The 1041 V form is an essential document for estates and trusts to report income tax and claim a refund. Despite its importance, many beneficiaries and fiduciaries are unfamiliar with the form's requirements and implications. In this article, we will delve into five essential facts about the 1041 V form, providing a comprehensive understanding of its purpose, benefits, and key considerations.

Understanding the 1041 V Form

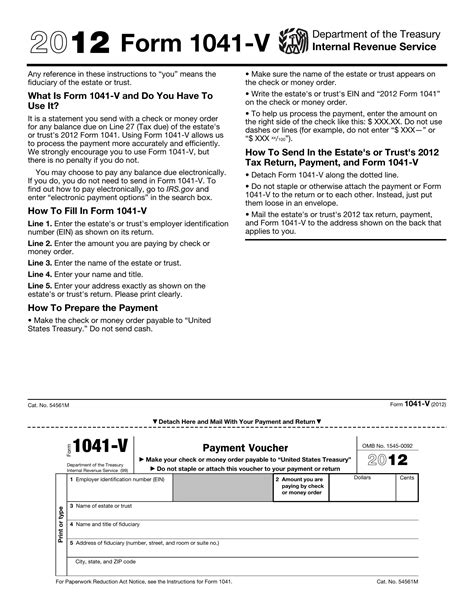

The 1041 V form is a voucher used by estates and trusts to make estimated tax payments or claim a refund. It is typically filed with the Internal Revenue Service (IRS) on a quarterly basis, with the due dates being April 15th, June 15th, September 15th, and January 15th of the following year. The form is used to report income tax, capital gains tax, and other taxes owed by the estate or trust.

Benefits of Filing the 1041 V Form

Filing the 1041 V form provides several benefits for estates and trusts, including:

• Reduced penalties and interest: By making timely estimated tax payments, estates and trusts can avoid penalties and interest on unpaid taxes. • Claiming refunds: The 1041 V form allows estates and trusts to claim refunds for overpaid taxes, which can be a significant advantage for beneficiaries. • Simplified tax compliance: Filing the 1041 V form helps estates and trusts stay compliant with tax laws and regulations, reducing the risk of audits and penalties.

Who Needs to File the 1041 V Form?

The 1041 V form is required for estates and trusts that meet specific criteria, including:

• Estates: Estates that have gross income of $600 or more, or that have a beneficiary who is a non-resident alien, must file the 1041 V form. • Trusts: Trusts that have gross income of $600 or more, or that have a beneficiary who is a non-resident alien, must file the 1041 V form. • Beneficiaries: Beneficiaries who receive income from an estate or trust may need to file the 1041 V form to report their share of income and claim a refund.

Key Information Required on the 1041 V Form

The 1041 V form requires several key pieces of information, including:

• Estate or trust name and taxpayer identification number • Beneficiary information, including name, address, and taxpayer identification number • Income and tax information, including gross income, deductions, and tax credits • Payment information, including the amount of estimated tax payments or refund claimed

Penalties for Not Filing the 1041 V Form

Failure to file the 1041 V form can result in significant penalties and interest, including:

• Late payment penalties: Estates and trusts that fail to make timely estimated tax payments may be subject to late payment penalties. • Late filing penalties: Estates and trusts that fail to file the 1041 V form may be subject to late filing penalties. • Interest on unpaid taxes: Estates and trusts that fail to pay taxes owed may be subject to interest on unpaid taxes.

Best Practices for Filing the 1041 V Form

To avoid penalties and ensure compliance with tax laws and regulations, estates and trusts should follow these best practices:

• Consult with a tax professional: Estates and trusts should consult with a tax professional to ensure accurate and timely filing of the 1041 V form. • Keep accurate records: Estates and trusts should keep accurate records of income, deductions, and tax credits to support the information reported on the 1041 V form. • Make timely payments: Estates and trusts should make timely estimated tax payments to avoid penalties and interest.

Common Mistakes to Avoid When Filing the 1041 V Form

Common mistakes to avoid when filing the 1041 V form include:

• Inaccurate or incomplete information: Estates and trusts should ensure that all information reported on the 1041 V form is accurate and complete. • Late filing: Estates and trusts should file the 1041 V form on a timely basis to avoid late filing penalties. • Insufficient payment: Estates and trusts should ensure that they make sufficient estimated tax payments to avoid penalties and interest.

Conclusion and Next Steps

In conclusion, the 1041 V form is an essential document for estates and trusts to report income tax and claim a refund. By understanding the form's requirements, benefits, and key considerations, estates and trusts can avoid penalties and ensure compliance with tax laws and regulations. We encourage readers to share their experiences and ask questions in the comments section below.

Who needs to file the 1041 V form?

+Estates and trusts that have gross income of $600 or more, or that have a beneficiary who is a non-resident alien, must file the 1041 V form.

What is the due date for filing the 1041 V form?

+The due date for filing the 1041 V form is April 15th, June 15th, September 15th, and January 15th of the following year.

What are the penalties for not filing the 1041 V form?

+Failure to file the 1041 V form can result in significant penalties and interest, including late payment penalties, late filing penalties, and interest on unpaid taxes.