Setting up employee direct deposit in QuickBooks is a straightforward process that can save you and your employees time and hassle. With direct deposit, you can transfer funds directly into your employees' bank accounts, eliminating the need for paper checks and reducing the risk of lost or stolen paychecks. In this article, we'll walk you through the process of setting up employee direct deposit in QuickBooks and provide you with a comprehensive guide to creating a QuickBooks employee direct deposit form.

Why Use Direct Deposit in QuickBooks?

Direct deposit offers numerous benefits for both employers and employees. For employers, direct deposit reduces the administrative burden of printing and distributing paper checks, saving time and money. It also reduces the risk of check fraud and lost or stolen paychecks. For employees, direct deposit provides a convenient and secure way to receive their paychecks, eliminating the need to visit a bank or wait for a check to clear.

How to Set Up Employee Direct Deposit in QuickBooks

To set up employee direct deposit in QuickBooks, follow these steps:

- Enable Direct Deposit: Go to the "Edit" menu and select "Preferences." In the "Preferences" window, select "Payroll & Employees" and then click on the "Company Preferences" tab. Check the box next to "Use Direct Deposit" and click "OK."

- Set Up Employee Bank Information: Go to the "Employees" menu and select "Employee Center." Click on the "Edit Employee" button and select the employee for whom you want to set up direct deposit. In the "Payroll Info" tab, click on the "Direct Deposit" button and enter the employee's bank account information.

- Create a Direct Deposit Payroll Item: Go to the "Lists" menu and select "Payroll Item List." Click on the "Payroll Item" button and select "New." Create a new payroll item for direct deposit and enter the necessary information, such as the item name, description, and bank account information.

- Assign the Direct Deposit Payroll Item to the Employee: Go to the "Employees" menu and select "Employee Center." Click on the "Edit Employee" button and select the employee for whom you want to assign the direct deposit payroll item. In the "Payroll Info" tab, click on the "Assign Payroll Items" button and select the direct deposit payroll item.

Creating a QuickBooks Employee Direct Deposit Form

To create a QuickBooks employee direct deposit form, you'll need to gather the following information from your employees:

- Name and address

- Bank account information (including bank name, routing number, and account number)

- Type of account (checking or savings)

- Authorization for direct deposit

You can create a direct deposit form in QuickBooks using the following steps:

- Go to the "Lists" Menu: Select "Payroll Item List" and click on the "Payroll Item" button.

- Select "New": Create a new payroll item for direct deposit and enter the necessary information, such as the item name, description, and bank account information.

- Add Fields: Add fields to the form for the employee's name and address, bank account information, type of account, and authorization for direct deposit.

- Save the Form: Save the form and print it out for employees to sign and return.

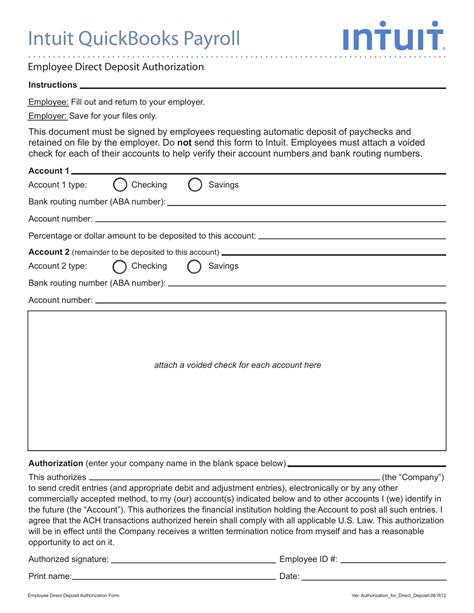

Sample QuickBooks Employee Direct Deposit Form

Here is a sample QuickBooks employee direct deposit form:

Employee Direct Deposit Authorization Form

Employee Name: _____________________________________________________ Employee Address: _____________________________________________________

Bank Account Information

- Bank Name: _____________________________________________________

- Routing Number: _____________________________________________________

- Account Number: _____________________________________________________

- Type of Account (checking or savings): _______________________________________

Authorization

I hereby authorize [Company Name] to deposit my payroll funds directly into the bank account listed above. I understand that this authorization will remain in effect until I revoke it in writing.

Signature: _____________________________________________________ Date: _____________________________________________________

FAQs

What is direct deposit?

+Direct deposit is a payment method that allows employers to transfer funds directly into their employees' bank accounts.

How do I set up direct deposit in QuickBooks?

+To set up direct deposit in QuickBooks, go to the "Edit" menu and select "Preferences." In the "Preferences" window, select "Payroll & Employees" and then click on the "Company Preferences" tab. Check the box next to "Use Direct Deposit" and click "OK."

What information do I need to create a direct deposit form in QuickBooks?

+To create a direct deposit form in QuickBooks, you'll need to gather the following information from your employees: name and address, bank account information (including bank name, routing number, and account number), type of account (checking or savings), and authorization for direct deposit.

By following these steps and creating a QuickBooks employee direct deposit form, you can easily set up direct deposit in QuickBooks and start enjoying the benefits of this convenient and secure payment method.