Purchasing insurance can be a daunting task, especially when it comes to protecting your finances. Iowa durable power of attorney (DPOA) is a crucial document that can safeguard your financial well-being in the event of incapacitation or unexpected life changes. In this article, we will delve into the world of Iowa DPOA and explore five ways it can protect your finances.

Understanding Iowa Durable Power of Attorney

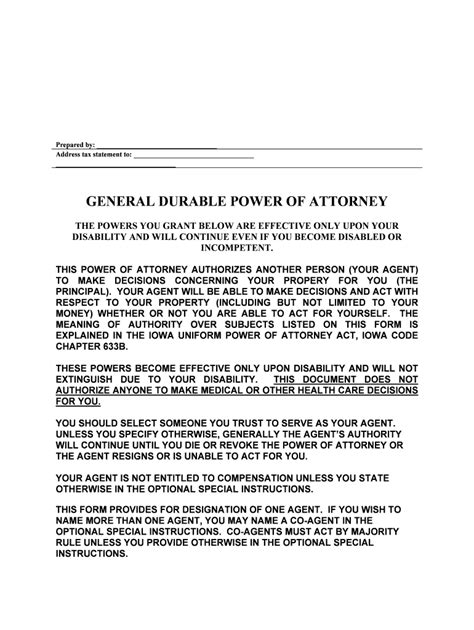

Before we dive into the benefits of Iowa DPOA, it's essential to understand what it entails. A durable power of attorney is a legal document that grants someone you trust, known as an attorney-in-fact or agent, the authority to manage your financial affairs on your behalf. This document remains effective even if you become incapacitated or unable to make decisions for yourself.

1. Financial Decision-Making

One of the primary benefits of Iowa DPOA is that it allows your agent to make financial decisions on your behalf. This includes managing your bank accounts, investments, and other financial assets. In the event of incapacitation, your agent can step in and ensure that your financial obligations are met, preventing late fees, penalties, and damage to your credit score.

For instance, if you are unable to work due to a medical condition, your agent can access your accounts and pay your bills, ensuring that you don't fall behind on your financial responsibilities.

2. Asset Protection

Iowa DPOA can also protect your assets from unnecessary depletion. If you become incapacitated, your agent can manage your assets, such as real estate, investments, and retirement accounts, to ensure that they are not misused or squandered. This can provide peace of mind for you and your loved ones, knowing that your assets are being protected and managed responsibly.

3. Tax Planning and Management

Your agent can also manage your tax obligations, ensuring that you take advantage of available tax deductions and credits. This can help minimize your tax liability and prevent penalties and fines. Additionally, your agent can file tax returns on your behalf, ensuring that you comply with tax laws and regulations.

For example, if you are unable to file your tax return due to incapacitation, your agent can step in and file the return, ensuring that you don't incur penalties or fines.

4. Medical Expense Management

Iowa DPOA can also help manage your medical expenses. Your agent can access your medical records, communicate with healthcare providers, and make informed decisions about your medical care. This can help ensure that you receive the best possible care, while also managing the associated costs.

5. Long-Term Care Planning

Finally, Iowa DPOA can help with long-term care planning. Your agent can explore options for long-term care, such as nursing home care or in-home care, and make decisions about your care and well-being. This can help ensure that you receive the care and support you need, while also managing the associated costs.

For instance, if you require long-term care due to a medical condition, your agent can explore options for care, such as Medicaid or veterans' benefits, and make decisions about your care and well-being.

Conclusion

Iowa durable power of attorney is a crucial document that can protect your finances in the event of incapacitation or unexpected life changes. By granting someone you trust the authority to manage your financial affairs, you can ensure that your financial obligations are met, your assets are protected, and your medical expenses are managed. If you're considering creating an Iowa DPOA, consult with an attorney or financial advisor to ensure that your document is valid and effective.

Encouraging Engagement

We hope this article has provided valuable insights into the world of Iowa durable power of attorney. If you have any questions or comments, please feel free to share them below. Additionally, if you're considering creating an Iowa DPOA, we encourage you to consult with an attorney or financial advisor to ensure that your document is valid and effective.

What is the purpose of an Iowa durable power of attorney?

+The purpose of an Iowa durable power of attorney is to grant someone you trust the authority to manage your financial affairs on your behalf, in the event of incapacitation or unexpected life changes.

Who can create an Iowa durable power of attorney?

+Any competent adult can create an Iowa durable power of attorney. However, it's recommended that you consult with an attorney or financial advisor to ensure that your document is valid and effective.

What are the benefits of having an Iowa durable power of attorney?

+The benefits of having an Iowa durable power of attorney include financial decision-making, asset protection, tax planning and management, medical expense management, and long-term care planning.