Filling out Form W-4, also known as the Employee's Withholding Certificate, is a crucial step in ensuring that the correct amount of taxes is withheld from your paycheck. The form helps your employer determine how much federal income tax to withhold from your wages. In this article, we will provide you with 7 tips for filling out Form W-4 accurately and efficiently.

Understanding the Importance of Form W-4

Form W-4 is a critical document that affects your take-home pay and tax obligations. By filling out the form correctly, you can avoid overpaying or underpaying taxes throughout the year. Overpaying taxes can result in a larger refund, but it also means that you've essentially given the government an interest-free loan. On the other hand, underpaying taxes can lead to penalties and interest when you file your tax return.

TIP 1: Determine Your Filing Status

The first step in filling out Form W-4 is to determine your filing status. Your filing status affects the number of allowances you can claim, which in turn affects the amount of taxes withheld from your paycheck. You can choose from the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

How to Choose Your Filing Status

- If you're unmarried or separated, choose "Single."

- If you're married and filing a joint tax return, choose "Married filing jointly."

- If you're married but filing separate tax returns, choose "Married filing separately."

- If you're unmarried and have dependents, choose "Head of household."

- If you're a widow(er) with dependents, choose "Qualifying widow(er)."

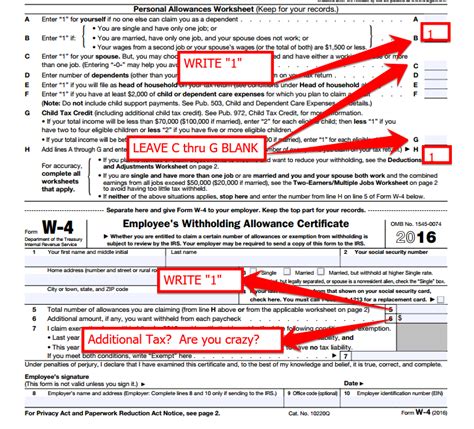

TIP 2: Claim the Correct Number of Allowances

The number of allowances you claim on Form W-4 determines the amount of taxes withheld from your paycheck. The more allowances you claim, the less taxes will be withheld. You can claim allowances for:

- Yourself

- Your spouse

- Your dependents

- Other income or deductions

How to Claim Allowances

- Claim one allowance for yourself and one for your spouse.

- Claim one allowance for each dependent you claim on your tax return.

- Claim additional allowances if you have other income or deductions that reduce your tax liability.

TIP 3: Account for Multiple Income Sources

If you have multiple income sources, such as a second job or investments, you may need to adjust your withholding to avoid underpaying taxes. You can use the worksheets on Form W-4 to calculate the correct amount of withholding.

How to Account for Multiple Income Sources

- List all your income sources on the worksheets.

- Calculate the total amount of income from all sources.

- Adjust your withholding accordingly.

TIP 4: Consider Your Tax Credits and Deductions

Tax credits and deductions can reduce your tax liability, but they may also affect your withholding. Consider the following tax credits and deductions:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Mortgage interest deduction

- Charitable donations

How to Consider Tax Credits and Deductions

- List all your tax credits and deductions on the worksheets.

- Calculate the total amount of tax credits and deductions.

- Adjust your withholding accordingly.

TIP 5: Use the IRS Withholding Estimator

The IRS Withholding Estimator is a useful tool that can help you determine the correct amount of withholding. The estimator takes into account your income, tax credits, and deductions to provide a personalized recommendation.

How to Use the IRS Withholding Estimator

- Visit the IRS website and access the Withholding Estimator.

- Enter your income, tax credits, and deductions.

- Follow the estimator's recommendations to adjust your withholding.

TIP 6: Review and Update Your Form W-4 Regularly

Your tax situation may change over time, so it's essential to review and update your Form W-4 regularly. You may need to update your form if:

- You get married or divorced.

- You have children or adopt a child.

- You start or stop working.

- You receive a raise or promotion.

How to Review and Update Your Form W-4

- Review your tax situation regularly.

- Update your Form W-4 if your tax situation changes.

- Submit the updated form to your employer.

TIP 7: Seek Professional Help if Needed

Filling out Form W-4 can be complex, especially if you have multiple income sources or tax credits and deductions. If you're unsure about how to fill out the form, consider seeking professional help from a tax professional or financial advisor.

How to Seek Professional Help

- Consult with a tax professional or financial advisor.

- Ask questions and seek clarification on any doubts.

- Follow their recommendations to ensure accurate withholding.

By following these 7 tips, you can ensure that you fill out Form W-4 accurately and efficiently. Remember to review and update your form regularly to reflect changes in your tax situation. If you're unsure about any aspect of the form, don't hesitate to seek professional help.

What is Form W-4?

+Form W-4 is the Employee's Withholding Certificate, which helps your employer determine how much federal income tax to withhold from your wages.

How often should I review and update my Form W-4?

+You should review and update your Form W-4 regularly, especially if your tax situation changes. You may need to update your form if you get married or divorced, have children or adopt a child, start or stop working, or receive a raise or promotion.

Can I claim allowances for my dependents?

+Yes, you can claim allowances for your dependents. You can claim one allowance for each dependent you claim on your tax return.