The process of establishing and maintaining a Limited Liability Company (LLC) involves various formalities, one of which is filing the LLC extension form. This document is crucial for extending the life of an existing LLC, typically required when the initial period of operation is about to expire. For entrepreneurs, business owners, and anyone interested in the intricacies of LLC management, understanding how to navigate this process is essential.

The importance of timely filing of the LLC extension form cannot be overstated. Failure to do so can lead to serious consequences, including loss of business continuity, dissolution of the company, or even lawsuits. This makes it crucial for business entities to stay on top of their legal obligations, especially when it comes to maintaining their operational status.

For those who are new to the world of LLCs, the process of filing an extension might seem daunting. It involves several steps and requires accurate information to avoid any potential delays or complications. This article aims to provide a comprehensive, step-by-step guide on how to file an LLC extension form, ensuring that businesses can continue to operate smoothly.

Understanding LLC Extension Forms

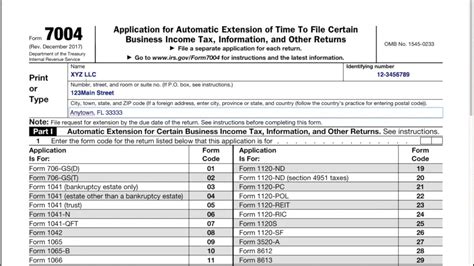

Before diving into the filing process, it's essential to grasp what an LLC extension form is and its purpose. An LLC extension form, also known as articles of continuation or a certificate of continuation, is a document filed with the state to extend the duration of an LLC beyond its original expiration date. Each state has its own version of this form, so it's crucial to check with the Secretary of State or business registration agency in the state where the LLC was formed.

Purpose of Filing an LLC Extension Form

The primary purpose of filing an LLC extension form is to continue the life of the LLC. When an LLC is formed, it typically has a stated duration, which can range from a few years to perpetuity. As the expiration date approaches, filing an extension form allows the LLC to continue operating beyond that date.

Step-by-Step Guide to Filing an LLC Extension Form

Filing an LLC extension form involves several key steps. Here's a detailed guide to help navigate the process:

Step 1: Review State Requirements

The first step is to review the specific requirements for the state in which the LLC was formed. Different states have varying rules and regulations regarding LLC extensions. Some states require the filing of a new articles of organization, while others may demand a certificate of continuation. Understanding these requirements is crucial for accurate filing.

Step 2: Gather Necessary Documents

Before filing, ensure all necessary documents are in order. This typically includes:

- The original articles of organization.

- Any amendments to the articles of organization.

- A current business license.

- Proof of publication (if required by the state).

Step 3: Prepare the LLC Extension Form

Next, prepare the LLC extension form according to the state's specifications. This form will typically require:

- The LLC's name and business address.

- The date of formation and the original duration.

- The new duration of the LLC (if changing).

- A statement indicating the purpose of the filing.

Step 4: Sign the LLC Extension Form

The LLC extension form must be signed by a member or manager of the LLC, or by an authorized representative. The signature should be accompanied by a notarization, depending on the state's requirements.

Step 5: File the LLC Extension Form

The final step is to file the LLC extension form with the appropriate state agency. This can usually be done online, by mail, or in person. There is typically a filing fee associated with this process, which varies by state.

After Filing: What to Expect

After filing the LLC extension form, there are a few things to expect:

Processing Time

The processing time for an LLC extension form can vary from state to state. It's usually a matter of days or weeks, but it's essential to plan ahead to avoid any lapses in the LLC's operational status.

Confirmation of Extension

Once the LLC extension form is processed, the state will typically issue a confirmation or a certificate of extension. This document serves as proof that the LLC's duration has been successfully extended.

Public Notice (If Required)

Some states require the publication of the LLC extension in a local newspaper. This is to provide public notice of the extension, ensuring transparency and compliance with state regulations.

Conclusion and Next Steps

Filing an LLC extension form is a critical step in maintaining the operational status of an LLC. By following the steps outlined in this guide, business owners can ensure their LLC remains in good standing. It's also essential to keep track of the LLC's expiration date to avoid any future lapses.

For those who have successfully filed their LLC extension form, the next steps involve continuing to operate the business according to state and federal laws. This includes maintaining accurate records, filing annual reports, and ensuring compliance with all regulatory requirements.

FAQ Section:

How long does it take to process an LLC extension form?

+The processing time varies by state but typically ranges from a few days to a couple of weeks.

Do all states require the publication of the LLC extension?

+No, not all states require public notice of the LLC extension. It's essential to check with the state's business registration agency for specific requirements.

What happens if I fail to file an LLC extension form?

+Failing to file an LLC extension form can lead to serious consequences, including the dissolution of the LLC and potential lawsuits.