The state of California requires various forms and filings to ensure compliance with its regulations. Among these forms, the California Form 100 is a crucial document for businesses operating within the state. In this comprehensive guide, we'll delve into the world of California Form 100, exploring its purpose, benefits, and a step-by-step guide on how to file it correctly.

What is California Form 100?

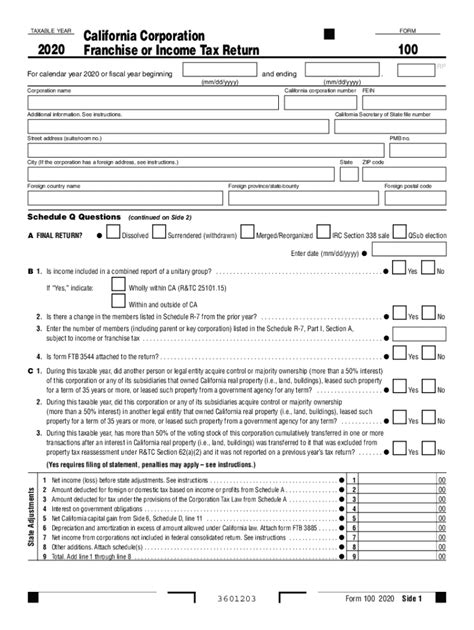

California Form 100, also known as the Statement of Information, is a document required by the California Secretary of State's office. This form is used to update or provide information about a business entity, such as a corporation, limited liability company (LLC), or limited partnership (LP). The form serves as a record of the business's current information, including its name, address, management structure, and ownership details.

Why is California Form 100 important?

Filing California Form 100 is essential for several reasons:

- Compliance with state regulations: The California Secretary of State's office requires businesses to file Form 100 to maintain compliance with state regulations.

- Update business information: The form allows businesses to update their information, ensuring that the state's records are accurate and up-to-date.

- Maintain good standing: Filing Form 100 helps businesses maintain good standing with the state, which is essential for conducting business activities.

Benefits of Filing California Form 100

Filing California Form 100 offers several benefits to businesses operating in the state:

- Improved compliance: By filing Form 100, businesses can ensure compliance with state regulations, reducing the risk of penalties and fines.

- Enhanced credibility: Filing the form demonstrates a business's commitment to transparency and accountability, enhancing its credibility with customers, investors, and partners.

- Streamlined business operations: Accurate and up-to-date information on file with the state can help streamline business operations, reducing the risk of errors and delays.

Step-by-Step Guide to Filing California Form 100

Filing California Form 100 is a relatively straightforward process. Here's a step-by-step guide to help you file the form correctly:

- Obtain the form: You can download California Form 100 from the California Secretary of State's website or obtain it by mail.

- Gather required information: Ensure you have the necessary information, including the business's name, address, management structure, and ownership details.

- Complete the form: Fill out the form accurately and completely, making sure to sign it.

- Submit the form: File the form with the California Secretary of State's office, either online or by mail.

Required Information for California Form 100

To complete California Form 100, you'll need to provide the following information:

- Business name and address

- Management structure (e.g., CEO, CFO, directors)

- Ownership details (e.g., shareholders, members)

- Business purpose (optional)

Filing Fees and Requirements

The filing fee for California Form 100 varies depending on the type of business entity:

- Corporations: $25 (online) or $30 (by mail)

- LLCs and LPs: $20 (online) or $25 (by mail)

Additionally, you may need to provide additional documentation, such as a certified copy of the business's articles of incorporation or articles of organization.

Penalties for Non-Compliance

Failure to file California Form 100 or providing inaccurate information can result in penalties and fines. The California Secretary of State's office may impose the following penalties:

- Late filing fee: $250 (in addition to the regular filing fee)

- Penalty for inaccurate information: $250 (in addition to the regular filing fee)

Conclusion: Stay Compliant with California Form 100

California Form 100 is an essential document for businesses operating in the state. By filing this form, businesses can ensure compliance with state regulations, update their information, and maintain good standing. Follow the step-by-step guide and provide the required information to file California Form 100 correctly.

Now that you've completed this guide, you're well on your way to filing California Form 100 with confidence. If you have any questions or need further assistance, don't hesitate to ask.

What is the purpose of California Form 100?

+California Form 100, also known as the Statement of Information, is used to update or provide information about a business entity, such as a corporation, limited liability company (LLC), or limited partnership (LP).

How often do I need to file California Form 100?

+California Form 100 must be filed every two years, unless there are changes to the business's information, in which case an updated form must be filed.

Can I file California Form 100 online?

+Yes, you can file California Form 100 online through the California Secretary of State's website.