Filing taxes can be a daunting task, but it's essential to ensure that you're in compliance with the law and taking advantage of the tax credits and deductions available to you. One crucial step in the tax filing process is submitting Form W-4V, also known as the Voluntary Withholding Request. This form is used to request voluntary withholding on certain government payments, such as Social Security benefits, Supplemental Security Income (SSI), and certain pensions.

In this article, we'll walk you through the step-by-step process of filing Form W-4V online, providing you with a comprehensive guide to help you navigate this process with ease.

Understanding Form W-4V

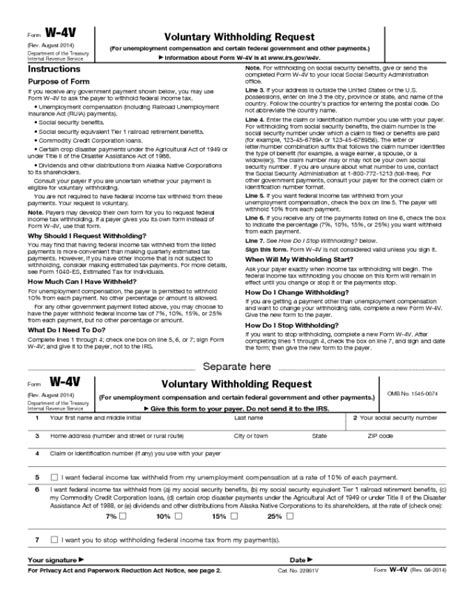

Before we dive into the filing process, it's essential to understand what Form W-4V is and why it's necessary. Form W-4V is a voluntary withholding request form that allows you to request withholding on certain government payments. This form is typically used by individuals who receive Social Security benefits, SSI, or certain pensions and want to have federal income tax withheld from these payments.

Who Needs to File Form W-4V?

Not everyone needs to file Form W-4V. This form is typically required for individuals who receive government payments that are subject to federal income tax withholding. Some examples of government payments that may require Form W-4V include:

- Social Security benefits

- Supplemental Security Income (SSI)

- Certain pensions

- Railroad Retirement benefits

- Civil Service Retirement benefits

Gathering Required Information

Before you start the filing process, make sure you have the following information readily available:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your name and address

- The type of government payment you're receiving (e.g., Social Security benefits, SSI, pension)

- The amount of the payment you want to have withheld

Step-by-Step Guide to Filing Form W-4V Online

Now that you have all the required information, let's move on to the step-by-step guide to filing Form W-4V online:

Step 1: Visit the IRS Website

To start the filing process, visit the official IRS website at . Click on the "Forms and Publications" tab and search for Form W-4V.

Step 2: Download and Complete Form W-4V

Download Form W-4V from the IRS website and complete it electronically or by hand. Make sure to fill out all the required fields, including your name, address, Social Security number or ITIN, and the type of government payment you're receiving.

Step 3: Choose Your Withholding Option

Choose the withholding option that applies to you. You can choose to have a fixed percentage of your payment withheld or a fixed amount withheld. You can also choose to have no withholding.

Step 4: Submit Form W-4V

Once you've completed Form W-4V, submit it electronically through the IRS website or by mail. If you're submitting by mail, make sure to send it to the address listed on the form.

Tips and Reminders

Here are some tips and reminders to keep in mind when filing Form W-4V:

- Make sure to file Form W-4V by the deadline to avoid any penalties or fines.

- Keep a copy of your completed Form W-4V for your records.

- If you need to make changes to your withholding, you can file a new Form W-4V.

- You can also use Form W-4V to stop withholding on your government payments.

Common Errors to Avoid

When filing Form W-4V, there are some common errors to avoid:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Incorrect withholding option

- Failure to submit the form by the deadline

FAQs

Here are some frequently asked questions about Form W-4V:

Q: Who needs to file Form W-4V?

A: Individuals who receive government payments that are subject to federal income tax withholding need to file Form W-4V.

Q: What is the deadline for filing Form W-4V?

A: The deadline for filing Form W-4V varies depending on the type of government payment you're receiving. Check the IRS website for specific deadlines.

Q: Can I file Form W-4V electronically?

A: Yes, you can file Form W-4V electronically through the IRS website.

What happens if I don't file Form W-4V?

+If you don't file Form W-4V, you may be subject to penalties or fines. You may also be required to pay estimated taxes on your government payments.

Can I change my withholding option after filing Form W-4V?

+Where can I get help with filing Form W-4V?

+You can get help with filing Form W-4V by visiting the IRS website or contacting the IRS directly. You can also consult with a tax professional for assistance.

By following this step-by-step guide, you'll be able to file Form W-4V online with ease. Remember to gather all the required information, choose the correct withholding option, and submit the form by the deadline to avoid any penalties or fines. If you have any questions or need help with the filing process, don't hesitate to reach out to the IRS or a tax professional for assistance.