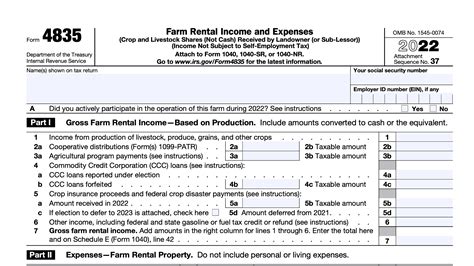

As a farmer or rancher, you're no stranger to hard work and dedication. However, when it comes to taxes, it can be overwhelming to navigate the complex world of forms and regulations. One crucial form you'll need to familiarize yourself with is the IRS Form 4835, also known as the Farm Rental Income and Expenses form. In this article, we'll break down the IRS Form 4835 instructions, providing a step-by-step guide to help you accurately complete the form and ensure you're taking advantage of all the deductions you're eligible for.

Understanding the Purpose of IRS Form 4835

The IRS Form 4835 is used to report farm rental income and expenses. If you're a farmer or rancher who rents out your land, livestock, or equipment, you'll need to complete this form to report your income and claim deductions on your tax return. The form is typically filed by individuals, estates, and trusts, but it can also be used by partnerships and corporations.

Gathering Necessary Information

Before you start filling out the form, it's essential to gather all the necessary information. You'll need to have the following documents and records:

- Rental agreements and contracts

- Ledger or journal entries for farm income and expenses

- Bank statements and canceled checks

- Invoices and receipts for expenses

- Depreciation records for assets

Section 1: Farm Rental Income

The first section of the form deals with farm rental income. You'll need to report the total amount of rental income you received from your farm or ranch. This includes:

- Cash rent

- Crop shares

- Livestock shares

- Equipment rental income

You'll also need to report any advances or deposits you received from tenants.

Section 2: Farm Rental Expenses

In this section, you'll report all the expenses related to your farm rental income. This includes:

- Rent paid to others

- Interest paid on loans

- Taxes paid on the rental property

- Insurance premiums

- Repairs and maintenance

- Depreciation

You'll also need to report any other expenses related to the rental property, such as utilities, supplies, and equipment expenses.

Section 3: Net Farm Rental Income

In this section, you'll calculate your net farm rental income by subtracting your total expenses from your total income.

Section 4: Deductions and Credits

This section deals with deductions and credits related to your farm rental income. You'll need to report any deductions you're eligible for, such as:

- Depreciation

- Interest paid on loans

- Taxes paid on the rental property

- Insurance premiums

You'll also need to report any credits you're eligible for, such as the mortgage interest credit or the farm credit.

Section 5: Additional Information

In this section, you'll provide additional information related to your farm rental income, such as:

- The type of farm or ranch you operate

- The number of acres rented

- The number of livestock or equipment rented

Step-by-Step Instructions for Completing IRS Form 4835

Now that we've covered the different sections of the form, let's go through a step-by-step guide on how to complete it:

- Start by filling out your name, address, and taxpayer identification number at the top of the form.

- Complete Section 1 by reporting your farm rental income.

- Complete Section 2 by reporting your farm rental expenses.

- Calculate your net farm rental income in Section 3.

- Complete Section 4 by reporting any deductions and credits you're eligible for.

- Provide additional information in Section 5.

- Sign and date the form.

Common Mistakes to Avoid

When completing IRS Form 4835, there are several common mistakes to avoid:

- Failing to report all rental income

- Failing to claim all eligible deductions

- Incorrectly calculating net farm rental income

- Failing to provide additional information

Conclusion

Completing IRS Form 4835 can be a daunting task, but by following these step-by-step instructions, you'll be able to accurately report your farm rental income and expenses. Remember to gather all the necessary information, complete each section carefully, and avoid common mistakes. By doing so, you'll ensure you're taking advantage of all the deductions you're eligible for and minimizing your tax liability.

What is IRS Form 4835 used for?

+IRS Form 4835 is used to report farm rental income and expenses.

Who needs to file IRS Form 4835?

+Individuals, estates, and trusts who rent out their land, livestock, or equipment need to file IRS Form 4835.

What information do I need to gather before completing IRS Form 4835?

+You'll need to gather rental agreements, ledger or journal entries, bank statements, invoices, and receipts.