Tax season can be a daunting time for individuals, especially when it comes to navigating the various tax forms and requirements. One of the most common tax forms for individuals is the K-40 tax form, which is used to report income and claim deductions and credits. In this article, we will delve into the world of the K-40 tax form, exploring its importance, components, and how to fill it out accurately.

Why is the K-40 tax form important?

The K-40 tax form is crucial for individuals who need to report their income and claim deductions and credits to the state of Kansas. The form is used to calculate the individual's tax liability and determine if they owe taxes or are eligible for a refund. Failure to file the K-40 tax form or providing inaccurate information can result in penalties, fines, and even audits.

Components of the K-40 tax form

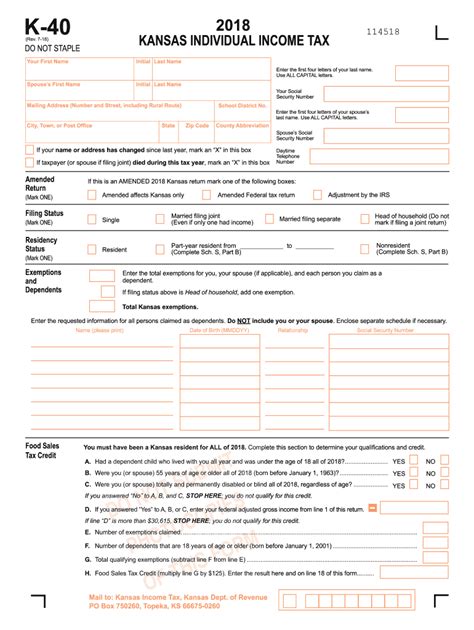

The K-40 tax form is comprised of several sections, each designed to capture specific information about the individual's income, deductions, and credits. The main components of the form include:

- Name and address: This section requires the individual to provide their name, address, and social security number.

- Filing status: The individual must select their filing status, which determines the tax rates and deductions they are eligible for.

- Income: This section requires the individual to report their income from various sources, including wages, salaries, tips, and self-employment income.

- Deductions: The individual can claim deductions for expenses such as mortgage interest, charitable donations, and medical expenses.

- Credits: The individual can claim credits for expenses such as child care, education, and retirement savings.

How to fill out the K-40 tax form

Filling out the K-40 tax form can be a complex and time-consuming process, but with the right guidance, individuals can ensure accuracy and avoid errors. Here are some steps to follow:

- Gather required documents: Individuals should gather all necessary documents, including W-2 forms, 1099 forms, and receipts for deductions and credits.

- Choose the correct filing status: Individuals should select the correct filing status, which determines the tax rates and deductions they are eligible for.

- Report income accurately: Individuals should report their income from all sources, including wages, salaries, tips, and self-employment income.

- Claim deductions and credits: Individuals should claim deductions and credits for eligible expenses, such as mortgage interest, charitable donations, and child care expenses.

**Types of Income Reported on the K-40 Tax Form**

The K-40 tax form requires individuals to report various types of income, including:

- Wages, salaries, and tips: This includes income from employment, tips, and bonuses.

- Self-employment income: This includes income from self-employment, freelancing, and consulting.

- Interest and dividends: This includes income from investments, such as interest and dividend payments.

- Capital gains and losses: This includes income from the sale of assets, such as stocks, bonds, and real estate.

Deductions and Credits on the K-40 Tax Form

The K-40 tax form allows individuals to claim deductions and credits for eligible expenses, including:

- Mortgage interest: Individuals can claim a deduction for mortgage interest paid on their primary residence.

- Charitable donations: Individuals can claim a deduction for charitable donations made to qualified organizations.

- Medical expenses: Individuals can claim a deduction for medical expenses, including doctor visits, hospital stays, and prescription medications.

- Child care expenses: Individuals can claim a credit for child care expenses, including daycare and after-school programs.

**Common Mistakes to Avoid on the K-40 Tax Form**

When filling out the K-40 tax form, individuals should avoid common mistakes, including:

- Inaccurate income reporting: Individuals should ensure that they report their income accurately, including all sources of income.

- Failure to claim deductions and credits: Individuals should claim all eligible deductions and credits to minimize their tax liability.

- Math errors: Individuals should double-check their math to avoid errors and ensure accuracy.

Conclusion

The K-40 tax form is a crucial document for individuals who need to report their income and claim deductions and credits to the state of Kansas. By understanding the components of the form and following the steps to fill it out accurately, individuals can ensure that they are in compliance with tax laws and regulations. Remember to avoid common mistakes, such as inaccurate income reporting and failure to claim deductions and credits. If you have any questions or concerns, consider consulting a tax professional or seeking guidance from the Kansas Department of Revenue.

We hope this article has been informative and helpful in understanding the K-40 tax form. If you have any questions or comments, please feel free to share them below.

What is the deadline for filing the K-40 tax form?

+The deadline for filing the K-40 tax form is typically April 15th of each year.

Can I file the K-40 tax form electronically?

+Yes, you can file the K-40 tax form electronically through the Kansas Department of Revenue's website.

What is the penalty for not filing the K-40 tax form?

+The penalty for not filing the K-40 tax form can range from 5% to 25% of the unpaid tax, plus interest and fees.