The W-9 form is a crucial document for freelancers, independent contractors, and businesses to provide to their clients and vendors. It's used to certify the taxpayer identification number (TIN) and name of the payee, ensuring compliance with the Internal Revenue Service (IRS) regulations. If you're looking for a 2017 W-9 printable form, here are five ways to obtain it:

Understanding the Importance of the W-9 Form

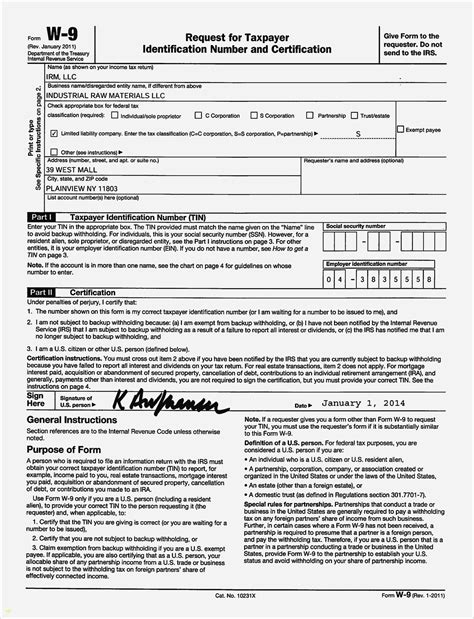

The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document for freelancers, independent contractors, and businesses. It's used to certify the taxpayer identification number (TIN) and name of the payee, ensuring compliance with the IRS regulations. The form is typically required by clients and vendors to verify the identity of their payees and to ensure that they're in compliance with tax laws.

What's Included in the W-9 Form?

The W-9 form includes the following information:

- The payee's name and business name (if different)

- The payee's taxpayer identification number (TIN)

- The payee's address

- The payee's certification that they're not subject to backup withholding

- The payee's certification that they're a U.S. person (including a resident alien)

5 Ways to Get a 2017 W-9 Printable Form

Here are five ways to obtain a 2017 W-9 printable form:

1. Download from the IRS Website

The IRS website offers a free downloadable version of the W-9 form. You can visit the IRS website at and search for "W-9 form." The form is available in PDF format, which can be easily printed and filled out.

2. Use Online Tax Preparation Software

Many online tax preparation software, such as TurboTax or H&R Block, offer a W-9 form that can be printed and filled out. These software programs often provide a fillable version of the form, which can be completed online and then printed.

3. Visit a Local Office Supply Store

Office supply stores like Staples or Office Depot often carry a selection of tax forms, including the W-9 form. You can visit a local store and purchase a packet of W-9 forms.

4. Contact the IRS by Phone

If you're unable to access the internet or prefer to order the form by phone, you can contact the IRS at 1-800-829-3676. They will mail you a copy of the W-9 form.

5. Use a Online Form Provider

There are several online form providers, such as Rocket Lawyer or LawDepot, that offer a W-9 form that can be printed and filled out. These providers often offer a fillable version of the form, which can be completed online and then printed.

Completing and Submitting the W-9 Form

Once you've obtained a W-9 form, you'll need to complete it and submit it to your clients and vendors. Here are some tips for completing and submitting the form:

- Make sure to fill out the form accurately and completely.

- Use a black or blue pen to sign the form.

- Make a copy of the completed form for your records.

- Submit the completed form to your clients and vendors.

Tips for Businesses

If you're a business, it's essential to keep a copy of the completed W-9 form on file for each payee. This will help you comply with IRS regulations and ensure that you're not subject to backup withholding.

Common Questions About the W-9 Form

Here are some common questions about the W-9 form:

What's the purpose of the W-9 form?

The W-9 form is used to certify the taxpayer identification number (TIN) and name of the payee, ensuring compliance with IRS regulations.

Who needs to complete a W-9 form?

Freelancers, independent contractors, and businesses need to complete a W-9 form to provide to their clients and vendors.

How do I obtain a W-9 form?

You can obtain a W-9 form by downloading it from the IRS website, using online tax preparation software, visiting a local office supply store, contacting the IRS by phone, or using an online form provider.

How do I complete and submit the W-9 form?

Make sure to fill out the form accurately and completely, use a black or blue pen to sign the form, make a copy of the completed form for your records, and submit the completed form to your clients and vendors.

What's the difference between a W-9 and a 1099?

+A W-9 form is used to certify the taxpayer identification number (TIN) and name of the payee, while a 1099 form is used to report income paid to independent contractors and freelancers.

Do I need to file the W-9 form with the IRS?

+No, you don't need to file the W-9 form with the IRS. Instead, you'll submit it to your clients and vendors, who will use the information to complete their tax returns.

Can I use a W-9 form from a previous year?

+No, you should use the current year's W-9 form. The IRS updates the form annually, so it's essential to use the latest version to ensure compliance with tax laws.

By following these tips and understanding the importance of the W-9 form, you'll be able to comply with IRS regulations and ensure that your business or freelance career runs smoothly.