Michigan Sales Tax Form 5080 is a crucial document for businesses operating in the state of Michigan. As a business owner, it's essential to understand the ins and outs of this form to ensure compliance with Michigan sales tax laws. In this article, we'll delve into the world of Michigan Sales Tax Form 5080, providing a step-by-step guide on how to complete it accurately.

Why is Michigan Sales Tax Form 5080 important?

Michigan Sales Tax Form 5080 is used to report and remit sales tax to the state of Michigan. It's a critical document that helps the state track and collect sales tax revenue from businesses. As a business owner, it's your responsibility to accurately complete and submit this form on a regular basis.

Failure to comply with Michigan sales tax laws can result in penalties, fines, and even business closure. Therefore, it's essential to understand the importance of Michigan Sales Tax Form 5080 and how to complete it correctly.

Who needs to file Michigan Sales Tax Form 5080?

Businesses that are required to collect and remit sales tax in Michigan need to file Michigan Sales Tax Form 5080. This includes:

- Retailers

- Wholesalers

- Manufacturers

- Service providers

- Online sellers

If your business operates in Michigan and makes sales of tangible personal property, you're likely required to file Michigan Sales Tax Form 5080.

What information do I need to complete Michigan Sales Tax Form 5080?

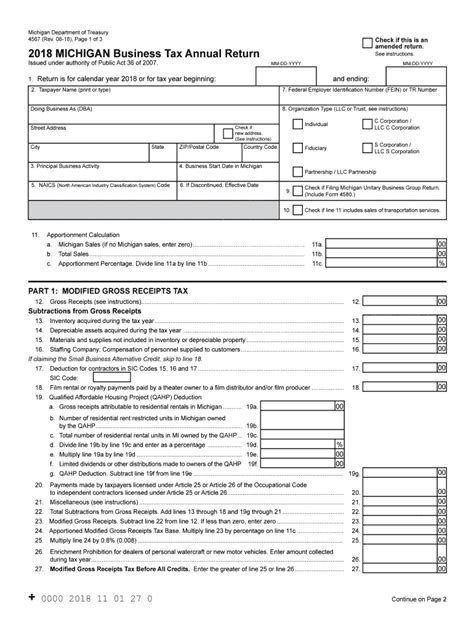

To complete Michigan Sales Tax Form 5080, you'll need the following information:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Michigan sales tax license number

- Reporting period (e.g., monthly, quarterly, or annually)

- Total sales for the reporting period

- Sales tax collected for the reporting period

- Deductions and exemptions

You'll also need to have records of your sales and sales tax collections, including invoices, receipts, and ledgers.

Step-by-Step Guide to Completing Michigan Sales Tax Form 5080

Completing Michigan Sales Tax Form 5080 can seem daunting, but it's a straightforward process. Here's a step-by-step guide to help you get started:

Step 1: Gather Required Information

Gather all the necessary information, including your business name and address, FEIN, Michigan sales tax license number, and reporting period.

Step 2: Determine Your Reporting Period

Determine your reporting period, which is usually monthly, quarterly, or annually. Make sure to report sales tax for the correct period.

Step 3: Calculate Total Sales

Calculate your total sales for the reporting period. This includes all sales of tangible personal property.

Step 4: Calculate Sales Tax Collected

Calculate the sales tax collected for the reporting period. This includes sales tax collected from customers.

Step 5: Calculate Deductions and Exemptions

Calculate any deductions and exemptions, such as sales tax exemptions for certain types of businesses or transactions.

Step 6: Complete the Form

Complete Michigan Sales Tax Form 5080 using the information gathered in the previous steps. Make sure to sign and date the form.

Step 7: Submit the Form

Submit the completed form to the Michigan Department of Treasury along with any required payment.

Tips and Tricks for Completing Michigan Sales Tax Form 5080

Here are some tips and tricks to help you complete Michigan Sales Tax Form 5080 accurately:

- Keep accurate records of your sales and sales tax collections.

- Use a sales tax calculator to ensure accuracy.

- Double-check your calculations to avoid errors.

- Make sure to report sales tax for the correct period.

- Keep a copy of the completed form for your records.

Common Mistakes to Avoid When Completing Michigan Sales Tax Form 5080

Here are some common mistakes to avoid when completing Michigan Sales Tax Form 5080:

- Inaccurate calculations

- Missing or incorrect information

- Failure to report sales tax for the correct period

- Failure to sign and date the form

- Failure to submit the form on time

Consequences of Not Filing or Filing Incorrectly

Failure to file or filing incorrectly can result in penalties, fines, and even business closure. The Michigan Department of Treasury may impose the following penalties:

- Late filing penalty: 5% of the tax due

- Late payment penalty: 5% of the tax due

- Interest on the tax due

Conclusion

Michigan Sales Tax Form 5080 is a critical document for businesses operating in the state of Michigan. By following the step-by-step guide outlined in this article, you can ensure accurate completion and submission of the form. Remember to keep accurate records, use a sales tax calculator, and double-check your calculations to avoid errors. Don't hesitate to reach out to a tax professional if you need help.

FAQs

Who needs to file Michigan Sales Tax Form 5080?

+Businesses that are required to collect and remit sales tax in Michigan need to file Michigan Sales Tax Form 5080. This includes retailers, wholesalers, manufacturers, service providers, and online sellers.

What is the reporting period for Michigan Sales Tax Form 5080?

+The reporting period for Michigan Sales Tax Form 5080 is usually monthly, quarterly, or annually.

What are the consequences of not filing or filing incorrectly?

+Failure to file or filing incorrectly can result in penalties, fines, and even business closure. The Michigan Department of Treasury may impose late filing and payment penalties, as well as interest on the tax due.

Please comment below if you have any questions or need further clarification on Michigan Sales Tax Form 5080. Share this article with others who may find it helpful.