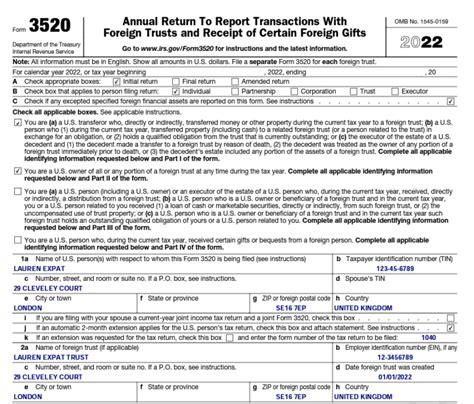

As a US taxpayer, it's essential to understand your reporting obligations, especially when it comes to foreign transactions. One crucial form you might need to file is Form 3520, also known as the Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts. In this article, we'll delve into the world of Form 3520, explaining its purpose, who needs to file it, and providing a step-by-step guide on how to complete it accurately.

Understanding the Purpose of Form 3520

The primary purpose of Form 3520 is to report certain transactions with foreign trusts and receipt of foreign gifts. The form is used by the Internal Revenue Service (IRS) to track and monitor these transactions, ensuring that US taxpayers comply with tax laws and regulations. By filing Form 3520, you're providing the IRS with essential information about your foreign transactions, which helps prevent tax evasion and ensures that you're meeting your tax obligations.

Who Needs to File Form 3520?

Not everyone needs to file Form 3520. However, if you're a US taxpayer and have engaged in certain foreign transactions, you might be required to file this form. Here are some scenarios where you might need to file Form 3520:

- You're a beneficiary of a foreign trust and have received a distribution from the trust.

- You're a grantor or transferor of a foreign trust and have transferred property to the trust.

- You've received a foreign gift exceeding $16,111 (adjusted annually for inflation).

- You're an owner or grantor of a foreign trust and have transactions with the trust.

Step-by-Step Guide to Filing Form 3520

Now that we've established who needs to file Form 3520, let's dive into the step-by-step process of completing the form.

Step 1: Gather Required Information

Before starting the filing process, gather all necessary information and documents. You'll need:

- Your name, address, and taxpayer identification number (TIN).

- Information about the foreign trust, including its name, address, and TIN (if applicable).

- Details about the transactions, such as the date, amount, and type of transaction.

- Documentation supporting the transactions, such as receipts, invoices, and bank statements.

Step 2: Complete Part I – Identification of the Taxpayer

Start by completing Part I of Form 3520, which requires your identification information. Provide your name, address, and TIN.

Step 3: Complete Part II – Transactions with Foreign Trusts

In Part II, you'll report transactions with foreign trusts. Complete the following sections:

- Section A: Provide information about the foreign trust, including its name, address, and TIN (if applicable).

- Section B: Report the transactions with the foreign trust, including the date, amount, and type of transaction.

Step 4: Complete Part III – Receipt of Foreign Gifts

If you've received foreign gifts, complete Part III of Form 3520. Provide information about the gift, including the amount, date, and type of gift.

Step 5: Complete Part IV – Additional Information

In Part IV, you'll provide additional information about the transactions reported on Form 3520. This includes:

- A description of the transactions.

- The amount of tax withheld (if applicable).

- The date and amount of any distributions or withdrawals.

Step 6: Sign and Date the Form

Once you've completed all the necessary sections, sign and date Form 3520.

Step 7: File the Form

Attach all supporting documentation and file Form 3520 with the IRS by the due date. The due date for Form 3520 is typically April 15th for individual taxpayers.

Penalties for Failure to File or Late Filing

If you fail to file Form 3520 or file it late, you may be subject to penalties. The IRS can impose a penalty of up to $10,000 or 5% of the gross reportable amount, whichever is greater.

Conclusion

Filing Form 3520 is a crucial step in reporting your foreign transactions and ensuring compliance with US tax laws. By following this step-by-step guide, you'll be able to complete the form accurately and avoid potential penalties. Remember to gather all necessary information, complete the form carefully, and file it on time.

Additional Resources

For more information on Form 3520, visit the IRS website or consult with a tax professional.

What is the purpose of Form 3520?

+Form 3520 is used to report certain transactions with foreign trusts and receipt of foreign gifts.

Who needs to file Form 3520?

+US taxpayers who have engaged in certain foreign transactions, such as receiving distributions from a foreign trust or receiving foreign gifts exceeding $16,111 (adjusted annually for inflation).

What is the due date for Form 3520?

+The due date for Form 3520 is typically April 15th for individual taxpayers.