Utah residents and businesses are required to file their taxes annually, and one of the most important forms to submit is the Utah Tax Form TC-40. This form is used to report individual income tax, and it's essential to file it correctly to avoid any penalties or delays in receiving your refund. In this article, we'll explore five ways to file Utah Tax Form TC-40, highlighting the benefits and requirements of each method.

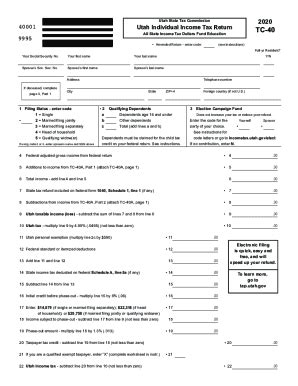

Understanding Utah Tax Form TC-40

Before we dive into the filing methods, let's take a closer look at Utah Tax Form TC-40. This form is used to report individual income tax, and it's required for all Utah residents who earn income from various sources, including wages, salaries, tips, and self-employment income. The form is used to calculate the taxpayer's tax liability, and it's also used to claim any eligible deductions and credits.

Requirements for Filing Utah Tax Form TC-40

To file Utah Tax Form TC-40, you'll need to meet certain requirements. These include:

- You must be a Utah resident or have income from Utah sources.

- You must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- You must have all necessary documentation, including W-2 forms, 1099 forms, and any other relevant tax documents.

Method 1: E-Filing through the Utah State Tax Commission Website

One of the most convenient ways to file Utah Tax Form TC-40 is through the Utah State Tax Commission website. The website offers a secure online portal where you can create an account, upload your tax documents, and submit your return. E-filing is fast, easy, and convenient, and you can expect to receive your refund in as little as 7-10 business days.

Benefits of E-Filing through the Utah State Tax Commission Website

E-filing through the Utah State Tax Commission website offers several benefits, including:

- Fast and secure submission of your tax return.

- Quick processing and refund issuance.

- Reduced risk of errors and delays.

- Ability to track the status of your return online.

Method 2: Mailing Your Tax Return

Another way to file Utah Tax Form TC-40 is by mailing your tax return to the Utah State Tax Commission. This method is more traditional, but it's still an effective way to submit your return. Simply complete your tax form, attach all required documentation, and mail it to the address listed on the form.

Requirements for Mailing Your Tax Return

To mail your tax return, you'll need to:

- Complete Utah Tax Form TC-40 accurately and legibly.

- Attach all required documentation, including W-2 forms and 1099 forms.

- Use the correct mailing address, which is listed on the form.

- Ensure timely submission, as late filings may incur penalties.

Method 3: Using Tax Preparation Software

Tax preparation software is another popular way to file Utah Tax Form TC-40. This software guides you through the tax preparation process, ensuring accuracy and completeness. Some popular tax preparation software options include TurboTax, H&R Block, and TaxAct.

Benefits of Using Tax Preparation Software

Using tax preparation software offers several benefits, including:

- Easy and guided tax preparation process.

- Accuracy and completeness of your tax return.

- Eligibility for free filing options, depending on your income level.

- Ability to e-file your return for faster processing and refunds.

Method 4: Hiring a Tax Professional

If you're not comfortable preparing your own tax return, you can hire a tax professional to do it for you. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), have the expertise and knowledge to ensure accurate and complete filing of Utah Tax Form TC-40.

Benefits of Hiring a Tax Professional

Hiring a tax professional offers several benefits, including:

- Expertise and knowledge of tax laws and regulations.

- Accuracy and completeness of your tax return.

- Ability to claim all eligible deductions and credits.

- Representation in case of an audit or tax dispute.

Method 5: Visiting a Tax Office or Tax Preparation Service

Finally, you can visit a tax office or tax preparation service to file Utah Tax Form TC-40. These services typically offer guided tax preparation and e-filing, and some may offer free filing options for eligible taxpayers.

Benefits of Visiting a Tax Office or Tax Preparation Service

Visiting a tax office or tax preparation service offers several benefits, including:

- Guided tax preparation and e-filing.

- Expertise and knowledge of tax laws and regulations.

- Ability to claim all eligible deductions and credits.

- Convenient and timely submission of your tax return.

In conclusion, there are several ways to file Utah Tax Form TC-40, each with its own benefits and requirements. Whether you choose to e-file through the Utah State Tax Commission website, mail your tax return, use tax preparation software, hire a tax professional, or visit a tax office or tax preparation service, make sure to submit your return accurately and on time to avoid any penalties or delays in receiving your refund.

What is the deadline for filing Utah Tax Form TC-40?

+The deadline for filing Utah Tax Form TC-40 is typically April 15th of each year. However, if you need an extension, you can file Form TC-40EXT to request an automatic six-month extension.

Do I need to file Utah Tax Form TC-40 if I don't owe taxes?

+Yes, even if you don't owe taxes, you may still need to file Utah Tax Form TC-40. For example, if you have taxes withheld from your paycheck or you have self-employment income, you may need to file a return to report these amounts and claim any eligible deductions and credits.

Can I file Utah Tax Form TC-40 electronically?

+Yes, you can file Utah Tax Form TC-40 electronically through the Utah State Tax Commission website or through tax preparation software. E-filing is fast, easy, and convenient, and you can expect to receive your refund in as little as 7-10 business days.