As a former or current employee of Kohl's, accessing and retrieving your W2 form is a crucial task, especially during tax season. Your W2 form contains vital information about your income and taxes withheld, which you'll need to file your tax return accurately. In this comprehensive guide, we'll walk you through the easy steps to access and retrieve your Kohl's W2 form, as well as provide valuable insights into the benefits and deadlines associated with this essential document.

What is a W2 Form?

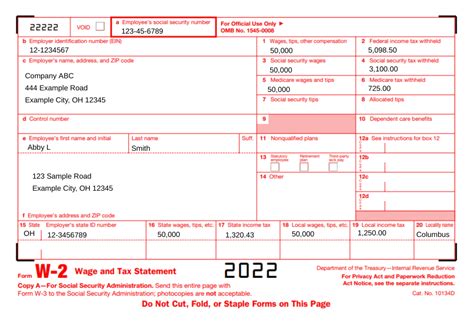

Before we dive into the nitty-gritty of accessing and retrieving your Kohl's W2 form, let's take a brief moment to understand what this document is and why it's so important. A W2 form, also known as the Wage and Tax Statement, is a document provided by employers to their employees, detailing their income and taxes withheld for the previous tax year. This form is typically issued by January 31st of each year and is a critical component of the tax filing process.

Why is my W2 Form Important?

Your W2 form contains essential information that you'll need to accurately file your tax return. This includes:

- Your employer's name, address, and Employer Identification Number (EIN)

- Your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your gross income and taxes withheld for the tax year

- Any tips or bonuses you received

- Any deductions or credits you're eligible for

How to Access Your Kohl's W2 Form

Kohl's offers a convenient and secure way to access and retrieve your W2 form. Here are the easy steps to follow:

Online Access

- Visit the Kohl's HR website:

- Log in to your account using your username and password

- Click on the "Payroll" or "W2" tab

- Select the tax year for which you want to retrieve your W2 form

- Click on the "View" or "Print" button to access your W2 form

Employee Self-Service Portal

- Log in to the Employee Self-Service Portal:

- Click on the "Payroll" or "W2" tab

- Select the tax year for which you want to retrieve your W2 form

- Click on the "View" or "Print" button to access your W2 form

Phone Support

If you're having trouble accessing your W2 form online or need assistance, you can contact Kohl's HR support team by phone:

- Call the Kohl's HR support line: 1-855-KOHLS-4U (1-855-564-5748)

- Follow the prompts to speak with a representative

- Provide your employee ID or Social Security number to verify your identity

- Request that the representative assist you with accessing or retrieving your W2 form

Deadlines and Benefits

W2 Form Deadlines

- January 31st: Employers must provide W2 forms to employees by this date

- April 15th: Tax filing deadline for individual taxpayers

- October 15th: Extended tax filing deadline for individual taxpayers who filed for an extension

Benefits of Accessing Your W2 Form Early

- Accurate tax filing: Accessing your W2 form early ensures you have the necessary information to file your tax return accurately and on time.

- Avoid delays: Retrieving your W2 form early helps you avoid delays in filing your tax return, which can result in penalties and fines.

- Potential refunds: Filing your tax return early can result in a faster refund, if you're eligible for one.

FAQs

How do I access my W2 form if I'm a former employee?

+If you're a former employee, you can access your W2 form by contacting Kohl's HR support team by phone or logging in to the Employee Self-Service Portal.

What if I didn't receive my W2 form?

+If you didn't receive your W2 form, contact Kohl's HR support team by phone or log in to the Employee Self-Service Portal to request a replacement copy.

Can I access my W2 form online?

+Yes, you can access your W2 form online by logging in to the Kohl's HR website or Employee Self-Service Portal.

By following these easy steps and understanding the importance of your W2 form, you'll be well on your way to accessing and retrieving your Kohl's W2 form with ease. Don't forget to take advantage of the benefits of accessing your W2 form early, including accurate tax filing, avoiding delays, and potential refunds. If you have any questions or concerns, don't hesitate to reach out to Kohl's HR support team for assistance.