In the state of Louisiana, a quit claim deed is a type of deed that allows one party to transfer their interest in a property to another party. This type of deed is often used in situations where the transfer of ownership is not necessarily guaranteed, such as in a divorce or when a property is being gifted. However, it is essential to understand the implications and requirements of a quit claim deed in Louisiana before proceeding with the filing process.

A quit claim deed in Louisiana is a crucial document that can significantly impact the ownership and title of a property. It is vital to ensure that the deed is correctly executed and filed to avoid any potential issues or disputes in the future. This article will provide a comprehensive overview of the Louisiana quit claim deed form and the filing process, including the necessary steps, requirements, and implications of using this type of deed.

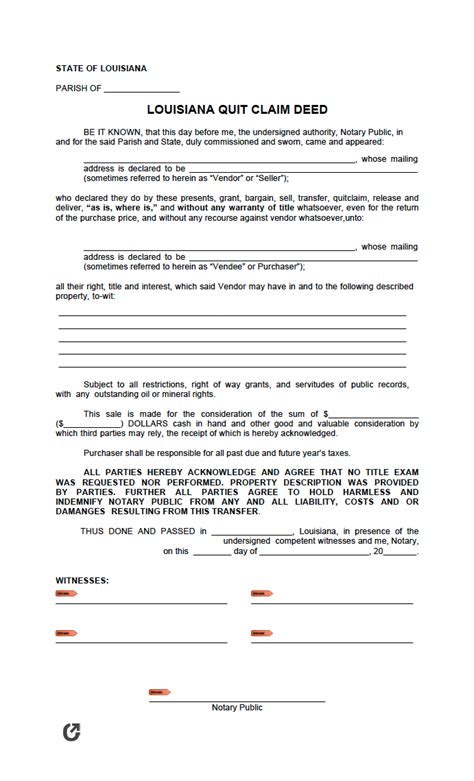

Understanding the Louisiana Quit Claim Deed Form

The Louisiana quit claim deed form is a standardized document that must be used when transferring ownership of a property in the state. The form typically includes the following information:

- The names and addresses of the grantor (the party transferring the property) and the grantee (the party receiving the property)

- A description of the property being transferred, including the parish and municipal district where the property is located

- The type of property being transferred (e.g., residential, commercial, etc.)

- The consideration (if any) for the transfer

- The signatures of the grantor and grantee

It is essential to note that the Louisiana quit claim deed form must be notarized and recorded with the parish recorder's office to be considered valid.

Types of Quit Claim Deeds in Louisiana

There are several types of quit claim deeds that can be used in Louisiana, including:

- Special warranty deed: This type of deed guarantees that the grantor has the right to transfer the property and that the property is free from any encumbrances or defects.

- General warranty deed: This type of deed provides additional guarantees, including that the grantor has the right to transfer the property, that the property is free from any encumbrances or defects, and that the grantor will defend the title against any claims.

- Quit claim deed: This type of deed transfers the grantor's interest in the property to the grantee, but does not guarantee that the grantor has the right to transfer the property or that the property is free from any encumbrances or defects.

The Filing Process for a Quit Claim Deed in Louisiana

The filing process for a quit claim deed in Louisiana involves several steps, including:

- Preparation of the deed: The grantor must prepare the quit claim deed form, including the necessary information and signatures.

- Notarization: The deed must be notarized by a notary public in the state of Louisiana.

- Recording: The deed must be recorded with the parish recorder's office in the parish where the property is located.

- Filing fees: The grantor must pay the necessary filing fees, which vary by parish.

- Document return: After recording, the deed will be returned to the grantor, and a copy will be retained by the parish recorder's office.

Requirements for Filing a Quit Claim Deed in Louisiana

To file a quit claim deed in Louisiana, the following requirements must be met:

- The deed must be in writing and signed by the grantor.

- The deed must be notarized by a notary public in the state of Louisiana.

- The deed must be recorded with the parish recorder's office in the parish where the property is located.

- The grantor must pay the necessary filing fees.

- The deed must include the necessary information, including the names and addresses of the grantor and grantee, a description of the property, and the consideration (if any) for the transfer.

Implications of Using a Quit Claim Deed in Louisiana

Using a quit claim deed in Louisiana can have significant implications, including:

- Transfer of ownership: A quit claim deed can transfer ownership of a property from one party to another, which can impact the title and interest in the property.

- Liability: The grantor may still be liable for any defects or encumbrances on the property, even after transferring ownership.

- Tax implications: The transfer of ownership can have tax implications, including the potential for capital gains tax or other taxes.

- Insurance implications: The transfer of ownership can also impact insurance coverage, including the potential for changes in premiums or coverage.

Common Uses of Quit Claim Deeds in Louisiana

Quit claim deeds are commonly used in Louisiana for various purposes, including:

- Divorce: Quit claim deeds can be used to transfer ownership of a property from one spouse to another as part of a divorce settlement.

- Gifting: Quit claim deeds can be used to gift a property to another party, such as a family member or friend.

- Inheritance: Quit claim deeds can be used to transfer ownership of a property from an estate to a beneficiary.

- Business transactions: Quit claim deeds can be used to transfer ownership of a property as part of a business transaction, such as a sale or merger.

If you are considering using a quit claim deed in Louisiana, it is essential to consult with an attorney to ensure that the deed is correctly executed and filed, and to understand the potential implications of using this type of deed.

What is a quit claim deed in Louisiana?

+A quit claim deed in Louisiana is a type of deed that allows one party to transfer their interest in a property to another party, without guaranteeing that the grantor has the right to transfer the property or that the property is free from any encumbrances or defects.

How do I file a quit claim deed in Louisiana?

+To file a quit claim deed in Louisiana, you must prepare the deed, have it notarized, and record it with the parish recorder's office in the parish where the property is located. You must also pay the necessary filing fees.

What are the implications of using a quit claim deed in Louisiana?

+Using a quit claim deed in Louisiana can have significant implications, including the transfer of ownership, liability for defects or encumbrances, tax implications, and insurance implications.

If you have any questions or concerns about using a quit claim deed in Louisiana, we encourage you to consult with an attorney or leave a comment below.