Iowa is a state in the Midwestern United States known for its rich agricultural land, rolling hills, and bustling cities. As a resident of Iowa or a business owner operating within the state, you may be required to complete a W-9 form for tax purposes. In this article, we will provide you with a comprehensive guide on how to complete the Iowa W-9 form in 5 easy steps.

The Importance of Accurate Tax Forms

Before we dive into the step-by-step guide, it's essential to understand the importance of accurate tax forms. The W-9 form is a crucial document that helps the government verify your identity, taxpayer status, and tax obligations. Failure to complete the form accurately can lead to delays, penalties, or even audits. Therefore, it's crucial to take your time and ensure that all information is correct and up-to-date.

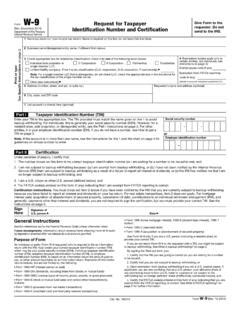

What is a W-9 Form?

A W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a tax document used to certify a taxpayer's identity and taxpayer identification number (TIN). The form is typically required for freelancers, independent contractors, and businesses operating in the United States. The W-9 form is used to report income earned from various sources, including self-employment, freelance work, and other business activities.

5 Easy Steps to Complete the Iowa W-9 Form

Completing the Iowa W-9 form is a straightforward process that requires some basic information. Here are the 5 easy steps to follow:

Step 1: Gather Required Information

Before starting the form, make sure you have the following information readily available:

- Your name and business name (if applicable)

- Business address and telephone number

- Taxpayer identification number (TIN) or Social Security number (SSN)

- Type of business entity (sole proprietorship, partnership, corporation, etc.)

- Business classification (e.g., self-employment, freelance, etc.)

Step 2: Download and Print the Form

You can download the Iowa W-9 form from the official website of the Iowa Department of Revenue or from the IRS website. Once you have downloaded the form, print it out and ensure that you have a pen and paper ready to fill it out.

Step 3: Fill Out the Form

Fill out the form carefully, making sure to provide accurate and up-to-date information. Here's a brief overview of each section:

- Section 1: Enter your name, business name, and business address.

- Section 2: Provide your taxpayer identification number (TIN) or Social Security number (SSN).

- Section 3: Indicate the type of business entity and business classification.

- Section 4: Sign and date the form.

Step 4: Review and Verify Information

Double-check the form to ensure that all information is accurate and complete. Verify that your taxpayer identification number (TIN) or Social Security number (SSN) is correct and matches the one on file with the IRS.

Step 5: Submit the Form

Once you have completed and reviewed the form, submit it to the requesting party, such as your employer, client, or the Iowa Department of Revenue. You can submit the form via mail, email, or in-person, depending on the requirements.

Tips and Reminders

Here are some additional tips and reminders to keep in mind when completing the Iowa W-9 form:

- Ensure that you use a pen and paper to fill out the form, as pencil marks may not be accepted.

- Use a separate form for each business entity or taxpayer identification number (TIN).

- Keep a copy of the completed form for your records.

- Submit the form on time to avoid delays or penalties.

Common Mistakes to Avoid

When completing the Iowa W-9 form, avoid the following common mistakes:

- Inaccurate or incomplete information

- Failure to sign and date the form

- Using a pencil or incorrect ink color

- Submitting the form late or to the wrong address

Benefits of Accurate Tax Forms

Completing the Iowa W-9 form accurately and on time can have several benefits, including:

- Reduced risk of delays or penalties

- Improved tax compliance and reporting

- Increased confidence in tax preparation and filing

- Better relationships with clients, employers, and the Iowa Department of Revenue

Conclusion:

Completing the Iowa W-9 form is a straightforward process that requires some basic information and attention to detail. By following the 5 easy steps outlined in this article, you can ensure that your form is accurate, complete, and submitted on time. Remember to review and verify your information carefully, and avoid common mistakes that can lead to delays or penalties.

Invite Engagement:

Have you completed the Iowa W-9 form before? Share your experiences or tips in the comments below! If you have any questions or concerns about the form, feel free to ask, and we'll do our best to help.

FAQ Section:

What is the purpose of the Iowa W-9 form?

+The Iowa W-9 form is used to certify a taxpayer's identity and taxpayer identification number (TIN) for tax purposes.

Who needs to complete the Iowa W-9 form?

+Freelancers, independent contractors, and businesses operating in Iowa may need to complete the W-9 form.

How do I submit the Iowa W-9 form?

+You can submit the form via mail, email, or in-person, depending on the requirements.