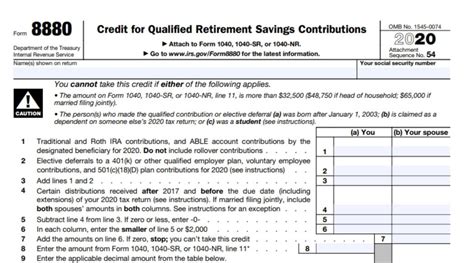

Filing taxes can be a daunting task, especially when it comes to claiming credits. The Form 8880 Credit Limit Worksheet is a crucial part of the tax filing process for individuals who want to claim the Retirement Savings Contributions Credit. In this article, we will break down the Form 8880 Credit Limit Worksheet, explain its purpose, and provide a step-by-step guide on how to complete it.

Why is the Form 8880 Credit Limit Worksheet important?

The Form 8880 Credit Limit Worksheet is used to calculate the amount of credit you are eligible for under the Retirement Savings Contributions Credit (RSCC) program. The RSCC is a tax credit designed to encourage low- and moderate-income individuals to save for retirement. By completing the Form 8880 Credit Limit Worksheet, you can determine the maximum amount of credit you can claim on your tax return.

What is the Retirement Savings Contributions Credit?

The Retirement Savings Contributions Credit (RSCC) is a non-refundable tax credit that allows eligible individuals to claim a credit of up to $2,000 ($4,000 if married filing jointly) for contributions made to a qualified retirement plan, such as a 401(k) or an IRA. The credit is calculated based on the amount contributed to the retirement plan and the individual's adjusted gross income (AGI).

How to complete the Form 8880 Credit Limit Worksheet

The Form 8880 Credit Limit Worksheet is a simple, one-page worksheet that requires you to provide some basic information about your retirement contributions and income. Here's a step-by-step guide to completing the worksheet:

Step 1: Determine your eligibility

Before you begin, make sure you are eligible for the RSCC. To qualify, you must:

- Be 18 years or older

- Not be a full-time student

- Not be claimed as a dependent on someone else's tax return

- Have contributed to a qualified retirement plan, such as a 401(k) or an IRA

Step 2: Gather required information

To complete the worksheet, you will need to gather the following information:

- Your adjusted gross income (AGI) from your tax return

- The amount you contributed to a qualified retirement plan

- Your filing status (single, married filing jointly, married filing separately, etc.)

Step 3: Complete the worksheet

Using the information gathered in Step 2, complete the Form 8880 Credit Limit Worksheet as follows:

- Enter your AGI from your tax return on Line 1.

- Enter the amount you contributed to a qualified retirement plan on Line 2.

- Determine your filing status and enter the corresponding credit limit from the table on Line 3.

- Calculate the credit limit by multiplying the amount on Line 2 by the percentage on Line 3.

Example

Let's say you are single, have an AGI of $30,000, and contributed $5,000 to a 401(k) plan. Using the Form 8880 Credit Limit Worksheet, you would:

- Enter $30,000 on Line 1

- Enter $5,000 on Line 2

- Determine your filing status is single and enter the corresponding credit limit of 20% on Line 3

- Calculate the credit limit by multiplying $5,000 by 20% (0.20), which equals $1,000

In this example, your credit limit would be $1,000.

**h2>What's next?

Once you have completed the Form 8880 Credit Limit Worksheet, you can claim the Retirement Savings Contributions Credit on your tax return. Make sure to attach the completed worksheet to your tax return and keep a copy for your records.

**h2>Common mistakes to avoid

When completing the Form 8880 Credit Limit Worksheet, avoid the following common mistakes:

- Failing to qualify for the credit

- Entering incorrect information

- Not claiming the credit on your tax return

By following the steps outlined in this article, you can ensure you complete the Form 8880 Credit Limit Worksheet accurately and claim the Retirement Savings Contributions Credit you are eligible for.

**h2>Additional resources

For more information on the Retirement Savings Contributions Credit and the Form 8880 Credit Limit Worksheet, visit the IRS website or consult with a tax professional.

**h2>Take action

Don't miss out on the opportunity to claim the Retirement Savings Contributions Credit. Complete the Form 8880 Credit Limit Worksheet today and take the first step towards saving for your retirement.

FAQ Section:

What is the Retirement Savings Contributions Credit?

+The Retirement Savings Contributions Credit is a non-refundable tax credit that allows eligible individuals to claim a credit of up to $2,000 ($4,000 if married filing jointly) for contributions made to a qualified retirement plan.

Who is eligible for the Retirement Savings Contributions Credit?

+To qualify for the credit, you must be 18 years or older, not be a full-time student, not be claimed as a dependent on someone else's tax return, and have contributed to a qualified retirement plan.

How do I claim the Retirement Savings Contributions Credit on my tax return?

+To claim the credit, complete the Form 8880 Credit Limit Worksheet and attach it to your tax return. Make sure to keep a copy for your records.

Note: This article is for general information purposes only and should not be considered as tax advice. Consult with a tax professional or the IRS website for specific guidance on the Form 8880 Credit Limit Worksheet and the Retirement Savings Contributions Credit.