Understanding tax forms can be a daunting task, especially with the numerous forms and deadlines to keep track of. One such form that often raises questions is Form 3922, also known as the Exercise of an Incentive Stock Option Under Section 422(b). In this article, we will delve into the details of Form 3922, its purpose, and what you need to know about reporting it on your tax return.

What is Form 3922?

Form 3922 is an information return filed by corporations to report the exercise of incentive stock options (ISOs) under Section 422(b) of the Internal Revenue Code. The form is used to report the transfer of stock upon the exercise of an ISO, which is a type of employee stock option that meets specific requirements under the tax code.

Why is Form 3922 important?

Form 3922 is crucial because it provides the IRS with information about the exercise of ISOs, which can have tax implications for both the corporation and the employee. The form helps the IRS track the transfer of stock and ensures that the correct tax treatment is applied to the transaction.

Who is required to file Form 3922?

Corporations that issue ISOs are required to file Form 3922 with the IRS. The form must be filed for each transfer of stock upon the exercise of an ISO, regardless of whether the stock is sold or held by the employee.

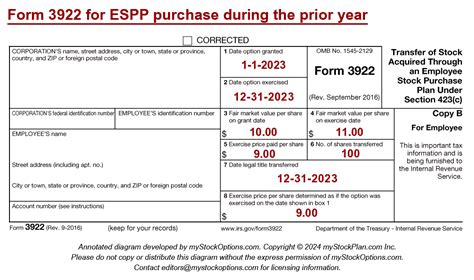

What information is reported on Form 3922?

Form 3922 requires the following information:

- The name, address, and taxpayer identification number (TIN) of the corporation

- The name, address, and TIN of the employee exercising the ISO

- The date of the transfer

- The number of shares transferred

- The fair market value of the shares on the date of transfer

- The exercise price per share

Does Form 3922 go on tax return?

Form 3922 is an information return, which means it is not filed with the employee's tax return. Instead, the corporation files Form 3922 with the IRS, and a copy is provided to the employee. The employee may need to report the income from the exercise of the ISO on their tax return, but Form 3922 itself is not attached to the tax return.

How does Form 3922 affect tax reporting?

The exercise of an ISO can have tax implications for the employee. The employee may need to report the income from the exercise of the ISO as ordinary income or capital gain, depending on the holding period of the stock. Form 3922 provides the necessary information for the employee to report the income correctly on their tax return.

What are the tax implications of exercising an ISO?

The tax implications of exercising an ISO depend on the holding period of the stock. If the employee holds the stock for at least two years from the date of grant and one year from the date of exercise, the gain is taxed as long-term capital gain. If the employee sells the stock within this period, the gain is taxed as ordinary income.

Example of how Form 3922 affects tax reporting

Let's say John exercises an ISO to purchase 100 shares of stock with a fair market value of $100 per share. The exercise price is $50 per share. Form 3922 would report the transfer of 100 shares with a fair market value of $10,000. John would need to report the income from the exercise of the ISO on his tax return, which would be the difference between the fair market value and the exercise price, or $5,000 ($10,000 - $5,000).

Best practices for reporting Form 3922

To ensure accurate reporting of Form 3922, corporations should:

- Maintain accurate records of ISO exercises, including the date of transfer, number of shares, and fair market value

- Provide a copy of Form 3922 to the employee

- File Form 3922 with the IRS by the required deadline

Employees should:

- Keep a copy of Form 3922 for their records

- Report the income from the exercise of the ISO on their tax return, if required

- Consult with a tax professional if they have questions about reporting the income

In conclusion, Form 3922 is an important information return that reports the exercise of incentive stock options. While it is not filed with the employee's tax return, it provides necessary information for accurate tax reporting. By understanding the purpose and requirements of Form 3922, corporations and employees can ensure compliance with tax regulations and avoid potential penalties.

Frequently Asked Questions

What is the purpose of Form 3922?

+Form 3922 is an information return filed by corporations to report the exercise of incentive stock options (ISOs) under Section 422(b) of the Internal Revenue Code.

Who is required to file Form 3922?

+Corporations that issue ISOs are required to file Form 3922 with the IRS.

What information is reported on Form 3922?

+Form 3922 requires the following information: name, address, and taxpayer identification number (TIN) of the corporation and employee, date of transfer, number of shares transferred, fair market value of the shares, and exercise price per share.

We hope this article has provided you with a comprehensive understanding of Form 3922 and its role in tax reporting. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional for guidance.