. You'll need to provide documentation, such as your W-2 forms and 1099-INT forms.

- Standard Deduction: Claim the standard deduction, which varies depending on your filing status and age.

- Tax and Credits: Calculate your total tax liability, taking into account any tax credits you're eligible for, such as the EITC.

Tips for Filing the 1040A Form

To ensure a smooth filing process, keep the following tips in mind:

- Gather all necessary documents: Collect your W-2 forms, 1099-INT forms, and any other relevant documentation before starting the filing process.

- Use the correct filing status: Choose the correct filing status to avoid delays or even an audit.

- Double-check your math: Ensure you've accurately calculated your income, deductions, and tax liability.

- Consider e-filing: E-filing can speed up the refund process and reduce the risk of errors.

Common Mistakes to Avoid

When filing the 1040A form, it's essential to avoid common mistakes that can lead to delays or even an audit. Be mindful of the following:

- Inaccurate income reporting: Ensure you've reported all income from wages, salaries, tips, and interest.

- Incorrect filing status: Choose the correct filing status to avoid delays or even an audit.

- Math errors: Double-check your calculations to ensure accuracy.

- Missing signatures: Don't forget to sign and date the form.

Missouri State Taxes

As a Missourian, you'll also need to file state taxes. The Missouri Department of Revenue provides a range of resources to help you navigate the state tax filing process.

- Missouri State Tax Forms: Familiarize yourself with the necessary state tax forms, such as the MO-1040.

- Missouri State Tax Rates: Understand the state tax rates and how they apply to your situation.

- Missouri State Tax Credits: Explore the available state tax credits, such as the Missouri Property Tax Credit.

Seeking Professional Help

If you're unsure about any aspect of the 1040A form or Missouri state taxes, consider seeking professional help. A tax professional can guide you through the filing process, ensuring you take advantage of all eligible deductions and credits.

- Find a tax professional: Look for a reputable tax professional in your area or consider using online tax preparation services.

- Ask questions: Don't hesitate to ask questions or seek clarification on any aspect of the filing process.

Conclusion

Filing the 1040A form can seem daunting, but with the right guidance, it can be a straightforward process. By understanding the ins and outs of this form, you'll be better equipped to navigate the tax filing process and ensure you receive the refund you're entitled to. Remember to gather all necessary documents, double-check your math, and consider seeking professional help if needed.

We hope this comprehensive guide has provided you with the knowledge and confidence to tackle your taxes with ease. If you have any questions or concerns, please don't hesitate to reach out. Share your thoughts and experiences in the comments below, and don't forget to share this article with friends and family who may benefit from this information.

What is the deadline for filing the 1040A form?

+The deadline for filing the 1040A form is typically April 15th of each year.

Can I file the 1040A form electronically?

+Yes, you can file the 1040A form electronically through the IRS website or using tax preparation software.

What is the Missouri state tax rate?

+The Missouri state tax rate ranges from 1.5% to 5.2%, depending on your income level.