The Maryland Form 202, also known as the "Maryland Business Personal Property Return," is a crucial document for business owners operating in the state of Maryland. The form is used to report personal property owned or leased by a business, which is subject to taxation. In this article, we will provide a comprehensive guide on how to file the Maryland Form 202, including the benefits, requirements, and a step-by-step filing process.

Understanding the Maryland Form 202

The Maryland Form 202 is a mandatory filing for all businesses operating in Maryland, regardless of size or structure. The form is used to report personal property, such as equipment, furniture, and fixtures, which is used in the operation of the business. The form is filed annually with the local government, typically by April 15th of each year.

Benefits of Filing the Maryland Form 202

Filing the Maryland Form 202 provides several benefits to business owners, including:

- Compliance with Maryland tax laws and regulations

- Accurate assessment of personal property taxes

- Potential reduction in tax liability

- Improved record-keeping and financial management

Requirements for Filing the Maryland Form 202

To file the Maryland Form 202, businesses must meet the following requirements:

- Be registered with the State of Maryland

- Have personal property valued at $2,500 or more

- Be in operation on January 1st of the tax year

- Have a federal tax identification number (EIN)

What to Include in the Maryland Form 202

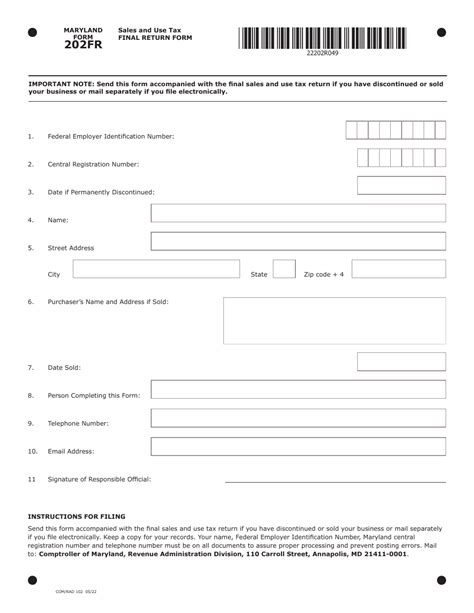

The Maryland Form 202 requires businesses to report the following information:

- Business name and address

- Federal tax identification number (EIN)

- Business type and structure

- List of personal property, including:

- Equipment and machinery

- Furniture and fixtures

- Leasehold improvements

- Other personal property

A Step-By-Step Filing Guide for the Maryland Form 202

Filing the Maryland Form 202 can be a complex process, but by following these steps, businesses can ensure accurate and timely filing:

- Gather required documents: Collect all necessary documents, including financial records, receipts, and invoices.

- Complete the form: Fill out the Maryland Form 202, making sure to include all required information.

- List personal property: Report all personal property, including equipment, furniture, and fixtures.

- Calculate tax liability: Calculate the total tax liability based on the reported personal property.

- Submit the form: File the completed form with the local government by the designated deadline.

- Pay any taxes owed: Pay any taxes owed, including penalties and interest, if applicable.

Common Mistakes to Avoid When Filing the Maryland Form 202

When filing the Maryland Form 202, businesses should avoid the following common mistakes:

- Failing to report all personal property

- Underreporting or overreporting tax liability

- Missing deadlines

- Failing to pay taxes owed

Conclusion

Filing the Maryland Form 202 is a critical step in maintaining compliance with Maryland tax laws and regulations. By following the steps outlined in this guide, businesses can ensure accurate and timely filing, avoiding potential penalties and fines.

What is the deadline for filing the Maryland Form 202?

+The deadline for filing the Maryland Form 202 is typically April 15th of each year.

What is considered personal property for the purposes of the Maryland Form 202?

+Personal property includes equipment, furniture, fixtures, leasehold improvements, and other tangible assets used in the operation of the business.

Can I file the Maryland Form 202 electronically?

+Yes, the Maryland Form 202 can be filed electronically through the Maryland State Department of Assessments and Taxation website.