Accumulated earnings tax is a penalty imposed by the Internal Revenue Service (IRS) on corporations that accumulate excessive earnings beyond their reasonable business needs. This tax is designed to prevent corporations from avoiding income tax by retaining earnings instead of distributing them to shareholders. The IRS Form 4972 is used to calculate and report this tax.

What is Accumulated Earnings Tax?

Accumulated earnings tax is a type of penalty tax imposed on corporations that accumulate excessive earnings beyond their reasonable business needs. This tax is designed to prevent corporations from avoiding income tax by retaining earnings instead of distributing them to shareholders. The tax is calculated based on the accumulated earnings and profits (E&P) of the corporation.

Reasonable Business Needs

Reasonable business needs refer to the amount of earnings that a corporation needs to retain to meet its future business requirements. This may include funds needed for expansion, research and development, or other business purposes. The IRS allows corporations to retain a certain amount of earnings for reasonable business needs, but excessive accumulations are subject to the accumulated earnings tax.

How to Calculate Accumulated Earnings Tax

The accumulated earnings tax is calculated based on the accumulated earnings and profits (E&P) of the corporation. The tax is imposed on the excess of the corporation's accumulated E&P over the amount that is reasonably needed for business purposes.

To calculate the accumulated earnings tax, corporations must follow these steps:

- Determine the corporation's accumulated E&P.

- Calculate the amount of earnings that is reasonably needed for business purposes.

- Subtract the amount reasonably needed for business purposes from the accumulated E&P to determine the excess.

- Multiply the excess by the accumulated earnings tax rate (currently 20%).

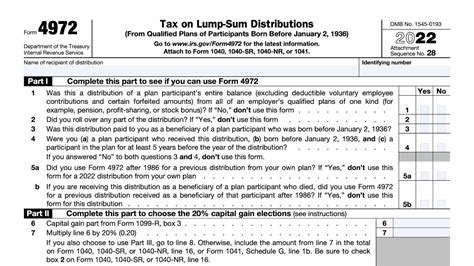

IRS Form 4972

The IRS Form 4972 is used to calculate and report the accumulated earnings tax. The form requires corporations to provide information about their accumulated E&P, reasonable business needs, and the calculation of the tax.

Corporations must file Form 4972 with their annual income tax return (Form 1120) if they have accumulated earnings and profits that exceed the amount reasonably needed for business purposes.

Benefits of Filing Form 4972

Filing Form 4972 provides several benefits to corporations, including:

- Avoiding penalties and interest: Filing Form 4972 on time helps corporations avoid penalties and interest on the accumulated earnings tax.

- Reducing tax liability: Filing Form 4972 allows corporations to calculate and report the accumulated earnings tax, which may reduce their tax liability.

- Meeting compliance requirements: Filing Form 4972 helps corporations meet their compliance requirements and avoid any potential penalties or fines.

Consequences of Not Filing Form 4972

Failure to file Form 4972 can result in serious consequences, including:

- Penalties and interest: Corporations that fail to file Form 4972 may be subject to penalties and interest on the accumulated earnings tax.

- Increased tax liability: Failure to file Form 4972 may result in an increased tax liability, as the IRS may impose additional taxes and penalties.

- Compliance issues: Failure to file Form 4972 can lead to compliance issues and potential penalties or fines.

Steps to Complete Form 4972

To complete Form 4972, corporations must follow these steps:

- Determine the corporation's accumulated E&P.

- Calculate the amount of earnings that is reasonably needed for business purposes.

- Subtract the amount reasonably needed for business purposes from the accumulated E&P to determine the excess.

- Multiply the excess by the accumulated earnings tax rate (currently 20%).

- Complete Form 4972, including the calculation of the accumulated earnings tax.

- File Form 4972 with the annual income tax return (Form 1120).

Additional Tips

- Consult with a tax professional: Completing Form 4972 can be complex, so it's recommended to consult with a tax professional to ensure accuracy and compliance.

- Keep accurate records: Corporations must keep accurate records of their accumulated E&P and reasonable business needs to support the calculation of the accumulated earnings tax.

- File on time: Corporations must file Form 4972 on time to avoid penalties and interest.

By following these steps and tips, corporations can ensure compliance with the accumulated earnings tax and avoid any potential penalties or fines.

FAQs

What is the purpose of Form 4972?

+Form 4972 is used to calculate and report the accumulated earnings tax.

What is the accumulated earnings tax rate?

+The accumulated earnings tax rate is currently 20%.

What happens if a corporation fails to file Form 4972?

+Failure to file Form 4972 can result in penalties and interest on the accumulated earnings tax.

If you have any questions or need further clarification on the accumulated earnings tax or Form 4972, please don't hesitate to ask. We're here to help!