Michigan is a popular state for real estate transactions, and having the right documents is crucial for a smooth transfer of property ownership. One of the most commonly used documents in Michigan real estate is the Quitclaim Deed Form 863. In this article, we will provide a comprehensive guide to the Michigan Quitclaim Deed Form 863, including a free download and a detailed explanation of its purpose, benefits, and usage.

What is a Quitclaim Deed Form 863 in Michigan?

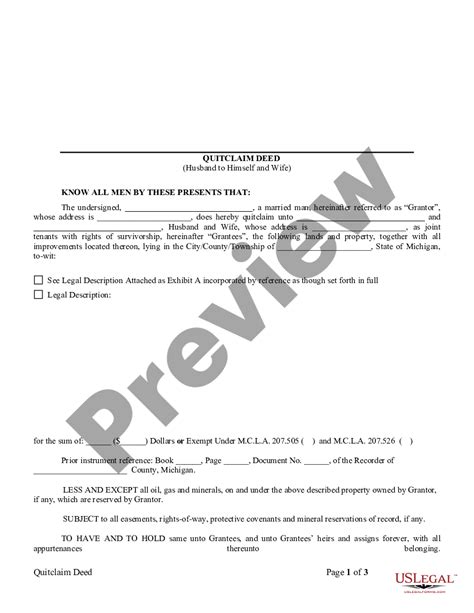

A Quitclaim Deed Form 863 in Michigan is a type of deed that is used to transfer ownership of real property from one party to another. The deed is called a "quitclaim" because the seller (or grantor) is essentially "quitting" their claim to the property and transferring it to the buyer (or grantee). Unlike other types of deeds, such as a warranty deed, a quitclaim deed does not guarantee that the seller has clear title to the property or that there are no liens or other encumbrances.

Purpose of the Michigan Quitclaim Deed Form 863

The primary purpose of the Michigan Quitclaim Deed Form 863 is to provide a simple and efficient way for property owners to transfer ownership of their property. This type of deed is often used in situations where the seller is not making any warranties or guarantees about the property, such as:

- Transferring property between family members or spouses

- Transferring property to a trust or LLC

- Correcting errors in a previous deed

- Removing a spouse's name from a deed after a divorce

Benefits of Using the Michigan Quitclaim Deed Form 863

Using the Michigan Quitclaim Deed Form 863 offers several benefits, including:

- Easy to use: The form is simple and easy to fill out, making it a convenient option for property owners who want to transfer ownership quickly.

- Low cost: Quitclaim deeds are generally less expensive than other types of deeds, making them a cost-effective option for property owners.

- Flexibility: Quitclaim deeds can be used in a variety of situations, including transfers between family members, spouses, and trusts.

How to Fill Out the Michigan Quitclaim Deed Form 863

To fill out the Michigan Quitclaim Deed Form 863, you will need to provide the following information:

- Grantor's name and address: The name and address of the seller (or grantor)

- Grantee's name and address: The name and address of the buyer (or grantee)

- Property description: A detailed description of the property being transferred, including the address, parcel number, and any other identifying information

- Consideration: The amount of money or other consideration being paid for the property

- Signature: The grantor's signature, which must be notarized

Recording the Michigan Quitclaim Deed Form 863

After the quitclaim deed has been filled out and signed, it must be recorded with the county register of deeds office in the county where the property is located. The recording process typically involves submitting the deed to the county office and paying a filing fee.

Free Download of the Michigan Quitclaim Deed Form 863

You can download a free copy of the Michigan Quitclaim Deed Form 863 by clicking on the link below.

Conclusion

The Michigan Quitclaim Deed Form 863 is a valuable tool for property owners who want to transfer ownership of their property quickly and easily. By understanding the purpose, benefits, and usage of this form, property owners can ensure a smooth transfer of ownership and avoid potential pitfalls. If you have any questions or need further guidance, consult with a real estate attorney or other qualified professional.

Types of Michigan Quitclaim Deeds

There are several types of Michigan quitclaim deeds, including:

MIchigan Quitclaim Deed with Warranty

A quitclaim deed with warranty is a type of deed that includes a warranty that the seller has clear title to the property and that there are no liens or other encumbrances.

MIchigan Quitclaim Deed without Warranty

A quitclaim deed without warranty is a type of deed that does not include any warranties or guarantees about the property.

MIchigan Quitclaim Deed for Trusts

A quitclaim deed for trusts is a type of deed that is used to transfer property to a trust or LLC.

MIchigan Quitclaim Deed for Estates

A quitclaim deed for estates is a type of deed that is used to transfer property from an estate to a beneficiary.

Michigan Quitclaim Deed Requirements

To record a quitclaim deed in Michigan, you will need to meet the following requirements:

- Signatures: The grantor's signature must be notarized.

- Witnesses: Two witnesses are required to sign the deed.

- Description: The property must be described in detail, including the address, parcel number, and any other identifying information.

- Recording: The deed must be recorded with the county register of deeds office in the county where the property is located.

Common Mistakes to Avoid

When using the Michigan Quitclaim Deed Form 863, there are several common mistakes to avoid, including:

- Incorrect property description: Make sure to include a detailed description of the property, including the address, parcel number, and any other identifying information.

- Incomplete signatures: Make sure to include the grantor's signature, which must be notarized, and the signatures of two witnesses.

- Failure to record: Make sure to record the deed with the county register of deeds office in the county where the property is located.

FAQs

What is a quitclaim deed in Michigan?

+A quitclaim deed in Michigan is a type of deed that is used to transfer ownership of real property from one party to another.

How do I fill out the Michigan Quitclaim Deed Form 863?

+To fill out the Michigan Quitclaim Deed Form 863, you will need to provide the grantor's name and address, the grantee's name and address, a detailed description of the property, and the consideration being paid for the property.

Do I need to record the Michigan Quitclaim Deed Form 863?

+Yes, you will need to record the Michigan Quitclaim Deed Form 863 with the county register of deeds office in the county where the property is located.

We hope this guide has been helpful in explaining the Michigan Quitclaim Deed Form 863. If you have any further questions or need additional guidance, please don't hesitate to ask.