The IRS Form 6251 - a crucial document for taxpayers who need to calculate their Alternative Minimum Tax (AMT). As the tax season approaches, it's essential to understand how to fill out this form accurately to avoid any potential errors or penalties. In this article, we'll delve into the world of Form 6251 and provide you with six essential tips to help you navigate this complex form.

The Alternative Minimum Tax (AMT) was introduced to ensure that high-income individuals and corporations pay a minimum amount of tax, regardless of the deductions and exemptions they claim. The AMT is calculated using a separate set of rules and tax rates, which can be quite different from the regular tax system. If you're subject to the AMT, you'll need to fill out Form 6251 to calculate your tax liability.

What is the Purpose of Form 6251?

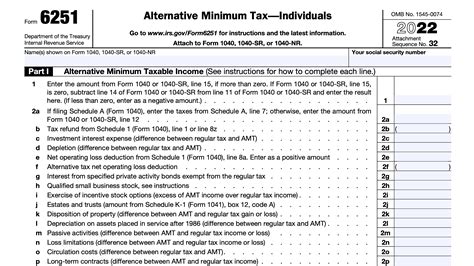

The primary purpose of Form 6251 is to calculate the Alternative Minimum Tax (AMT) for individual taxpayers. The form takes into account various income sources, deductions, and exemptions to determine whether you're subject to the AMT. If you are, you'll need to calculate your AMT liability and report it on your tax return.

Tip #1: Determine if You Need to File Form 6251

Before we dive into the tips, it's essential to determine if you need to file Form 6251. You'll need to file this form if your income exceeds certain thresholds, which vary based on your filing status. For the tax year 2022, you'll need to file Form 6251 if your income exceeds:

- $72,900 for single filers

- $113,400 for joint filers

- $56,950 for married filing separately

Additionally, you may need to file Form 6251 if you have certain types of income, such as:

- Long-term capital gains

- Dividend income

- Interest income

- Rent or royalty income

- Business income from a sole proprietorship or partnership

If you're unsure whether you need to file Form 6251, consult with a tax professional or use tax preparation software to help you determine your AMT liability.

Tip #2: Understand the AMT Exemptions and Phase-outs

The AMT exemptions and phase-outs can be complex, but it's essential to understand how they work. The AMT exemption is the amount of income that's exempt from the AMT. For the tax year 2022, the AMT exemption is:

- $72,900 for single filers

- $113,400 for joint filers

- $56,950 for married filing separately

However, the AMT exemption phases out as your income increases. The phase-out range is:

- $523,600 to $843,500 for single filers

- $844,100 to $1,246,700 for joint filers

- $422,050 to $641,200 for married filing separately

If your income falls within the phase-out range, you'll need to calculate the amount of the exemption that's phased out.

Tip #3: Calculate Your AMT Income

Calculating your AMT income is a critical step in filling out Form 6251. You'll need to report your income from various sources, including:

- Wages and salaries

- Interest and dividends

- Capital gains and losses

- Business income

- Rent and royalty income

You'll also need to add back certain deductions and exemptions, such as:

- State and local taxes

- Mortgage interest

- Charitable contributions

- Medical expenses

Tip #4: Claim AMT Preferences and Adjustments

AMT preferences and adjustments can significantly impact your AMT liability. You may need to claim preferences and adjustments for:

- Long-term capital gains and losses

- Qualified dividend income

- Interest income from private activity bonds

- Depletion allowances

You'll also need to make adjustments for:

- Depreciation and amortization

- Business income and expenses

- Rent and royalty income

Tip #5: Calculate Your AMT Liability

Once you've calculated your AMT income and claimed preferences and adjustments, you can calculate your AMT liability. You'll need to apply the AMT tax rates, which are:

- 26% on the first $199,900 of AMT income

- 28% on AMT income above $199,900

You'll also need to subtract the AMT exemption and any AMT foreign tax credit.

Tip #6: Report Your AMT Liability on Your Tax Return

Finally, you'll need to report your AMT liability on your tax return. You'll report the AMT liability on Form 1040, Schedule 2. If you owe AMT, you'll need to pay the tax by the tax filing deadline to avoid penalties and interest.

Conclusion: Navigating the Complex World of Form 6251

Filling out Form 6251 can be a daunting task, but with these six essential tips, you'll be well on your way to navigating the complex world of the Alternative Minimum Tax. Remember to determine if you need to file Form 6251, understand the AMT exemptions and phase-outs, calculate your AMT income, claim preferences and adjustments, calculate your AMT liability, and report your AMT liability on your tax return. If you're unsure about any aspect of the process, consult with a tax professional or use tax preparation software to help you file an accurate and complete return.

Frequently Asked Questions

What is the Alternative Minimum Tax (AMT)?

+The Alternative Minimum Tax (AMT) is a tax system designed to ensure that high-income individuals and corporations pay a minimum amount of tax, regardless of the deductions and exemptions they claim.

Who needs to file Form 6251?

+You'll need to file Form 6251 if your income exceeds certain thresholds, which vary based on your filing status. You may also need to file Form 6251 if you have certain types of income, such as long-term capital gains or business income.

How do I calculate my AMT liability?

+To calculate your AMT liability, you'll need to report your income from various sources, claim preferences and adjustments, and apply the AMT tax rates. You'll also need to subtract the AMT exemption and any AMT foreign tax credit.