Merrill Lynch is a well-established financial institution that provides a wide range of financial services to its clients. One of the forms that Merrill Lynch uses to ensure the security and integrity of its clients' accounts is the Trusted Contact Person Form. In this article, we will delve into the details of this form, its importance, and how it works.

Importance of the Trusted Contact Person Form

The Trusted Contact Person Form is a crucial document that allows Merrill Lynch to verify the identity of individuals who may be attempting to access or make changes to a client's account. This form is designed to prevent unauthorized access and protect clients from potential financial scams. By designating a trusted contact person, clients can ensure that their accounts are secure and that only authorized individuals can access their financial information.

How the Trusted Contact Person Form Works

The Trusted Contact Person Form is a simple document that requires clients to provide the name and contact information of a trusted individual. This individual can be a family member, friend, or other trusted person who is authorized to verify the client's identity and confirm any changes to their account. When a client designates a trusted contact person, Merrill Lynch will use the contact information provided to verify the client's identity and ensure that any changes to their account are legitimate.

Benefits of Designating a Trusted Contact Person

Designating a trusted contact person provides several benefits to Merrill Lynch clients. Some of the key benefits include:

- Enhanced security: By designating a trusted contact person, clients can ensure that their accounts are secure and that only authorized individuals can access their financial information.

- Prevention of financial scams: The Trusted Contact Person Form helps to prevent financial scams by verifying the identity of individuals who may be attempting to access or make changes to a client's account.

- Peace of mind: Designating a trusted contact person can provide clients with peace of mind, knowing that their accounts are secure and that they have a trusted individual who can verify their identity and confirm any changes to their account.

Who Can Be a Trusted Contact Person?

A trusted contact person can be anyone who is authorized by the client to verify their identity and confirm any changes to their account. Some examples of individuals who may be designated as trusted contact persons include:

- Family members: Spouses, children, parents, or other family members who are authorized to access the client's account.

- Friends: Close friends who are authorized to access the client's account and verify their identity.

- Attorneys: Attorneys who are authorized to access the client's account and verify their identity.

How to Complete the Trusted Contact Person Form

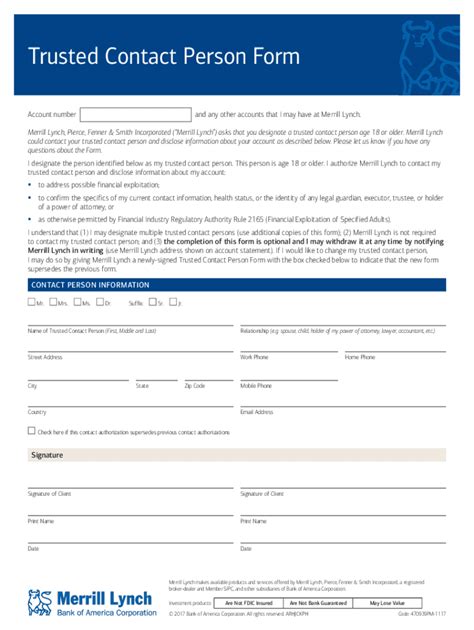

Completing the Trusted Contact Person Form is a simple process that requires clients to provide the name and contact information of their designated trusted contact person. Here are the steps to complete the form:

- Download the form: Clients can download the Trusted Contact Person Form from the Merrill Lynch website or obtain a copy from their financial advisor.

- Complete the form: Clients must complete the form by providing the name and contact information of their designated trusted contact person.

- Sign the form: Clients must sign the form to authorize the designation of their trusted contact person.

- Return the form: Clients must return the completed form to their financial advisor or mail it to Merrill Lynch.

What Happens After the Form is Completed?

After the Trusted Contact Person Form is completed and returned to Merrill Lynch, the designated trusted contact person will be authorized to verify the client's identity and confirm any changes to their account. If someone attempts to access or make changes to the client's account, Merrill Lynch will contact the trusted contact person to verify the client's identity and confirm the changes.

Common Questions About the Trusted Contact Person Form

Here are some common questions about the Trusted Contact Person Form:

- Who can be a trusted contact person?: A trusted contact person can be anyone who is authorized by the client to verify their identity and confirm any changes to their account.

- How do I complete the form?: Clients can complete the form by downloading it from the Merrill Lynch website, completing it, signing it, and returning it to their financial advisor or mailing it to Merrill Lynch.

- What happens after the form is completed?: After the form is completed, the designated trusted contact person will be authorized to verify the client's identity and confirm any changes to their account.

What is the purpose of the Trusted Contact Person Form?

+The Trusted Contact Person Form is designed to prevent unauthorized access and protect clients from potential financial scams by verifying the identity of individuals who may be attempting to access or make changes to a client's account.

Who can be designated as a trusted contact person?

+A trusted contact person can be anyone who is authorized by the client to verify their identity and confirm any changes to their account, such as family members, friends, or attorneys.

How do I complete the Trusted Contact Person Form?

+Clients can complete the form by downloading it from the Merrill Lynch website, completing it, signing it, and returning it to their financial advisor or mailing it to Merrill Lynch.

In conclusion, the Trusted Contact Person Form is an important document that helps to protect Merrill Lynch clients from potential financial scams and unauthorized access to their accounts. By designating a trusted contact person, clients can ensure that their accounts are secure and that only authorized individuals can access their financial information. If you have any questions or concerns about the Trusted Contact Person Form, do not hesitate to reach out to your financial advisor or contact Merrill Lynch directly.