As the tax season approaches, it's essential for businesses and individuals to prepare and file their tax returns accurately and on time. One of the critical forms that require attention is the IRS 1099 form, which reports various types of income and payments made throughout the year. In this article, we'll provide you with 5 tips to complete the IRS 1099 form accurately for the 2017 tax year.

The Importance of Accurate 1099 Forms

Accurate completion of the 1099 form is crucial for both businesses and individuals. The IRS uses this form to track income and payments made throughout the year, and any errors or discrepancies can lead to delays in processing tax returns, penalties, and even audits. Moreover, accurate 1099 forms help ensure that recipients receive the correct tax credits and deductions they're eligible for.

Tip 1: Understand the Types of 1099 Forms

There are several types of 1099 forms, each designed for specific purposes. The most common types include:

- 1099-MISC: Reports miscellaneous income, such as freelance work, rent, and royalty payments

- 1099-INT: Reports interest income, such as interest earned on savings accounts and bonds

- 1099-DIV: Reports dividend income, such as dividends earned on stocks

- 1099-B: Reports proceeds from broker and barter exchange transactions

It's essential to understand which type of 1099 form is required for your specific situation to ensure accurate completion.

Tip 2: Gather Required Information

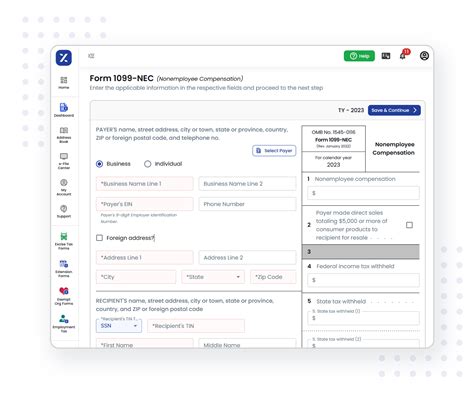

Before starting to complete the 1099 form, gather all the necessary information, including:

- Recipient's name, address, and taxpayer identification number (TIN)

- Payer's name, address, and TIN

- Type and amount of payment or income

- Dates of payment or income

Having all the required information readily available will help you complete the form accurately and efficiently.

Tip 3: Use the Correct Boxes and Codes

The 1099 form has various boxes and codes that require specific information. Use the correct boxes and codes to report the type and amount of payment or income. For example:

- Box 1: Reports miscellaneous income, such as freelance work and rent

- Box 2: Reports royalty payments

- Box 7: Reports non-employee compensation

Using the correct boxes and codes ensures that the information is reported accurately and helps prevent errors.

Understanding the IRS 1099 Form Instructions

The IRS provides detailed instructions for completing the 1099 form. It's essential to read and understand these instructions carefully to ensure accurate completion. The instructions cover topics such as:

- Who must file the 1099 form

- What types of payments are reported on the form

- How to complete each box and section

- Deadlines for filing the form

Tip 4: File the Form on Time

The deadline for filing the 1099 form is typically January 31st of each year. However, this deadline may vary depending on the type of payment or income reported. It's essential to file the form on time to avoid penalties and delays in processing tax returns.

Tip 5: Use Tax Preparation Software or Consult a Tax Professional

Completing the 1099 form accurately can be challenging, especially for those who are not familiar with tax laws and regulations. Consider using tax preparation software or consulting a tax professional to ensure accurate completion and avoid errors.

Benefits of Accurate 1099 Forms

Accurate completion of the 1099 form provides several benefits, including:

- Reduced risk of errors and penalties

- Faster processing of tax returns

- Increased accuracy of tax credits and deductions

- Improved compliance with tax laws and regulations

By following these 5 tips, you can ensure accurate completion of the IRS 1099 form for the 2017 tax year. Remember to understand the types of 1099 forms, gather required information, use the correct boxes and codes, file the form on time, and consider using tax preparation software or consulting a tax professional.

Conclusion

Completing the IRS 1099 form accurately is essential for both businesses and individuals. By following these 5 tips, you can ensure accurate completion and avoid errors, penalties, and delays in processing tax returns. Remember to stay informed about tax laws and regulations and consider using tax preparation software or consulting a tax professional to ensure compliance.

What is the deadline for filing the 1099 form?

+The deadline for filing the 1099 form is typically January 31st of each year. However, this deadline may vary depending on the type of payment or income reported.

What types of payments are reported on the 1099 form?

+The 1099 form reports various types of payments, including miscellaneous income, interest income, dividend income, and proceeds from broker and barter exchange transactions.

What happens if I file the 1099 form late?

+If you file the 1099 form late, you may be subject to penalties and delays in processing tax returns.