The Kentucky Form K-5 is a crucial document for individuals who are self-employed or have income that isn't subject to withholding. It's essential to understand the purpose, benefits, and requirements of this form to ensure accurate tax reporting and avoid any potential penalties. In this comprehensive guide, we'll delve into the world of the Ky Form K-5, exploring its importance, key components, and step-by-step instructions for completion.

What is the Ky Form K-5?

The Ky Form K-5 is an annual report that must be filed by individuals who have Kentucky source income that isn't subject to withholding. This form is used to report income from self-employment, rental properties, and other sources that aren't subject to state income tax withholding. The Kentucky Department of Revenue requires this form to ensure accurate tax reporting and to verify that individuals are meeting their tax obligations.

Benefits of Filing the Ky Form K-5

Filing the Ky Form K-5 provides several benefits, including:

- Accurate tax reporting: By filing this form, individuals can ensure that their tax obligations are up-to-date and accurate.

- Avoiding penalties: Failing to file the Ky Form K-5 can result in penalties and fines. By filing this form, individuals can avoid these penalties and ensure compliance with state tax laws.

- Reduced audit risk: Filing the Ky Form K-5 can help reduce the risk of an audit by demonstrating compliance with state tax laws.

Who Needs to File the Ky Form K-5?

The following individuals need to file the Ky Form K-5:

- Self-employed individuals with Kentucky source income

- Individuals with rental income from Kentucky properties

- Individuals with other sources of Kentucky income that aren't subject to withholding

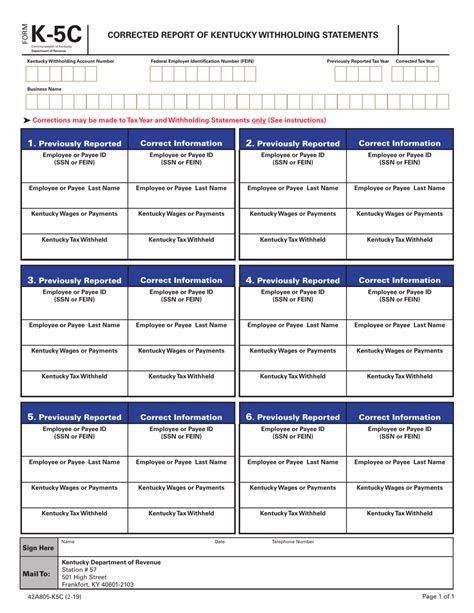

Key Components of the Ky Form K-5

The Ky Form K-5 consists of the following key components:

- Identification Information: This section requires individuals to provide their name, address, and Social Security number.

- Income Information: This section requires individuals to report their Kentucky source income, including self-employment income, rental income, and other sources of income.

- Withholding Information: This section requires individuals to report any withholding from their Kentucky source income.

Step-by-Step Instructions for Completing the Ky Form K-5

To complete the Ky Form K-5, follow these step-by-step instructions:

- Gather Required Documents: Gather all required documents, including your Social Security number, Kentucky source income statements, and withholding statements.

- Complete Identification Information: Complete the identification information section, including your name, address, and Social Security number.

- Report Income Information: Report your Kentucky source income, including self-employment income, rental income, and other sources of income.

- Report Withholding Information: Report any withholding from your Kentucky source income.

- Sign and Date the Form: Sign and date the form to certify that the information is accurate and complete.

Tips for Accurate Completion

To ensure accurate completion of the Ky Form K-5, follow these tips:

- Use the Correct Form: Use the correct form for the tax year you're reporting.

- Double-Check Information: Double-check all information to ensure accuracy and completeness.

- Seek Professional Help: Seek professional help if you're unsure about any aspect of the form.

Frequently Asked Questions

Q: What is the deadline for filing the Ky Form K-5? A: The deadline for filing the Ky Form K-5 is April 15th of each year.

Q: Can I file the Ky Form K-5 electronically? A: Yes, you can file the Ky Form K-5 electronically through the Kentucky Department of Revenue's website.

Q: What happens if I fail to file the Ky Form K-5? A: Failing to file the Ky Form K-5 can result in penalties and fines. It's essential to file this form to avoid these penalties and ensure compliance with state tax laws.

By understanding the purpose, benefits, and requirements of the Ky Form K-5, individuals can ensure accurate tax reporting and avoid potential penalties. If you're unsure about any aspect of the form, seek professional help to ensure compliance with state tax laws.

If you have any questions or concerns about the Ky Form K-5, please leave a comment below. Share this article with others who may benefit from this comprehensive guide.