The state of Kansas requires its residents to file a state income tax return, known as Form K-40, every year. The Kansas Department of Revenue is responsible for collecting and processing these tax returns, and the deadline for filing typically falls on April 15th. In this article, we will guide you through the process of filling out Form K-40, highlighting the necessary steps, and providing helpful tips to ensure a smooth and accurate tax filing experience.

Understanding Kansas State Income Tax

Kansas has a progressive income tax system, with three tax brackets: 3.1%, 5.2%, and 5.7%. The tax rates apply to the taxpayer's Kansas taxable income, which includes income from all sources, including wages, salaries, tips, and self-employment income. Kansas also allows for various deductions and credits, such as the standard deduction, personal exemption, and earned income tax credit (EITC).

Who Needs to File Form K-40?

Not all Kansas residents are required to file a state income tax return. You must file Form K-40 if:

- Your Kansas gross income exceeds $8,500 ($10,500 if married filing jointly)

- You have self-employment income of $400 or more

- You have received a distribution from a retirement account

- You have received unemployment compensation

- You have received other types of income that require filing a tax return

Gathering Necessary Documents

Before starting the tax filing process, it's essential to gather all necessary documents, including:

- W-2 forms from employers

- 1099 forms for self-employment income, freelance work, or other sources of income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Retirement account distribution statements (1099-R)

- Unemployment compensation statements

- Charitable donation receipts

- Medical expense receipts

Filling Out Form K-40

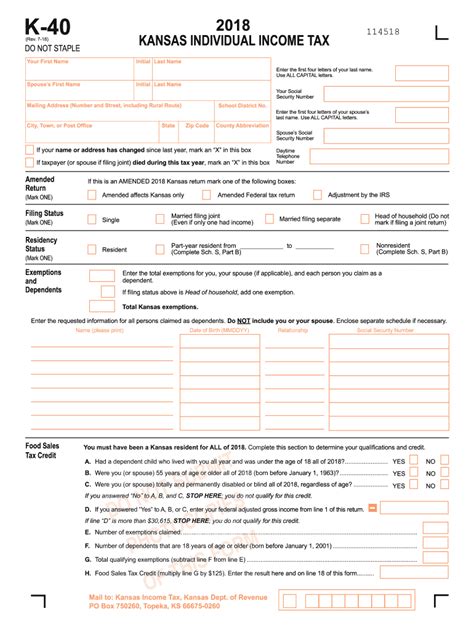

Form K-40 consists of several sections, including:

- Personal Information: Enter your name, address, social security number, and filing status.

- Income: Report all sources of income, including wages, salaries, tips, self-employment income, and other types of income.

- Deductions: Claim deductions for standard deduction, personal exemption, charitable donations, and medical expenses.

- Credits: Claim credits for earned income tax credit (EITC), child tax credit, and other eligible credits.

- Tax Computation: Calculate your Kansas state income tax liability.

Tips and Reminders

- Make sure to sign and date the tax return

- Use black ink to sign the return

- Attach all supporting documents, including W-2 forms and 1099 forms

- Use the correct filing status (single, married filing jointly, married filing separately, head of household)

- Claim all eligible deductions and credits

- Double-check math calculations to avoid errors

Electronic Filing Options

Kansas offers electronic filing options for state income tax returns. You can file Form K-40 online through the Kansas Department of Revenue website or through a tax preparation software provider. Electronic filing provides faster processing and refunds, as well as reduced errors.

Paper Filing

If you prefer to file a paper return, you can download Form K-40 from the Kansas Department of Revenue website or pick one up at a local library or post office. Mail the completed return to the Kansas Department of Revenue, along with all supporting documents.

Amending a Return

If you need to make changes to a previously filed return, you can file an amended return using Form K-40A. Attach a copy of the original return and explain the changes made.

Conclusion

Filing Form K-40 is a necessary step for Kansas residents to report their state income tax liability. By following the steps outlined in this guide, you can ensure a smooth and accurate tax filing experience. Remember to gather all necessary documents, claim eligible deductions and credits, and double-check math calculations to avoid errors. If you have any questions or concerns, consult the Kansas Department of Revenue website or seek professional tax advice.

Frequently Asked Questions

What is the deadline for filing Form K-40?

+The deadline for filing Form K-40 is typically April 15th.

Do I need to file Form K-40 if I only have self-employment income?

+Yes, you must file Form K-40 if you have self-employment income of $400 or more.

Can I file Form K-40 electronically?

+Yes, you can file Form K-40 electronically through the Kansas Department of Revenue website or through a tax preparation software provider.

We hope this guide has provided you with the necessary information to complete your Kansas state income tax return. If you have any further questions or concerns, please don't hesitate to comment below or seek professional tax advice.