Kentucky is one of the many states in the United States that requires employers to file a quarterly withholding tax return to report the state income tax withheld from employees' wages. For Kentucky employers, this return is filed using Form 725, also known as the "Kentucky Quarterly Withholding Tax Return." In this article, we will delve into the details of Form 725, including its purpose, who needs to file it, and how to file it correctly.

The importance of filing Form 725 correctly cannot be overstated. Failure to file or pay the required withholding tax can result in penalties and interest, which can be costly for employers. Moreover, accurate filing helps the state of Kentucky to efficiently process tax returns and disburse refunds to eligible taxpayers. Therefore, it is crucial for employers to understand the requirements and procedures for filing Form 725.

Who Needs to File Form 725?

Form 725 is required to be filed by all Kentucky employers who are required to withhold state income tax from their employees' wages. This includes:

- Employers who have one or more employees who are Kentucky residents or who work in Kentucky

- Employers who have employees who earn wages subject to Kentucky income tax withholding

- Employers who are required to file a federal quarterly employment tax return (Form 941)

Employers who are exempt from filing Form 725 include:

- Employers who do not have any employees who are subject to Kentucky income tax withholding

- Employers who are exempt from filing a federal quarterly employment tax return (Form 941)

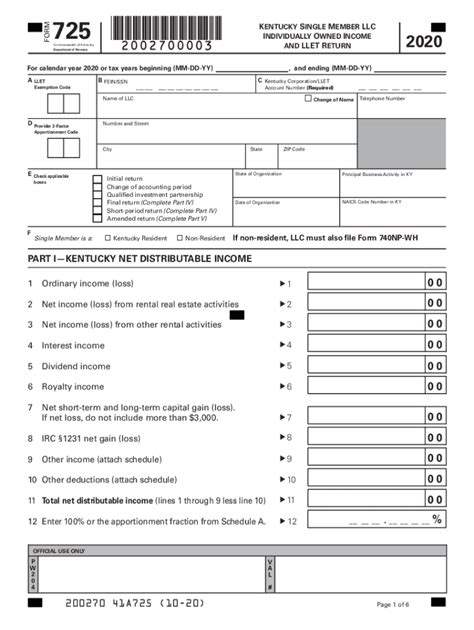

What Information is Required on Form 725?

Form 725 requires employers to report the following information:

- Employer's name, address, and federal employer identification number (FEIN)

- Quarter-ending date (March 31, June 30, September 30, or December 31)

- Total Kentucky withholding tax liability for the quarter

- Total wages paid to employees during the quarter

- Total Kentucky income tax withheld from employees' wages during the quarter

- Any additional taxes due or overpayment for the quarter

Employers must also attach a copy of the federal Form 941, Employer's Quarterly Federal Tax Return, to Form 725.

How to File Form 725 Correctly

To file Form 725 correctly, employers must follow these steps:

- Register for an account: Employers must register for an account on the Kentucky One Stop Business Portal to file Form 725 electronically.

- Gather required information: Employers must gather all required information, including employee wages, withholding tax liability, and federal Form 941.

- Complete Form 725: Employers must complete Form 725 accurately and thoroughly, ensuring that all required information is included.

- Attach supporting documents: Employers must attach a copy of the federal Form 941 to Form 725.

- File electronically: Employers must file Form 725 electronically through the Kentucky One Stop Business Portal.

- Pay any additional taxes due: Employers must pay any additional taxes due for the quarter.

- Keep records: Employers must keep accurate records of Form 725 and supporting documents for at least three years.

Deadlines for Filing Form 725

The deadlines for filing Form 725 are as follows:

- January 31 for the fourth quarter (October 1 - December 31)

- April 30 for the first quarter (January 1 - March 31)

- July 31 for the second quarter (April 1 - June 30)

- October 31 for the third quarter (July 1 - September 30)

Employers who fail to file Form 725 by the deadline may be subject to penalties and interest.

Common Mistakes to Avoid When Filing Form 725

When filing Form 725, employers should avoid the following common mistakes:

- Inaccurate or incomplete information: Ensure that all required information is accurate and complete.

- Late filing: File Form 725 by the deadline to avoid penalties and interest.

- Insufficient payment: Ensure that any additional taxes due are paid in full.

- Failure to attach supporting documents: Attach a copy of the federal Form 941 to Form 725.

By avoiding these common mistakes, employers can ensure that their Form 725 is filed correctly and efficiently.

Conclusion

Filing Form 725 correctly is crucial for Kentucky employers to avoid penalties and interest. By understanding who needs to file Form 725, what information is required, and how to file it correctly, employers can ensure that their quarterly withholding tax return is filed efficiently and accurately. Remember to register for an account, gather required information, complete Form 725 accurately, attach supporting documents, file electronically, pay any additional taxes due, and keep records.

We hope this guide has provided you with valuable information on how to file Form 725 correctly. If you have any questions or need further assistance, please do not hesitate to comment below or share this article with others.

Who needs to file Form 725?

+Form 725 is required to be filed by all Kentucky employers who are required to withhold state income tax from their employees' wages.

What information is required on Form 725?

+Form 725 requires employers to report employer's name, address, and federal employer identification number (FEIN), quarter-ending date, total Kentucky withholding tax liability for the quarter, total wages paid to employees during the quarter, and total Kentucky income tax withheld from employees' wages during the quarter.

How do I file Form 725 correctly?

+To file Form 725 correctly, employers must register for an account, gather required information, complete Form 725 accurately, attach supporting documents, file electronically, pay any additional taxes due, and keep records.