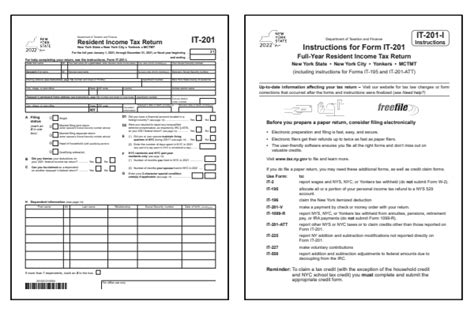

As a New Yorker, filing your taxes can be a daunting task, especially when it comes to completing the IT-201 form. The IT-201 form is the standard form used by the New York State Department of Taxation and Finance to report personal income tax. In this article, we will provide a comprehensive guide on how to complete the IT-201 form, ensuring that you file your taxes accurately and efficiently.

Why is the IT-201 form important?

The IT-201 form is a crucial document that helps the New York State Department of Taxation and Finance assess your taxable income and determine the amount of taxes you owe. By accurately completing the form, you can avoid errors, penalties, and potential audits. Moreover, the IT-201 form is used to calculate your state income tax liability, which can impact your eligibility for various tax credits and deductions.

Who needs to file the IT-201 form?

If you are a New York resident or non-resident with income earned in New York, you are required to file the IT-201 form. This includes:

- Full-year and part-year residents

- Non-residents with New York source income

- Trusts and estates

- Individuals with self-employment income

- Individuals with rental income

Gathering necessary documents

Before starting to complete the IT-201 form, gather all necessary documents, including:

- W-2 forms from employers

- 1099 forms for self-employment income, freelance work, or other income

- Interest statements from banks and financial institutions

- Dividend statements from investments

- Charitable donation receipts

- Medical expense records

Completing the IT-201 form

The IT-201 form consists of several sections, which we will guide you through below.

Section 1: Personal Information

- Enter your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN)

- Check the box indicating your filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er))

- Provide the name and Social Security number or ITIN of your spouse, if applicable

Section 2: Income

- Report all income earned from various sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Rents and royalties

- Other income ( specify the type of income and amount)

Section 3: Adjustments to Income

- Claim adjustments to income, such as:

- Alimony paid

- Student loan interest

- Moving expenses

- Self-employment tax deduction

Section 4: Deductions and Credits

- Claim standard or itemized deductions, including:

- Charitable contributions

- Medical expenses

- Mortgage interest and property taxes

- State and local taxes

- Claim tax credits, such as:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

Section 5: Tax Computation

- Calculate your total tax liability using the tax tables or schedules

- Apply any tax credits to reduce your tax liability

Tips and Reminders

- File your IT-201 form electronically to reduce errors and expedite processing

- Pay any tax due by the deadline to avoid penalties and interest

- Keep accurate records of your income, deductions, and credits for at least three years

- Consult a tax professional or seek assistance from the New York State Department of Taxation and Finance if you have questions or concerns

Conclusion

Completing the IT-201 form can be a daunting task, but by following these instructions and gathering necessary documents, you can ensure accuracy and efficiency. Remember to file your taxes on time, pay any tax due, and keep accurate records to avoid errors and potential audits. If you have any questions or concerns, don't hesitate to seek assistance from a tax professional or the New York State Department of Taxation and Finance.

Share your thoughts!

Have you had any experiences with completing the IT-201 form? Share your tips and advice with our readers in the comments section below!

What is the deadline for filing the IT-201 form?

+The deadline for filing the IT-201 form is typically April 15th of each year. However, if you are unable to file by this date, you can request an automatic six-month extension by filing Form IT-370.

Can I file the IT-201 form electronically?

+Yes, you can file the IT-201 form electronically through the New York State Department of Taxation and Finance's website or through tax preparation software. Electronic filing can reduce errors and expedite processing.

What if I have questions or concerns about completing the IT-201 form?

+If you have questions or concerns about completing the IT-201 form, you can contact the New York State Department of Taxation and Finance's Taxpayer Assistance Center or consult a tax professional for guidance.