Filling out a Florida Repossession Affidavit can be a daunting task, especially for those who are not familiar with the process. The affidavit is a crucial document that lenders and creditors use to repossess a vehicle after a borrower has defaulted on their loan payments. In this article, we will explore five ways to fill out a Florida Repossession Affidavit, providing you with a comprehensive guide to navigate the process.

Understanding the Florida Repossession Affidavit

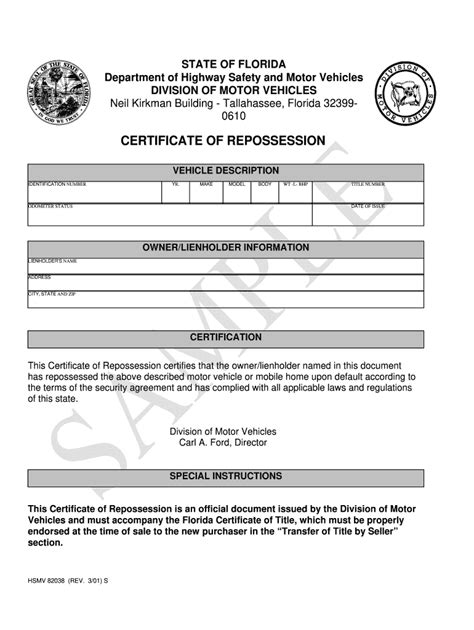

Before we dive into the five ways to fill out the affidavit, it's essential to understand what the document is and its purpose. The Florida Repossession Affidavit is a sworn statement that provides the lender with the necessary information to repossess a vehicle. The affidavit typically includes the borrower's name, address, and contact information, as well as the vehicle's make, model, and Vehicle Identification Number (VIN).

What is the Purpose of the Affidavit?

The purpose of the affidavit is to provide the lender with a clear and concise statement of the borrower's default on their loan payments. The affidavit serves as evidence that the borrower has failed to meet their obligations, and it provides the lender with the necessary documentation to repossess the vehicle.

Method 1: Hiring a Professional

One way to fill out a Florida Repossession Affidavit is to hire a professional. This can be a lawyer, a repossession company, or a document preparation service. Hiring a professional can be beneficial, especially if you are not familiar with the process or if you want to ensure that the affidavit is filled out correctly.

Benefits of Hiring a Professional

- Ensures the affidavit is filled out correctly

- Saves time and effort

- Provides peace of mind

Method 2: Using Online Templates

Another way to fill out a Florida Repossession Affidavit is to use online templates. There are many websites that offer free or paid templates that you can use to fill out the affidavit. Using online templates can be a convenient and cost-effective way to fill out the affidavit.

Benefits of Using Online Templates

- Convenient and easy to use

- Cost-effective

- Can be customized to meet your needs

Method 3: Filling Out the Affidavit Yourself

If you are comfortable with filling out forms and have a good understanding of the process, you can fill out the Florida Repossession Affidavit yourself. This method requires you to have the necessary information and documentation, such as the borrower's name and address, the vehicle's make and model, and the loan agreement.

Benefits of Filling Out the Affidavit Yourself

- Saves money

- Allows you to have control over the process

- Can be a learning experience

Method 4: Using a Repossession Software

There are many software programs available that can help you fill out a Florida Repossession Affidavit. These programs can guide you through the process and ensure that the affidavit is filled out correctly.

Benefits of Using Repossession Software

- Ensures the affidavit is filled out correctly

- Saves time and effort

- Can be used multiple times

Method 5: Consulting with a Lawyer

Finally, you can consult with a lawyer to fill out a Florida Repossession Affidavit. A lawyer can provide you with guidance and ensure that the affidavit is filled out correctly.

Benefits of Consulting with a Lawyer

- Ensures the affidavit is filled out correctly

- Provides peace of mind

- Can help you navigate the repossession process

In conclusion, filling out a Florida Repossession Affidavit can be a complex process, but there are many ways to do it. Whether you hire a professional, use online templates, fill out the affidavit yourself, use repossession software, or consult with a lawyer, the most important thing is to ensure that the affidavit is filled out correctly.

We invite you to share your experiences or ask questions about filling out a Florida Repossession Affidavit in the comments section below.

What is a Florida Repossession Affidavit?

+A Florida Repossession Affidavit is a sworn statement that provides the lender with the necessary information to repossess a vehicle.

What is the purpose of the affidavit?

+The purpose of the affidavit is to provide the lender with a clear and concise statement of the borrower's default on their loan payments.