The IRS Form 6198 is a crucial document for individuals and businesses that need to calculate their at-risk limitations. These limitations are essential in determining the amount of losses that can be deducted on your tax return. In this comprehensive guide, we will walk you through the IRS Form 6198 instructions, providing you with a clear understanding of the at-risk limitations and how to calculate them.

At-risk limitations are designed to prevent taxpayers from deducting losses that exceed their actual investment in a business or activity. This is especially important for individuals who invest in activities such as real estate, farming, or partnerships. By understanding the at-risk limitations, you can ensure that you are not overstating your losses and avoid potential penalties and interest.

In this article, we will delve into the world of at-risk limitations, providing you with a detailed explanation of the IRS Form 6198 instructions. We will cover topics such as what is at-risk, how to calculate at-risk limitations, and what activities are subject to these limitations.

Understanding At-Risk Limitations

At-risk limitations are a critical component of tax law, and it's essential to understand what they entail. At-risk limitations are the maximum amount of losses that can be deducted on your tax return for a particular activity or business. These limitations are calculated based on your actual investment in the activity or business, as well as any borrowed funds used to finance the activity.

The at-risk limitations are designed to prevent taxpayers from deducting losses that exceed their actual investment in a business or activity. For example, if you invest $10,000 in a real estate venture and borrow an additional $50,000 to finance the project, your at-risk limitation would be $10,000. This means that you can only deduct losses up to $10,000 on your tax return, even if the total losses exceed that amount.

Calculating At-Risk Limitations

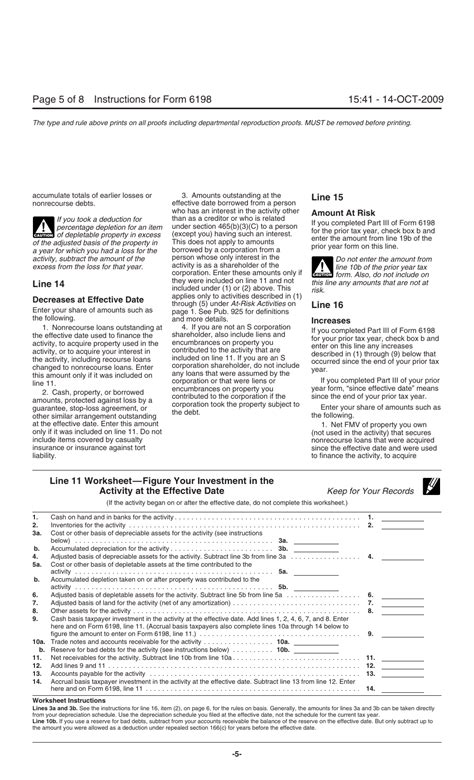

Calculating at-risk limitations can be a complex process, but it's essential to get it right to avoid any potential penalties and interest. To calculate your at-risk limitations, you will need to complete Form 6198. Here's a step-by-step guide to help you through the process:

- Determine Your At-Risk Amount: Start by determining your at-risk amount, which is the amount you have invested in the activity or business. This can include cash, property, or services.

- Calculate Your Borrowed Funds: Next, calculate the amount of borrowed funds used to finance the activity or business. This can include loans, mortgages, or other types of debt.

- Calculate Your At-Risk Limitation: Your at-risk limitation is the sum of your at-risk amount and borrowed funds. However, your at-risk limitation cannot exceed the amount of your at-risk amount.

Activities Subject to At-Risk Limitations

Not all activities are subject to at-risk limitations. However, there are several activities that are subject to these limitations, including:

- Real Estate Activities: Real estate activities, such as rental properties or real estate development projects, are subject to at-risk limitations.

- Farming Activities: Farming activities, such as raising livestock or growing crops, are subject to at-risk limitations.

- Partnership Activities: Partnership activities, such as investments in limited partnerships or limited liability companies, are subject to at-risk limitations.

IRS Form 6198 Instructions

The IRS Form 6198 instructions provide detailed guidance on how to calculate your at-risk limitations. Here's a summary of the instructions:

- Complete Form 6198: Complete Form 6198, which is the At-Risk Limitations form.

- List Your Activities: List all the activities that are subject to at-risk limitations.

- Calculate Your At-Risk Amount: Calculate your at-risk amount for each activity.

- Calculate Your Borrowed Funds: Calculate your borrowed funds for each activity.

- Calculate Your At-Risk Limitation: Calculate your at-risk limitation for each activity.

Conclusion

In conclusion, at-risk limitations are an essential component of tax law, and it's crucial to understand how to calculate them. By following the IRS Form 6198 instructions and using the guidelines outlined in this article, you can ensure that you are accurately calculating your at-risk limitations and avoiding any potential penalties and interest.

Additional Resources

For more information on at-risk limitations and the IRS Form 6198 instructions, you can refer to the following resources:

- IRS Publication 925: Passive Activity and At-Risk Rules

- IRS Form 6198 Instructions: At-Risk Limitations

FAQs

What is the purpose of the at-risk limitations?

+The purpose of the at-risk limitations is to prevent taxpayers from deducting losses that exceed their actual investment in a business or activity.

What activities are subject to at-risk limitations?

+Activities subject to at-risk limitations include real estate activities, farming activities, and partnership activities.

How do I calculate my at-risk limitation?

+Your at-risk limitation is the sum of your at-risk amount and borrowed funds. However, your at-risk limitation cannot exceed the amount of your at-risk amount.

We hope this guide has provided you with a comprehensive understanding of the at-risk limitations and the IRS Form 6198 instructions. If you have any further questions or concerns, please feel free to comment below.