As an employee or individual receiving regular payments, you're likely familiar with the convenience of direct deposit. It's a quick and secure way to receive your funds, eliminating the need for physical checks and reducing the risk of lost or delayed payments. If you're a KeyBank customer, you'll be pleased to know that setting up direct deposit is a straightforward process. In this article, we'll guide you through the steps to obtain and complete the KeyBank direct deposit form in 5 easy steps.

Having a direct deposit setup can save you time and effort in managing your finances. It's essential to understand the benefits and process of direct deposit, especially if you're new to banking or switching to KeyBank. By the end of this article, you'll be equipped with the knowledge to effortlessly set up direct deposit and start enjoying the convenience it offers.

What is Direct Deposit?

Before we dive into the steps, let's quickly explain what direct deposit is. Direct deposit is an electronic payment method that transfers funds directly from the payer's account to the recipient's account. This method is commonly used for payroll, government benefits, and tax refunds. With direct deposit, you can expect faster and more secure payment processing.

Benefits of Direct Deposit

So, why should you consider setting up direct deposit? Here are some benefits:

- Faster payment processing: Direct deposit eliminates the need for physical checks, which can take days or even weeks to clear.

- Increased security: Direct deposit reduces the risk of lost or stolen checks.

- Convenience: You can access your funds immediately, without having to visit a bank branch or ATM.

Step 1: Gather Required Information

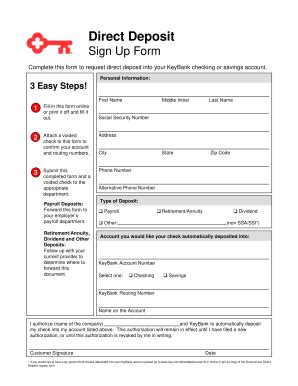

To complete the KeyBank direct deposit form, you'll need to gather some essential information. Make sure you have the following:

- Your KeyBank account number

- Your KeyBank routing number (found on the bottom left corner of your checks or on the KeyBank website)

- Your employer's or payer's name and address

- The type of payment you're expecting (e.g., payroll, government benefits, tax refund)

Step 2: Obtain the KeyBank Direct Deposit Form

You can obtain the KeyBank direct deposit form in several ways:

- Visit the KeyBank website and download the form

- Contact KeyBank customer service and request the form be emailed or mailed to you

- Visit a KeyBank branch and ask for the form

Step 3: Complete the KeyBank Direct Deposit Form

Once you have the form, fill it out accurately and completely. You'll need to provide the information gathered in Step 1. Make sure to review the form carefully to avoid any errors.

Step 4: Submit the KeyBank Direct Deposit Form

After completing the form, submit it to your employer or payer. They will need to verify the information and set up the direct deposit. You may also need to provide a voided check or a deposit slip to confirm your account information.

Step 5: Verify Direct Deposit Setup

Once your employer or payer has set up the direct deposit, verify that the funds are being deposited into your KeyBank account. You can check your account online or through the KeyBank mobile app.

By following these 5 easy steps, you can obtain and complete the KeyBank direct deposit form and start enjoying the convenience of direct deposit. Remember to verify the setup and ensure that your funds are being deposited correctly.

Don't hesitate to reach out to KeyBank customer service if you have any questions or concerns about the direct deposit process. With direct deposit, you can take control of your finances and enjoy a more streamlined payment experience.

Now that you've learned how to set up direct deposit with KeyBank, take the next step and start enjoying the benefits of faster and more secure payment processing.

What is the KeyBank routing number?

+The KeyBank routing number is a 9-digit number found on the bottom left corner of your checks or on the KeyBank website. It's used to identify the bank and facilitate direct deposit.

How long does it take to set up direct deposit with KeyBank?

+The setup process typically takes a few days to a week, depending on your employer or payer's processing time. Once set up, direct deposit usually takes 1-2 business days to process.

Can I set up direct deposit for multiple accounts?

+Yes, you can set up direct deposit for multiple accounts, including checking and savings accounts. However, you'll need to complete a separate direct deposit form for each account.