Are you struggling to pay your tax debt to the Internal Revenue Service (IRS)? Do you need a way to make monthly payments to settle your tax liability? Look no further than IRS Form 433-D, also known as the Installment Agreement. This form allows you to set up a payment plan with the IRS, making it easier to pay off your tax debt in manageable monthly installments.

In this article, we'll delve into the details of IRS Form 433-D, explaining what it is, how to use it, and the benefits of setting up an installment agreement with the IRS.

What is IRS Form 433-D?

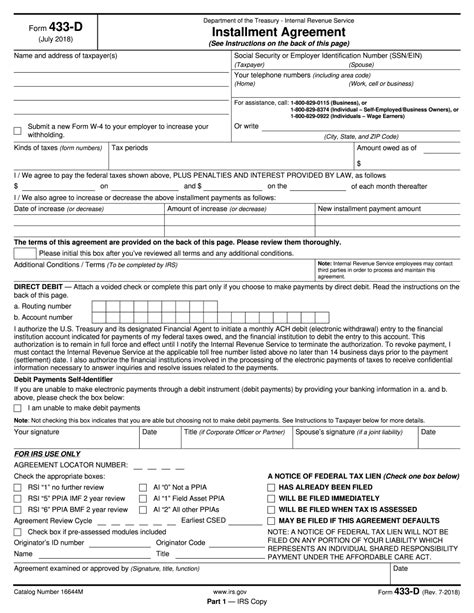

IRS Form 433-D is a document used by the IRS to establish an installment agreement with taxpayers who are unable to pay their tax debt in full. The form outlines the terms of the agreement, including the monthly payment amount, due date, and payment method. By signing the form, you agree to make regular payments to the IRS until your tax debt is paid in full.

Benefits of Using IRS Form 433-D

There are several benefits to using IRS Form 433-D to set up an installment agreement:

- Avoids additional penalties and interest: By making regular payments, you can avoid additional penalties and interest on your tax debt.

- Prevents wage garnishment: An installment agreement can prevent the IRS from garnishing your wages to collect on your tax debt.

- Stops collection activities: Once an installment agreement is in place, the IRS will stop collection activities, such as sending letters and making phone calls.

- Provides flexibility: You can choose a payment plan that fits your budget, making it easier to pay off your tax debt.

How to Use IRS Form 433-D

To use IRS Form 433-D, follow these steps:

- Determine your eligibility: You must owe $50,000 or less in combined tax, interest, and penalties to be eligible for an installment agreement.

- Gather required information: You'll need to provide your name, address, Social Security number, and tax return information.

- Choose a payment plan: You can choose from several payment plans, including monthly payments, quarterly payments, or annual payments.

- Complete Form 433-D: Fill out the form, providing all required information and signing it.

- Submit the form: Mail the completed form to the IRS address listed in the instructions.

What to Expect After Submitting IRS Form 433-D

After submitting IRS Form 433-D, you can expect the following:

- IRS review: The IRS will review your application to ensure you're eligible for an installment agreement.

- Approval or denial: The IRS will notify you in writing whether your application is approved or denied.

- Payment plan setup: If approved, the IRS will set up your payment plan and provide you with a payment schedule.

- Monthly payments: You'll begin making monthly payments to the IRS, following the payment schedule.

Payment Plans Available with IRS Form 433-D

There are several payment plans available with IRS Form 433-D, including:

- Monthly payments: Make monthly payments to the IRS, with the payment amount determined by your income and expenses.

- Quarterly payments: Make quarterly payments to the IRS, with the payment amount determined by your income and expenses.

- Annual payments: Make annual payments to the IRS, with the payment amount determined by your income and expenses.

How to Make Payments with IRS Form 433-D

To make payments with IRS Form 433-D, you can:

- Mail a check: Mail a check to the IRS address listed in the instructions.

- Pay online: Pay online through the IRS website.

- Set up automatic payments: Set up automatic payments through the IRS Electronic Federal Tax Payment System (EFTPS).

Consequences of Not Making Payments with IRS Form 433-D

If you fail to make payments with IRS Form 433-D, you may face consequences, including:

- Default on the agreement: The IRS may consider you in default of the agreement, which can lead to collection activities.

- Additional penalties and interest: You may be subject to additional penalties and interest on your tax debt.

- Wage garnishment: The IRS may garnish your wages to collect on your tax debt.

How to Revise or Terminate IRS Form 433-D

If you need to revise or terminate your installment agreement, you can:

- Contact the IRS: Contact the IRS to request a revision or termination of the agreement.

- Complete Form 9465: Complete Form 9465, Installment Agreement Request, to request a revision or termination.

- Submit the form: Submit the completed form to the IRS.

FAQs About IRS Form 433-D

What is the purpose of IRS Form 433-D?

+The purpose of IRS Form 433-D is to establish an installment agreement with the IRS, allowing taxpayers to make monthly payments to settle their tax debt.

How do I qualify for an installment agreement with the IRS?

+To qualify for an installment agreement, you must owe $50,000 or less in combined tax, interest, and penalties.

What happens if I fail to make payments with IRS Form 433-D?

+If you fail to make payments, you may face consequences, including default on the agreement, additional penalties and interest, and wage garnishment.

By following the guidelines outlined in this article, you can use IRS Form 433-D to set up an installment agreement with the IRS and make manageable monthly payments to settle your tax debt. Remember to carefully review the terms of the agreement and make timely payments to avoid consequences.