As a taxpayer with foreign income, understanding the IRS Form 1116 Schedule B is crucial for claiming the foreign tax credit. This guide will walk you through the process of completing Schedule B, including the necessary steps, calculations, and supporting documentation required.

What is the Foreign Tax Credit?

The foreign tax credit is a non-refundable tax credit that allows taxpayers to reduce their U.S. tax liability by the amount of foreign taxes paid or accrued on foreign-sourced income. This credit is designed to prevent double taxation on the same income.

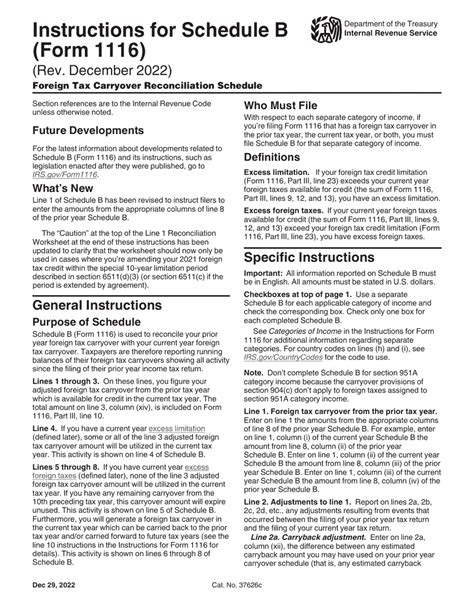

Who Needs to File Schedule B?

Taxpayers who claim a foreign tax credit on Form 1116 must complete Schedule B if they have:

- Foreign-sourced income subject to foreign tax

- Foreign taxes paid or accrued during the tax year

- A foreign tax credit carryover or carryback from a prior year

Understanding Schedule B

Schedule B is a supporting schedule to Form 1116, Foreign Tax Credit (Individual, Estate, or Trust). It is used to calculate the foreign tax credit limitation, which is the maximum amount of foreign tax credit that can be claimed.

Step 1: Gather Required Information

Before completing Schedule B, gather the following information:

- Foreign-sourced income and related foreign taxes paid or accrued

- Foreign tax credit carryover or carryback from a prior year

- Form 1099-INT, Interest Income, or Form 1099-DIV, Dividend Income, if applicable

- Foreign tax returns or statements showing the amount of foreign tax paid or accrued

Step 2: Complete Schedule B

Schedule B consists of two parts: Part I and Part II.

Part I: Foreign Taxes Paid or Accrued

- Line 1: List the country or countries where foreign taxes were paid or accrued

- Line 2: Enter the total amount of foreign taxes paid or accrued

- Line 3: Enter the total amount of foreign taxes paid or accrued that are subject to the foreign tax credit limitation

Part II: Foreign Tax Credit Limitation

- Line 4: Enter the total amount of foreign-sourced income subject to foreign tax

- Line 5: Enter the total amount of U.S. tax liability on foreign-sourced income

- Line 6: Calculate the foreign tax credit limitation by multiplying the U.S. tax liability on foreign-sourced income by the ratio of foreign taxes paid or accrued to foreign-sourced income

Example:

- Foreign-sourced income: $10,000

- Foreign taxes paid or accrued: $2,000

- U.S. tax liability on foreign-sourced income: $1,500

Foreign tax credit limitation: $1,500 x ($2,000 ÷ $10,000) = $300

Supporting Documentation

Keep the following documentation to support your foreign tax credit claim:

- Foreign tax returns or statements showing the amount of foreign tax paid or accrued

- Form 1099-INT or Form 1099-DIV, if applicable

- Records of foreign-sourced income and related foreign taxes paid or accrued

Calculating the Foreign Tax Credit

The foreign tax credit is calculated by multiplying the foreign tax credit limitation by the applicable foreign tax credit rate.

Foreign Tax Credit Rate

The foreign tax credit rate is determined by the type of foreign tax paid or accrued. The rates are as follows:

- Foreign income tax: 100%

- Foreign withholding tax: 85%

- Foreign tax on dividends: 85%

Example:

- Foreign tax credit limitation: $300

- Foreign tax credit rate: 100%

Foreign tax credit: $300 x 100% = $300

Carryover and Carryback

If the foreign tax credit exceeds the U.S. tax liability on foreign-sourced income, the excess can be carried over to future years or carried back to prior years.

Conclusion

Completing Schedule B is a crucial step in claiming the foreign tax credit. By following the steps outlined in this guide, taxpayers can accurately calculate their foreign tax credit limitation and claim the credit on their tax return. Remember to keep supporting documentation to support your foreign tax credit claim.

Common Mistakes to Avoid

- Failing to complete Schedule B

- Incorrectly calculating the foreign tax credit limitation

- Not keeping supporting documentation

- Failing to carry over or carry back excess foreign tax credit

Tips and Tricks

- Keep accurate records of foreign-sourced income and related foreign taxes paid or accrued

- Consult with a tax professional if unsure about completing Schedule B

- Consider claiming the foreign tax credit on a tentative basis if unsure about the amount of foreign taxes paid or accrued

What is the purpose of Schedule B?

+Schedule B is used to calculate the foreign tax credit limitation, which is the maximum amount of foreign tax credit that can be claimed.

Who needs to file Schedule B?

+Taxpayers who claim a foreign tax credit on Form 1116 must complete Schedule B if they have foreign-sourced income subject to foreign tax, foreign taxes paid or accrued during the tax year, or a foreign tax credit carryover or carryback from a prior year.

What is the foreign tax credit rate?

+The foreign tax credit rate is determined by the type of foreign tax paid or accrued. The rates are as follows: foreign income tax (100%), foreign withholding tax (85%), and foreign tax on dividends (85%).