Understanding the complexities of tax forms can be a daunting task for many individuals. One form that has gained significant attention in recent years is the IRS Form 8915-F. This form is specifically designed for qualified retirement plan participants who have received distributions from their plans due to the Coronavirus pandemic. In this article, we will delve into five essential facts about IRS Form 8915-F, providing you with a comprehensive understanding of its purpose, benefits, and requirements.

What is IRS Form 8915-F?

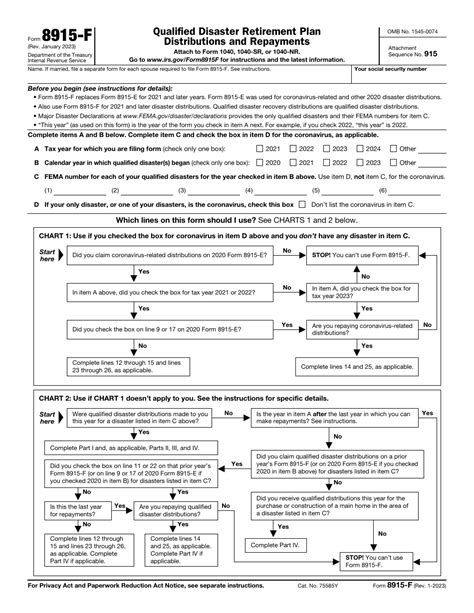

IRS Form 8915-F, also known as the Qualified Disaster Retirement Plan Distributions and Repayments, is a tax form used by individuals who have received qualified disaster distributions from their retirement plans. The form was introduced as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) in 2020. Its primary purpose is to help individuals who have been affected by the pandemic to access their retirement savings without incurring significant tax penalties.

Who is Eligible to File Form 8915-F?

To be eligible to file Form 8915-F, you must have received a qualified disaster distribution from your retirement plan due to the Coronavirus pandemic. A qualified disaster distribution is a payment made from a qualified retirement plan, such as a 401(k) or an IRA, to an individual who has been affected by the pandemic. To qualify, you must have been diagnosed with COVID-19, have experienced adverse financial consequences due to the pandemic, or have had a family member who has been affected by the pandemic.

Benefits of Filing Form 8915-F

Filing Form 8915-F provides several benefits to individuals who have received qualified disaster distributions. Some of the key benefits include:

- Reduced tax liability: By filing Form 8915-F, you may be able to reduce your tax liability on the distribution. The form allows you to report the distribution as a qualified disaster distribution, which may be subject to a lower tax rate.

- Waiver of the 10% penalty: Normally, individuals who receive distributions from their retirement plans before age 59 1/2 are subject to a 10% penalty. However, by filing Form 8915-F, you may be able to waive this penalty.

- Increased repayment period: If you repay the distribution within three years, you may be able to avoid paying taxes on the distribution.

How to File Form 8915-F

To file Form 8915-F, you will need to complete the form and attach it to your tax return (Form 1040). You can download the form from the IRS website or obtain it from your tax professional. The form requires you to provide information about the qualified disaster distribution, including the date and amount of the distribution, as well as the type of retirement plan from which it was made.

Common Mistakes to Avoid When Filing Form 8915-F

When filing Form 8915-F, there are several common mistakes to avoid. Some of the most common mistakes include:

- Failing to attach the form to your tax return

- Providing incorrect or incomplete information about the qualified disaster distribution

- Failing to report the distribution on your tax return

- Failing to repay the distribution within the required timeframe

Tips for Completing Form 8915-F

To ensure that you complete Form 8915-F accurately, here are some tips to follow:

- Carefully review the instructions for the form

- Ensure that you have all the necessary information about the qualified disaster distribution

- Use a tax professional or accountant to help you complete the form

- Double-check your math and ensure that all calculations are accurate

Conclusion

In conclusion, IRS Form 8915-F is an essential form for individuals who have received qualified disaster distributions from their retirement plans due to the Coronavirus pandemic. By understanding the benefits, requirements, and common mistakes to avoid, you can ensure that you complete the form accurately and take advantage of the tax benefits available to you.

We hope that this article has provided you with a comprehensive understanding of IRS Form 8915-F. If you have any further questions or concerns, please do not hesitate to contact us.

What is the purpose of IRS Form 8915-F?

+IRS Form 8915-F is used to report qualified disaster distributions from retirement plans due to the Coronavirus pandemic.

Who is eligible to file Form 8915-F?

+To be eligible to file Form 8915-F, you must have received a qualified disaster distribution from your retirement plan due to the Coronavirus pandemic.

What are the benefits of filing Form 8915-F?

+Filing Form 8915-F provides several benefits, including reduced tax liability, waiver of the 10% penalty, and increased repayment period.