Taxes can be a complex and daunting task for many individuals, but claiming a refund doesn't have to be. The Internal Revenue Service (IRS) provides various forms to help taxpayers navigate the refund process, and one of the most commonly used forms is the IRS Form 8801, also known as the "Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts" form.

In this comprehensive guide, we will walk you through the process of claiming your refund with IRS Form 8801, covering its purpose, eligibility, and a step-by-step guide on how to complete and submit the form.

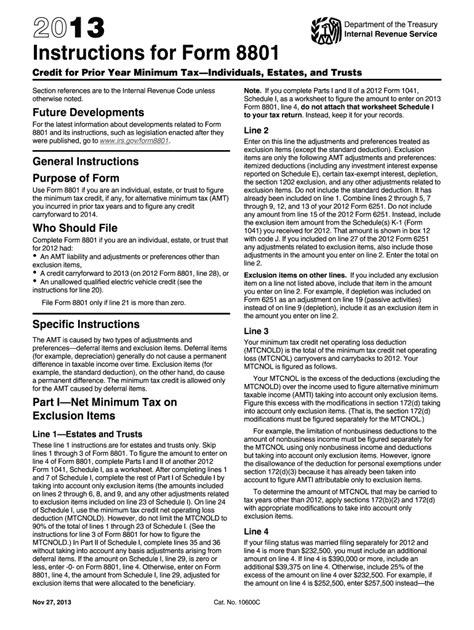

What is IRS Form 8801?

The IRS Form 8801 is a tax form used by individuals, estates, and trusts to claim a refund for the minimum tax credit. This credit is available to taxpayers who paid alternative minimum tax (AMT) in prior years and are now eligible to claim a refund. The form is used to calculate the minimum tax credit and to claim a refund for the excess amount paid.

Who is Eligible to Use IRS Form 8801?

To be eligible to use IRS Form 8801, you must meet the following requirements:

- You paid AMT in a prior year

- You are an individual, estate, or trust

- You have a minimum tax credit available

- You are not claiming the credit on another form (such as Form 6251)

If you meet these requirements, you can use IRS Form 8801 to claim a refund for the minimum tax credit.

Benefits of Using IRS Form 8801

Using IRS Form 8801 to claim a refund for the minimum tax credit has several benefits, including:

- Reduces tax liability: By claiming the minimum tax credit, you can reduce your tax liability and lower your tax bill

- Increases refund: If you are eligible for a refund, using IRS Form 8801 can help you claim the excess amount paid and increase your refund

- Simplifies tax process: The form is designed to simplify the tax process and make it easier to claim the minimum tax credit

Step-by-Step Guide to Completing IRS Form 8801

To complete IRS Form 8801, follow these steps:

- Gather required documents: Before starting the form, gather all required documents, including your prior year's tax return, Form 6251, and any other relevant documents.

- Determine eligibility: Review the eligibility requirements and ensure you meet the criteria to use the form.

- Complete Part I: Complete Part I of the form, which includes your name, address, and taxpayer identification number.

- Complete Part II: Complete Part II of the form, which includes the calculation of the minimum tax credit.

- Complete Part III: Complete Part III of the form, which includes the claim for refund.

- Sign and date the form: Sign and date the form, and ensure it is accurate and complete.

How to Submit IRS Form 8801

To submit IRS Form 8801, follow these steps:

- Mail the form: Mail the completed form to the IRS address listed in the instructions.

- E-file the form: You can also e-file the form through the IRS website or through a tax professional.

- Attach required documents: Attach all required documents, including your prior year's tax return and Form 6251.

Common Mistakes to Avoid When Completing IRS Form 8801

When completing IRS Form 8801, avoid the following common mistakes:

- Inaccurate calculations: Ensure accurate calculations when completing Part II of the form.

- Missing required documents: Ensure all required documents are attached, including your prior year's tax return and Form 6251.

- Incorrect eligibility: Ensure you meet the eligibility requirements before completing the form.

Conclusion

Claiming a refund with IRS Form 8801 can be a straightforward process if you follow the steps outlined in this guide. By understanding the purpose and eligibility requirements of the form, and by following the step-by-step guide, you can ensure accurate completion and submission of the form. Remember to avoid common mistakes and ensure all required documents are attached.

What is the purpose of IRS Form 8801?

+The purpose of IRS Form 8801 is to claim a refund for the minimum tax credit.

Who is eligible to use IRS Form 8801?

+Individuals, estates, and trusts who paid alternative minimum tax (AMT) in prior years and have a minimum tax credit available.

How do I submit IRS Form 8801?

+You can mail the completed form to the IRS address listed in the instructions or e-file the form through the IRS website or through a tax professional.

We hope this guide has been helpful in understanding how to claim your refund with IRS Form 8801. If you have any further questions or concerns, please don't hesitate to ask.