Completing an IRT Manual Income Verification Form can be a daunting task, especially for those who are not familiar with the process. However, it is a crucial step in verifying an individual's income, which is often required for various purposes such as loan applications, credit checks, and tax returns. In this article, we will break down the process into five manageable steps, providing you with a clear understanding of how to complete the form accurately.

Understanding the IRT Manual Income Verification Form

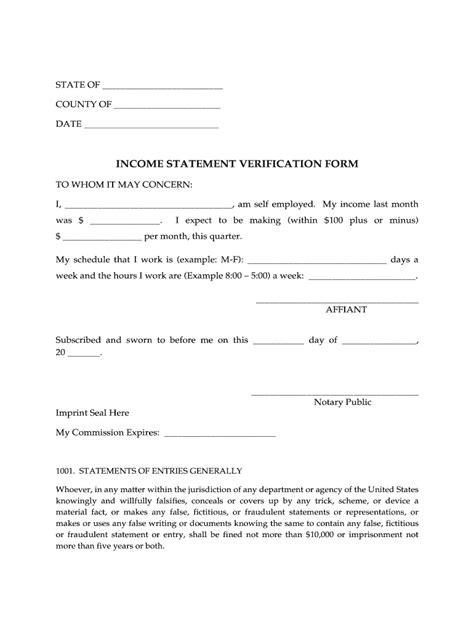

Before we dive into the steps, it's essential to understand what the IRT Manual Income Verification Form is and its purpose. The form is used to verify an individual's income, which is typically required by lenders, creditors, or government agencies. The form requires the individual to provide detailed information about their income, including sources, amounts, and frequency.

Why is Income Verification Important?

Income verification is a critical process that helps lenders, creditors, and government agencies assess an individual's creditworthiness, financial stability, and ability to repay debts. It also helps prevent identity theft and ensures that individuals are not misrepresenting their income.

Step 1: Gather Required Documents

To complete the IRT Manual Income Verification Form, you will need to gather various documents that support your income claims. These documents may include:

- Pay stubs

- W-2 forms

- 1099 forms

- Tax returns

- Letters from employers

- Bank statements

Ensure that you have all the necessary documents before starting the form, as this will make the process smoother and less time-consuming.

What if I'm Self-Employed?

If you're self-employed, you may need to provide additional documents, such as business tax returns, profit and loss statements, or invoices. It's essential to consult with a tax professional or accountant to ensure you have the necessary documents to support your income claims.

Step 2: Fill Out the Form Accurately

Once you have gathered all the necessary documents, it's time to fill out the form. Make sure to read the instructions carefully and fill out the form accurately. The form will typically ask for the following information:

- Personal details (name, address, date of birth, etc.)

- Income sources (employment, self-employment, investments, etc.)

- Income amounts (gross income, net income, etc.)

- Frequency of income (monthly, annually, etc.)

Tips for Filling Out the Form

- Use black ink to fill out the form

- Write clearly and legibly

- Use numbers instead of words (e.g., 1000 instead of one thousand)

- Do not leave any fields blank

Step 3: Calculate Your Income

To complete the form, you will need to calculate your income from various sources. This may include:

- Gross income from employment

- Net income from self-employment

- Investment income

- Other sources of income

Make sure to use the correct formulas and calculations to ensure accuracy.

What if I Have Multiple Sources of Income?

If you have multiple sources of income, you will need to calculate each source separately and then combine them. Ensure that you have all the necessary documents to support your income claims.

Step 4: Sign and Date the Form

Once you have completed the form, sign and date it. This is a critical step, as it confirms that the information provided is accurate and true.

What if I Need to Make Changes?

If you need to make changes to the form, ensure that you initial each change and provide a clear explanation for the changes.

Step 5: Submit the Form

Finally, submit the completed form to the relevant authority, such as a lender, creditor, or government agency. Ensure that you keep a copy of the form for your records.

What Happens Next?

Once the form is submitted, the relevant authority will review and verify the information provided. If everything is in order, you will receive a confirmation or approval. If there are any issues, you may be required to provide additional documentation or clarification.

What is the purpose of the IRT Manual Income Verification Form?

+The IRT Manual Income Verification Form is used to verify an individual's income, which is typically required by lenders, creditors, or government agencies.

What documents do I need to complete the form?

+You will need to gather various documents that support your income claims, such as pay stubs, W-2 forms, 1099 forms, tax returns, and letters from employers.

How do I calculate my income?

+You will need to calculate your income from various sources, such as gross income from employment, net income from self-employment, investment income, and other sources of income.

We hope this article has provided you with a clear understanding of how to complete the IRT Manual Income Verification Form. Remember to gather all the necessary documents, fill out the form accurately, calculate your income correctly, sign and date the form, and submit it to the relevant authority. If you have any further questions or concerns, please don't hesitate to reach out to us.